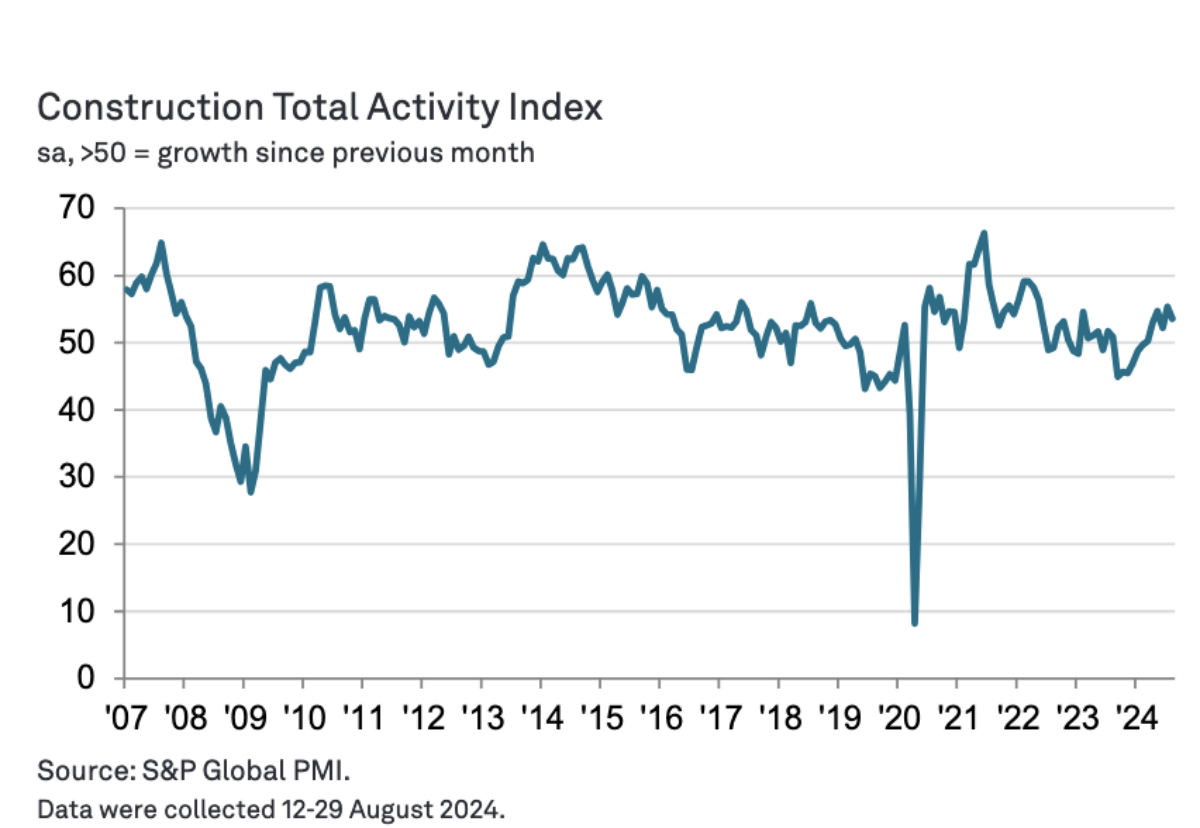

The bellwether S&P Global UK Construction Purchasing Managers’ Index recorded 53.6 in August – above the 50.0 no-change value for the sixth month running.

The pace of expansion slowed slightly from a record July figure of 55.3 but the industry continued to grow thanks to robust new order growth and a more supportive economic backdrop.

Commercial activity was the best-performing segment (index at 53.7), despite the pace of growth slipping to its lowest since March. A number of firms noted a boost from rising sales enquiries and the release of new orders following the general election.

Civil engineering activity (51.8) expanded at only a moderate pace that was notably weaker than in July.

Residential work was the only sub-sector to gain momentum with growth accelerating to its fastest since September 2022 (52.7).

Strengthening order books and an upturn in sales pipelines underpinned positive sentiment regarding the year ahead with confidence levels much higher than at the same time in 2023.

Tim Moore, Economics Director at S&P Global Market Intelligence, said: “The UK construction sector appears to have turned a corner after a difficult start to 2024, with renewed vigour in the house building segment the most notable development in August.

“Residential work expanded at the fastest pace for almost two years as lower borrowing costs and a gradual recovery in market conditions helped to boost activity.

“Commercial building was the best-performing part of the construction sector as the improving UK economic backdrop resulted in stronger order books, but the post-election bounce in demand faded somewhat in August.

“Another robust expansion of incoming new work was recorded in August, highlighting that new project starts are set to support a broader rebound in construction activity during the months ahead.

“Improving sales pipelines and a turnaround in demand conditions led to a relatively strong degree of business optimism across the construction sector. However, some firms cited a slowdown in civil engineering activity and concerns about the outlook for infrastructure work as constraints on growth expectations.”