- Purchase sparked renewed interest in Bitcoin, with a clear support around $57,493

- BTC might struggle to hit $60,000 due to reduced network activity

After Bitcoin’s [BTC] price dropped to $54,000 on 9 July, a market participant purchased 10,000 coins valued at $540 million. Ali Martinez, an analyst on X, revealed this.

Shortly after, the price of Bitcoin jumped to $58,000. The action mentioned above is a typical ‘buy the dip‘ behavior. This underlines the belief that a price decrease is a sign to purchase at discount prices, before another jump happens.

However, the buyer was not the only one involved in buying Bitcoin. Around the same period, spot Bitcoin ETFs’ inflows, which were seeing a dry spell, recorded a surge of 3,760 BTC accumulated in three days.

This, according to data from Farside Investors. Direct buying of BTC and increased exposure on the ETF front, together, imply rising confidence in the cryptocurrency.

Big buys, huge backing

At press time, Bitcoin was valued at $57,384, representing a mild 0.60% fall in the last 24 hours. Despite the decline, however, AMBCrypto’s analysis showed that the coin’s price might get close to $60,000.

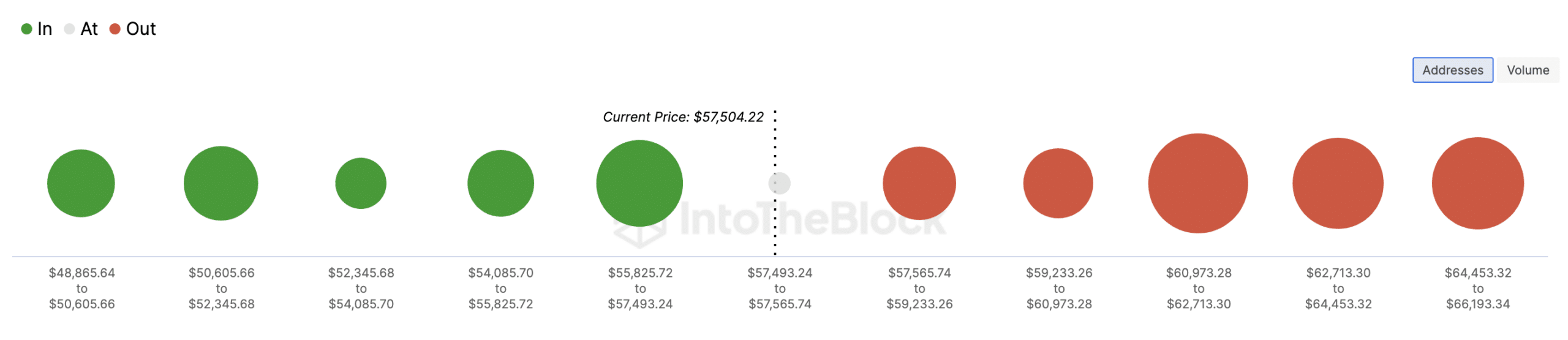

This was the conclusion after we examined the In/Out of Money Around Price (IOMAP) indicator. Here, the IOMAP classifies addresses based on those making money and those of out.

With this metric, one can tell if a coin has strong support or resistance at any given price. Typically, the larger the cluster of addresses at a price range, the stronger the support or resistance.

According to IntoTheBlock, 1.11 million addresses purchased a total of 623,720 BTC between $55,825 and 57,493. These addresses are in profits.

On the other hand, 701,630 addresses bought 279,210 BTC between $57,565 and $59,233. Since there was a higher number of addresses at the lower levels, they can provide support for Bitcoin.

Will buying now yield returns?

If this is the case, Bitcoin’s price might be able to break through the $59,233-resistance. Should this be the case, the value of the coin might surge past $60,000 in the short term.

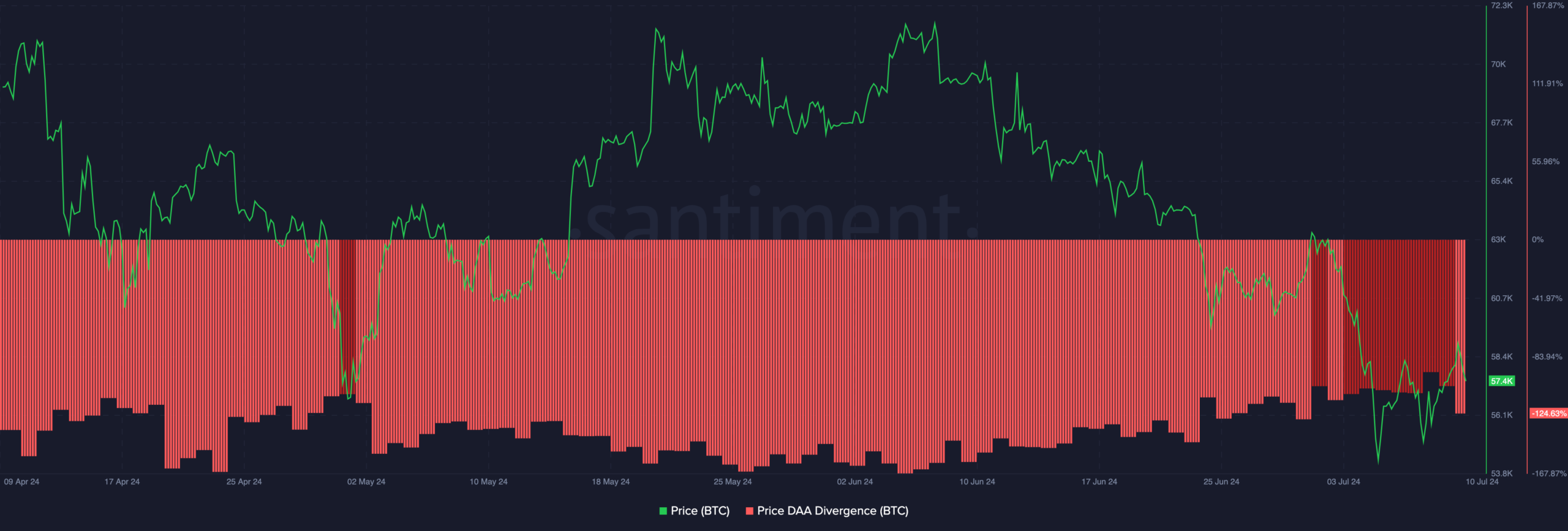

AMBCrypto also analyzed the price-DAA divergence. DAA is an acronym for Daily Active Addresses. Therefore, the indicator measures price changes and the rate of participation to generate buy and sell signals.

If the price is increasing as well as the DAA, it means that Bitcoin’s value has risen, and might continue. At press time, the divergence was in negative territory, indicating that the price decline was accompanied by a fall in network activity.

If this remains the same, it could be challenging for BTC to sustain a price hike. However, if activity on the network begins to increase, BTC could register a slow rise up the charts, surpassing $60,000 while doing so.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

On the contrary, this forecast might be invalidated if selling pressure continues. For example, Germany, which has been at the forefront of distributing Bitcoin lately, still has around $1 billion in its holdings. If it decides to distribute these coins, the crypto could drop below $58,000 again.