- Celsius sues Tether for $2.4 billion.

- The lawsuit alleges Tether inappropriately liquidated its collaterals.

Celsius sues Tether

In an attempt to restore its financial capabilities, defunct crypto exchange Celsius has sued Tether. Based on current market rates, the lawsuit targets 39,542 bitcoin worth more than $2.4 billion.

The suit against Tether aims to recover withdrawals and preferential payments made by the company in the last three months before bankruptcy.

In 2022, as markets started to decline, Tether requested additional collateral from Celsius to prop up its loans. Also, it, took an extra $300 million in USDT in loans but filed for bankruptcy three months later.

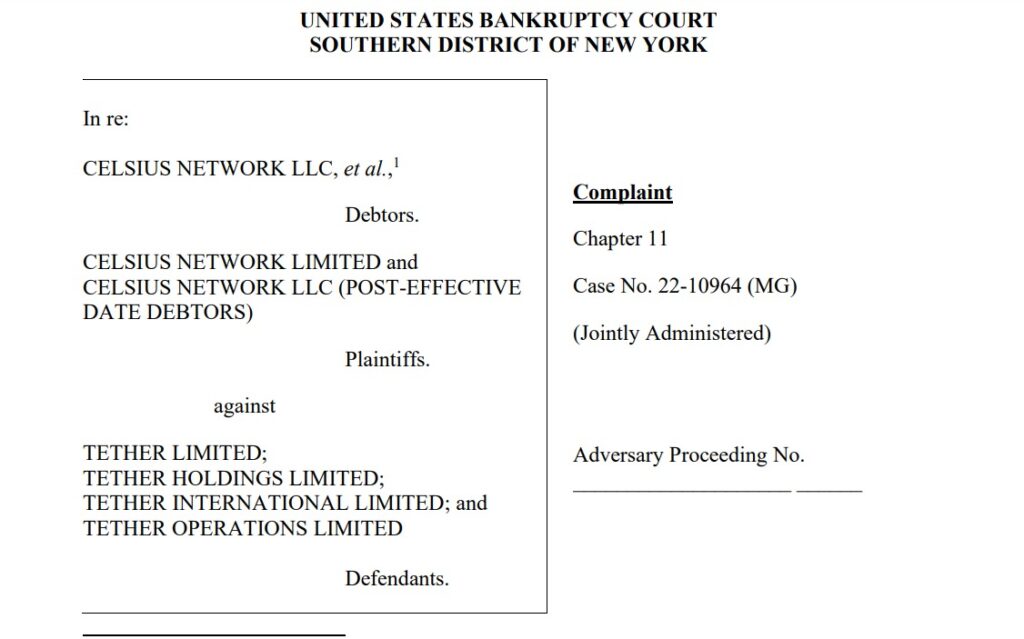

Source: UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

According to the lawsuit, after fulfilling Tether’s demand for 3000 bitcoin in June 2022, Tether further requested another collateral.

However, while Celsius sought the funds within the mandated timeline, Tether decided to liquidate Celsius collateral of 39, 542 bitcoin within hours. In detail, the lawsuit argues that,

“Tether applied Celsius’s property (39,542.42 Bitcoin) to pay itself back for Celsius’s outstanding loan for less than reasonably equivalent value when Celsius was insolvent.”

Tether’s CEO Paolo Ardoino responded to the lawsuit through X adding that,

“Now, more than two years later, this baseless lawsuit is trying to claim that we should give back the sold bitcoin to cover Celsius’ position.”

In July 2022, after freezing customer accounts to prevent withdrawals in June, Celsius filed for bankruptcy. Before its collapse, the firm was valued at $3 billion.

According to the filing, the firm estimated its assets and liabilities to be around $1 billion to $10 billion, with 100,000 creditors.

Equally, the company added that it had over $167 million in cash at hand. Although it boomed during the pandemic, its business came under scrutiny.

Celsius battles with other crypto firms

In a series of lawsuits, Celsius has sued various crypto firms. Firstly, last month, the exchange filed a lawsuit against Bancor DAO. According to the lawsuit, Bancor mechanism was flawed from the beginning.

The impermanent loss protection was to be paid by fees generated by the protocol. However, the fees that the protocol earned were insufficient to pay the impermanent loss cost.

Also, the crypto lender sued Badger Dao and Compound Labs in other lawsuits filed last month.