- ADA has declined to the $0.37 price range.

- The ADA unrealized loss has grown in the last few weeks.

In recent months, Cardano [ADA] has experienced a challenging period in terms of its price performance. As the price of ADA has declined, there has been a corresponding increase in the number of addresses holding the asset at a loss.

This trend indicates that many investors who purchased Cardano at higher prices are now facing negative returns on their investments.

Cardano at a loss

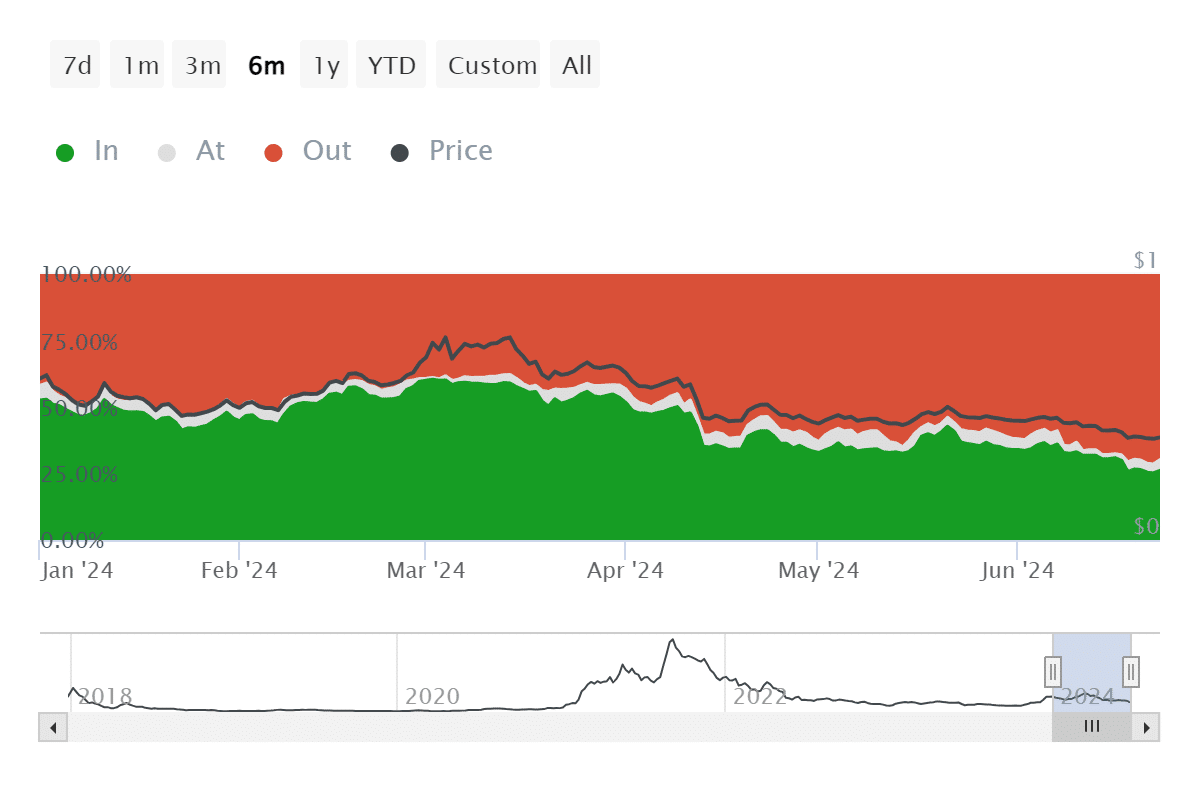

The analysis of the Global In/Out of the Money indicator for Cardano on IntoTheBlock provides insight into the current state of investor holdings.

The data shows that, as of now, 3.31 million addresses are “out of the money.”

This meant that the current price of Cardano was lower than the average cost at which these addresses purchased their ADA.

The analysis of Cardano’s market conditions further reveals that approximately 74% of all ADA addresses are currently “out of the money.” It was a significant majority that underscored the widespread impact of the price decline.

A detailed breakdown indicated that addresses which purchased ADA at a price close to $0.39 are nearest to breaking even despite the general market downturn.

These addresses collectively hold around 2.57 billion ADA tokens. There are about 180,000 addresses in this particular category, representing a sizable group of investors.

Cardano addresses become less active

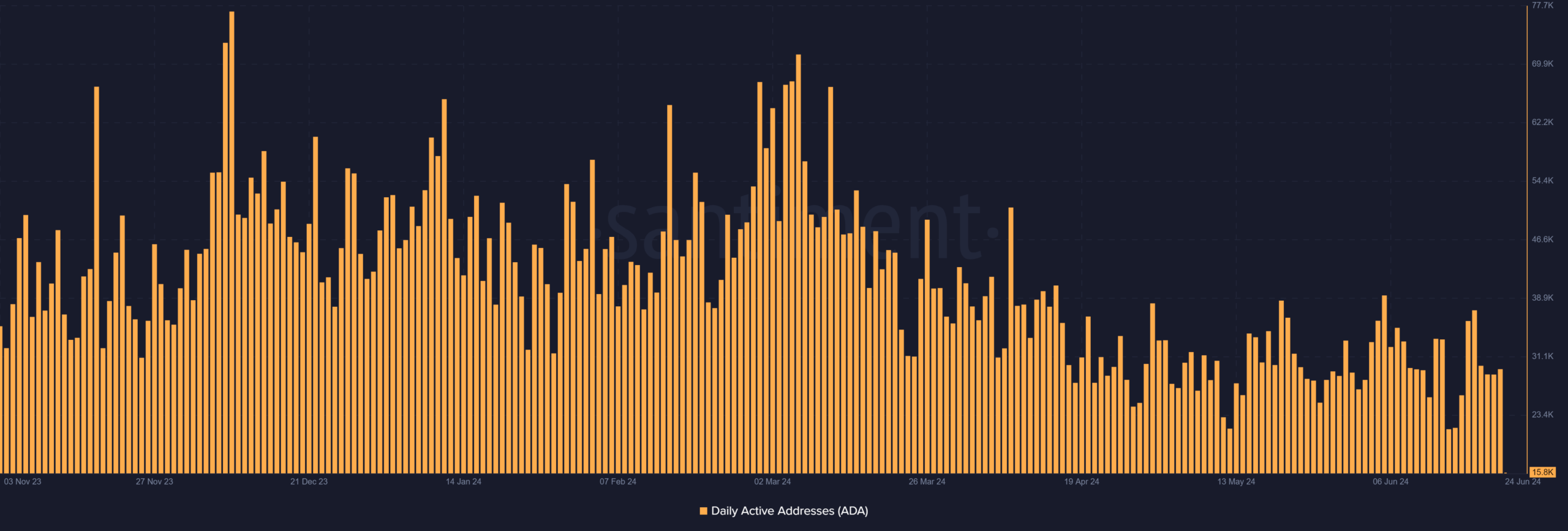

The analysis of Cardano’s daily active addresses indicates a decline into a consistent pattern over the last few days.

According to the chart from Santiment, the number of active addresses dropped to around 29,000 by 20th July.

Also, it has continued to hover within that range since then. By the end of trading on 23rd June, the number of active addresses was approximately 29,527.

As of the latest data, this number has decreased significantly to around 15,000. This reduction in active addresses could signify a decrease in network usage and engagement.

The recent analysis of Cardano’s trading volume indicated a decline, followed by a resurgence in activity.

As of the latest data, the trading volume stood at approximately $280 million, marking an increase from the $202 million recorded at the close of trade on 23rd June.

ADA price declines again

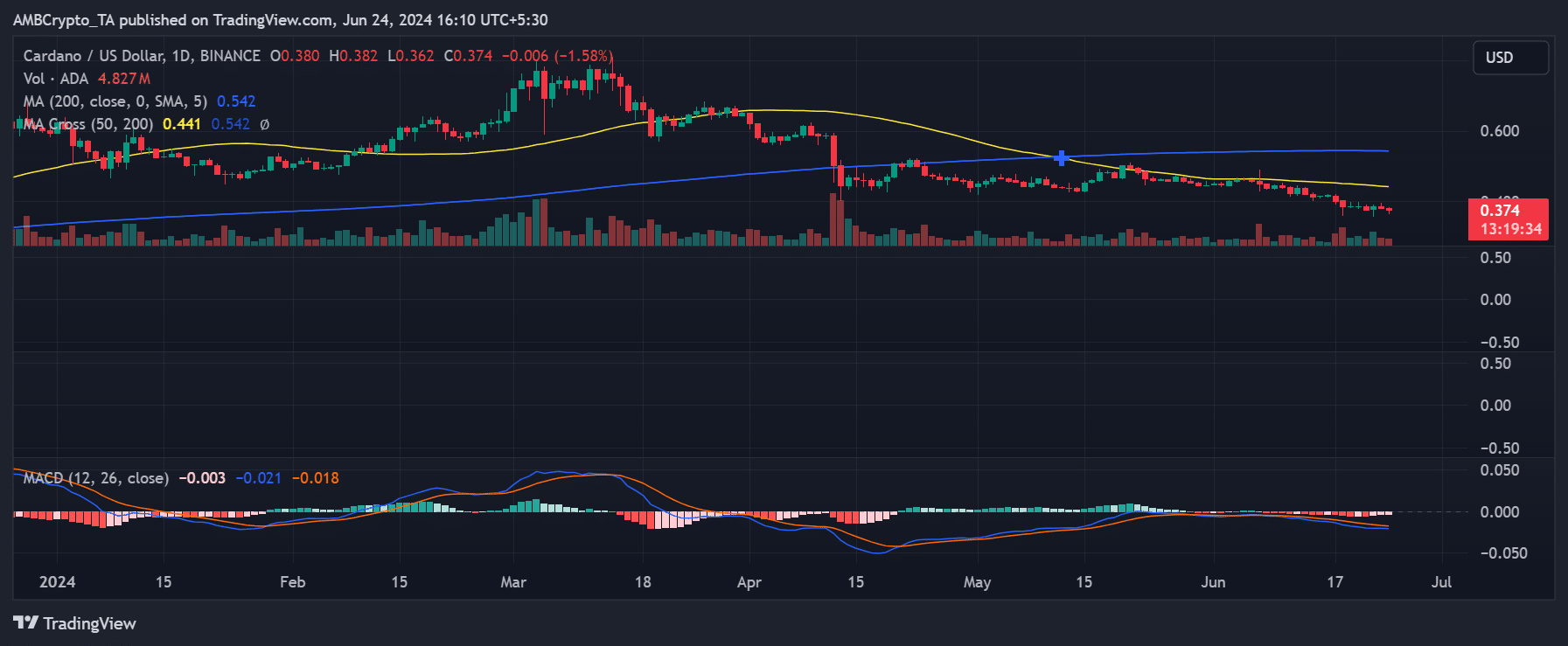

AMBCrypto’s analysis of the daily time frame chart for Cardano shows that after a decline of over 1% on 23rd June, it was trading at around $0.38.

Is your portfolio green? Check out the Cardano Profit Calculator

As of this writing, the price had further decreased to the $0.37 range following a decline of approximately 1.58%.

Additionally, the analysis highlights that the resistance level for Cardano, indicated by its short moving average (yellow line), is firmly established at around $0.44.