Skift Take

— Peden Doma Bhutia

In a rebound of international travel, over 1.5 million Chinese citizens embarked on outbound trips during the recent Golden Week holiday, marketing technology firm China Trading Desk told Skift.

This surge points to a significant revival in global travel following the easing of pandemic-related restrictions.

The relaxation of visa policies between China and several countries has played a crucial role in this uptick. During the Golden Week in late April and early May, the growth rate of inbound and outbound bookings outpaced domestic tourism, Trip.com Group told Skift.

Popular Destinations and Emerging Trends

According to data from Trip.com Group, Chinese tourists visited nearly 200 countries and over 3,000 towns worldwide during the Golden Week period.

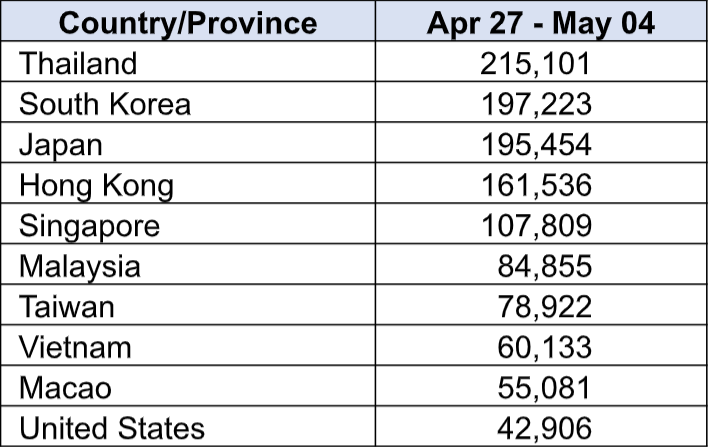

Thailand emerged as the top destination, with over 215,000 Chinese tourists between April 27 and May 4, according to China Trading Desk’s data. Factors such as visa-free entry offer by Thailand, shorter flight durations, and cost-effectiveness compared to other destinations have driven this trend.

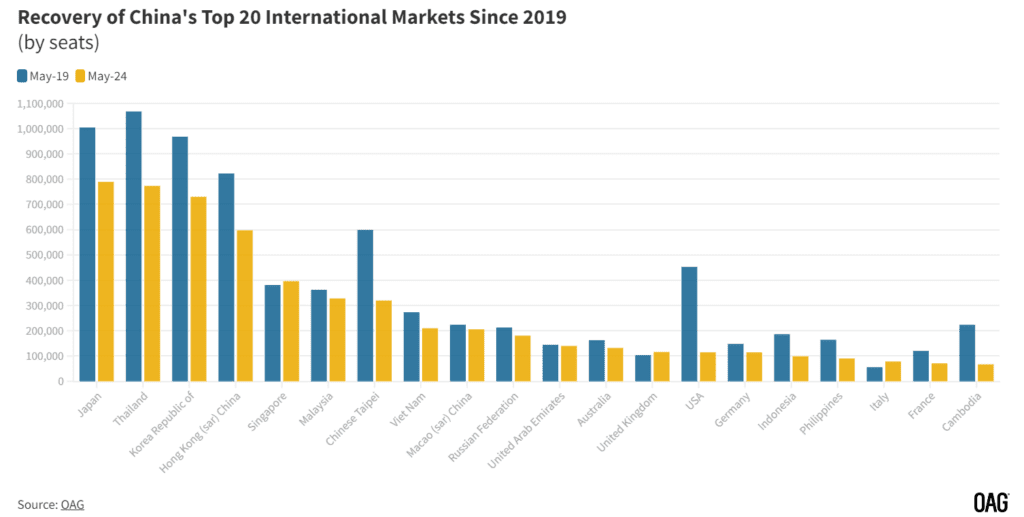

While strong, the numbers still haven’t reached pre-pandemic levels, said Subramania Bhatt, CEO of China Trading Desk.

The popularity of outbound travel is further evidenced by Ctrip’s report of a 190% year-on-year increase in the number of outbound tourists. Alibaba’s Fliggy also noted a near doubling in outbound travel bookings during the five-day holiday, with per capita spending on outbound travel surpassing 2019 levels significantly.

Alipay transactions reflect this increased spending, with a 77% rise in overseas markets during the initial days of Golden Week, particularly in destinations like Thailand and Malaysia.

Challenges in US-China Travel

Travel to the U.S. still faces hurdles, with flight capacity between the two countries around 25% of pre-Covid levels. During the 2019 Labor Day holiday, 70,000 travelers journeyed from China to the U.S., but most recently it was around 42,000.

Bhatt cited several reasons for this:

- Limited Flight Availability: There’s a slower resumption of direct flights and connectivity between China and the US, impacting the ease of planning trips.

- Visa Processing Delays: Longer visa processing times have been a deterrent, likely due to staffing issues and backlogs caused by the pandemic.

- Geopolitical Tensions: Ongoing political tensions between China and the US may make some potential travelers hesitant.

- Concerns Over Racial Treatment: There is apprehension about the treatment of Chinese individuals in the U.S., which can influence travel decisions.

Airline Capacity and Pricing Trends

Though limited, there has been a gradual restoration of airline service and that has helped. Fliggy said that the average price per person for international air tickets dropped by more than 10% compared to the previous year.

The preference for Asian destinations remains strong, with 9 out of the top 10 outbound destinations being in Asia. Bhatt attributed this to the ease of travel, increased flight availability, and visa-free access in many Southeast Asian countries, as well as Hong Kong, Taiwan, and Macau.

Europe continues to attract Chinese tourists, with over 100,000 travelers heading to European countries excluding the UK during the holiday season, according to China Trading Desk’s data. Trip.com reported notable increases in travel to Spain, Turkey, Austria, Slovenia, Italy, and Georgia, with year-on-year growth exceeding 1.5 times.

Domestic capacity in May still accounts for 92% of all seats to, from and within China this month, with international making up the remaining 8%, according to aviation data firm OAG.

Shifts in Travel Preferences

There is a notable shift towards exploring less traditionally frequented destinations. Austria, Turkey, Morocco, and other less traditionally frequented destinations by Chinese tourists saw the fastest growth rates in bookings, indicating a shift towards exploring new and diverse destinations

Fliggy also reported that bookings for long-distance travel to places like Austria, Turkey, Morocco, Russia, Portugal, Georgia, Egypt, Spain, Kazakhstan, and Brazil quadrupled compared to the previous year.

Additionally, Trip.com group noted significant increases in travel to Middle Eastern destinations such as Oman, Saudi Arabia, and Kuwait, with numbers more than tripling year-on-year.

Saudi Arabia and Qatar are set to increase the number of direct flights connecting China and Hong Kong, capitalizing on the resurgence of Chinese tourists. Having welcomed 140,000 Chinese tourists last year, Saudi Arabia aims to attract 5 million Chinese visitors by 2030.

Photo Credit: Fliggy reported that bookings to Turkey, Morocco, Georgia, Egypt and Kazakhstan have quadrupled compared to the previous year.