- Bitcoin was up 3% over the last seven days, at press time.

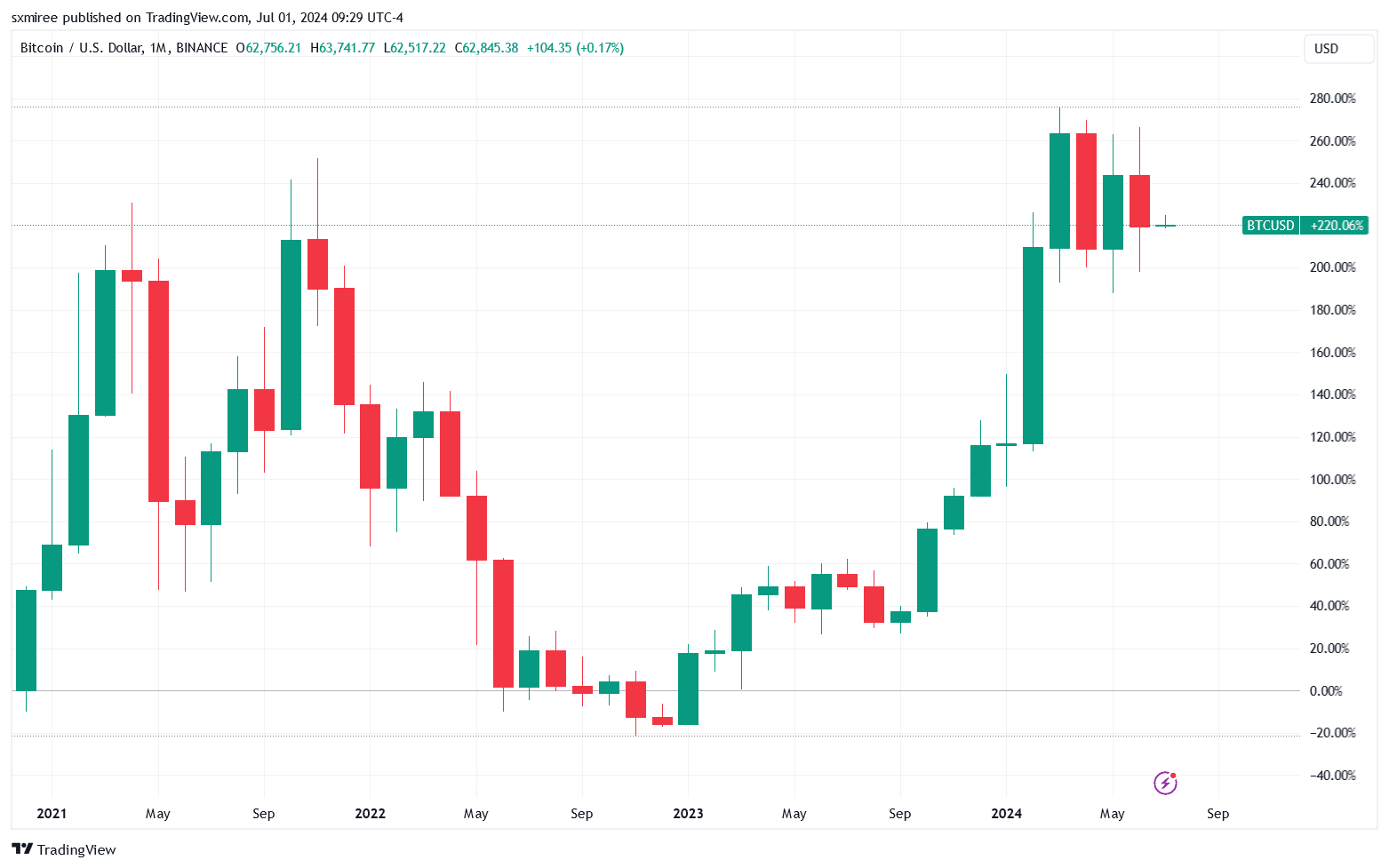

- June’s lackluster action ultimately saw Bitcoin register negative returns of almost 7%.

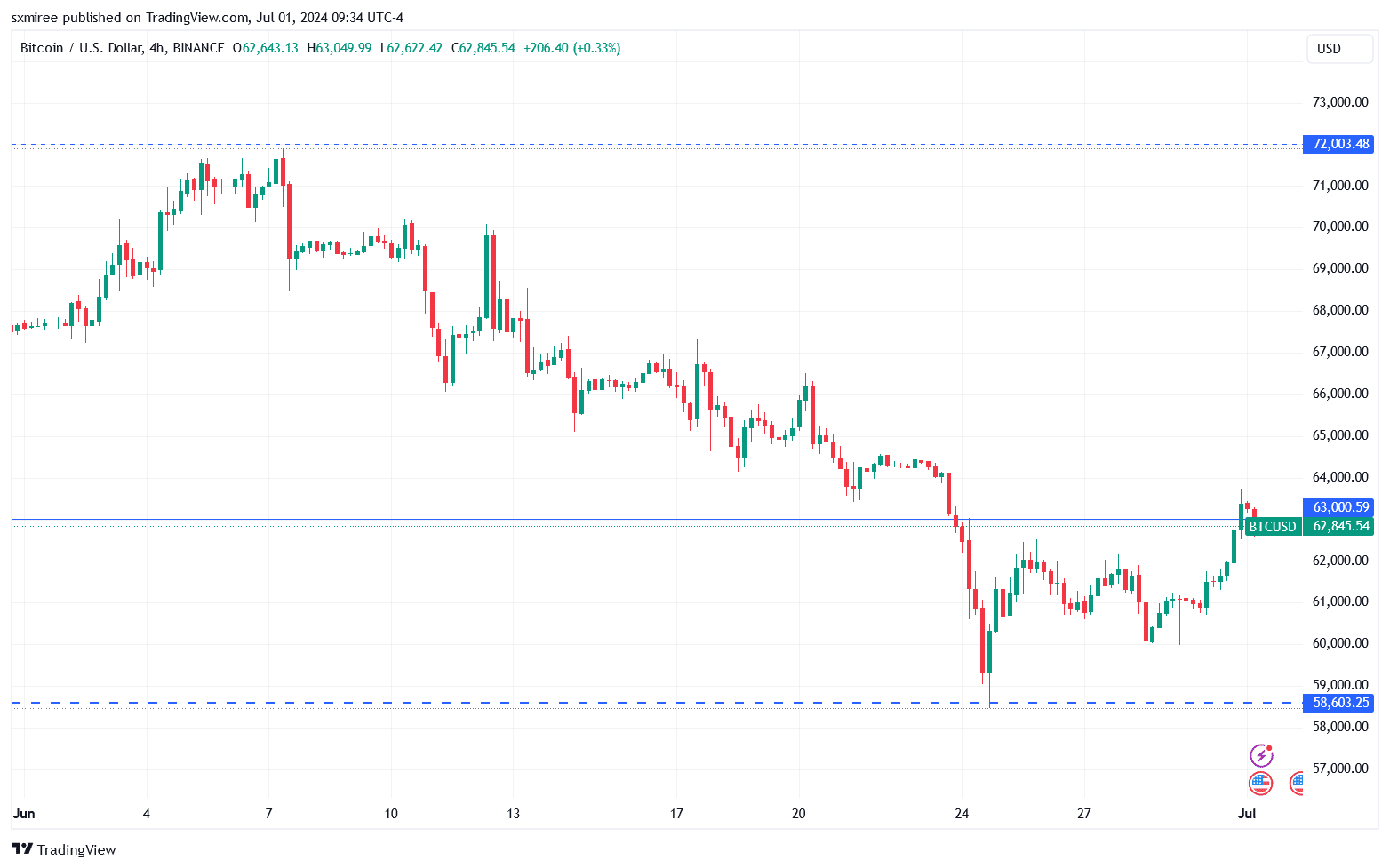

Bitcoin [BTC] traded promisingly above $63,000 coming off the weekend as bulls attempted to gain higher ground ahead of the monthly close.

Though they successfully defended the crucial $60,000 psychological support level boosted by price gains on the last day of the month, the BTC/USD pair nonetheless printed red monthly and quarterly candles.

Here is what is ahead for the leading cryptocurrency:

Bitcoin price action

June’s lackluster action ultimately saw Bitcoin register negative returns of almost 7% across the month and about 12% for the just-concluded quarter.

The BTC/USD pair faces more price volatility triggers in the second half of the year following a weak performance last quarter during which the pair booked two trips below $60,000.

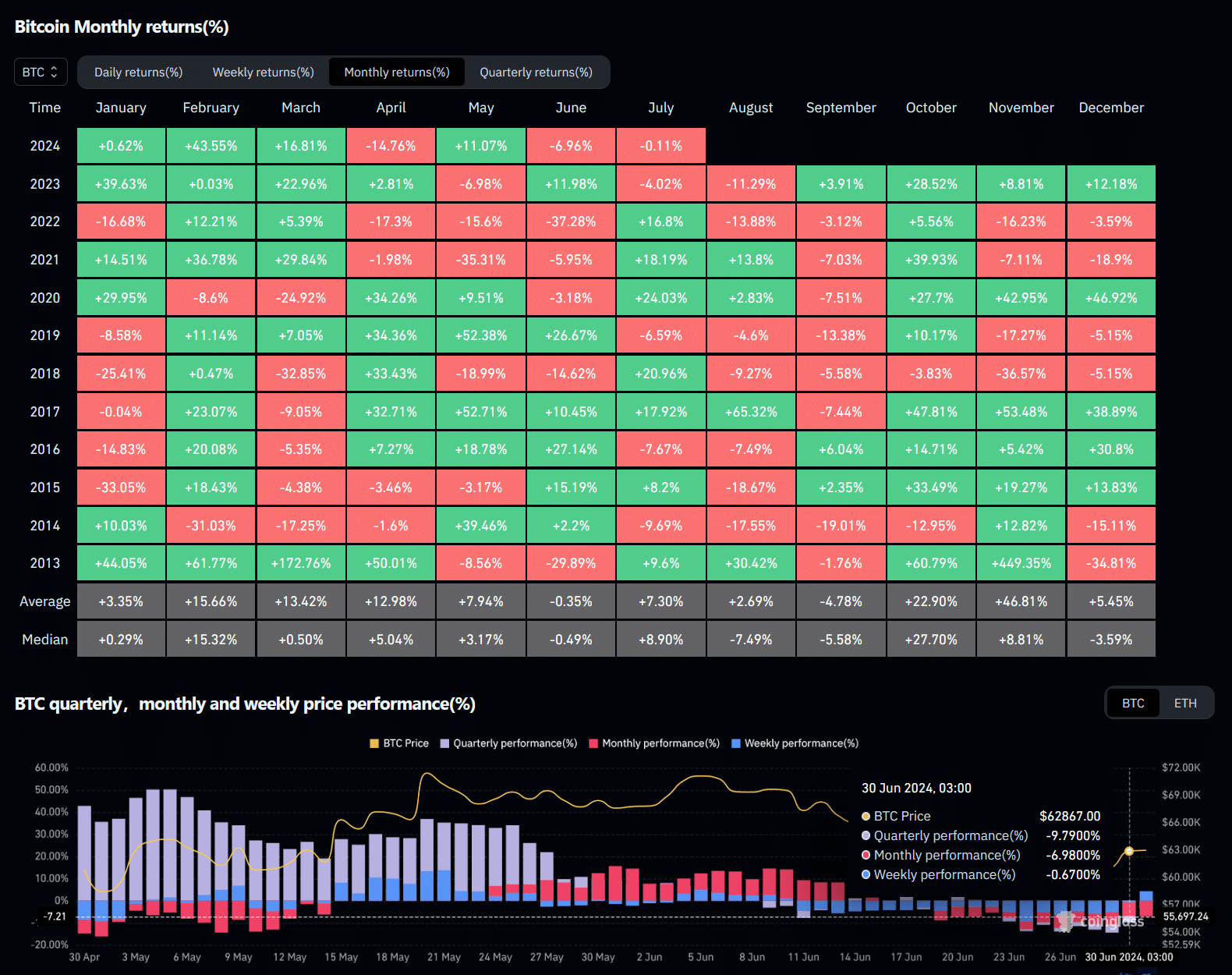

Fundamentals indicate that Bitcoin is still poised for potential upside in Q3. Bitcoin’s price has historically rebounded in July after tracking negative returns in June with an aggregated average return of 7.3% and a median return of 8.9%.

While historical data from Coinglass confirms Bitcoin’s July recovery narrative after being subdued in June, some market participants aren’t entirely sold on a bullish setup.

Macroeconomic picture

Uncertainties continue to linger in the macro picture going into the new month. This week, markets welcome mild catalysts in the form of US macroeconomic data releases, which could provide insights into central bankers’ view of inflation and interest rates.

Fed Chair Jerome Powell is expected to speak at a European Central Bank conference in Sintra, Portugal on Tuesday, followed by Wednesday’s release of minutes from the Fed’s previous meeting.

On Friday, stock markets will reopen and welcome the US jobs June report.

Signs of easing inflation so far have seen market commentators bet on a rate cutting-cycle by the US Federal Reserve at some point this year.

Markets broadly forecast two rates of 25 basis points each by the Fed before the end of the year per CME’s FedWatch tool. These potential rate cuts by the Fed could mean more investor inflows into alternative assets like cryptocurrencies.

In its annual economic report released on 30th June, the Bank of International Settlements (BIS) however warned against premature easing of monetary policy.

The BIS advised at its annual general meeting,

“A premature easing could reignite inflationary pressures and force a costly policy reversal – all the costlier because credibility would be undermined. Indeed, risks of de-anchored inflation expectations have not gone away, as pressure points remain,”

Market participants will need to keep an eye on the next Federal Open Market Committee (FOMC) meeting scheduled for July 30-31 to get a better reading on the Fed policy.

Read Bitcoin’s [BTC] Price Prediction 2024-25

BTC/USD technical analysis

Bitcoin reclaimed $63,000 during 1st July’s trading session setting an intraday high of $63,700 in the process. From a technical standpoint though, Bitcoin is still showing weakness inside the $58,500 to $72,000 range notwithstanding Monday’s price action.

A close below the 20-exponential moving average (EMA) at around $63,650 could see the crypto fall toward critical support at $60,000 again.