- Accumulation of BTC by large wallets continued to surge despite price stagnancy.

- Interest in Bitcoin’s ecosystem waned.

Bitcoin [BTC] has been stagnating at the $66,000 price mark for quite some time. A lot of investors have seen this as an opportunity to accumulate large amounts of BTC.

Whales accumulate

According to Santiment’s data, two years ago, the number of wallets holding 10 or more Bitcoin reached a peak. Interestingly, that same level of holdings has been observed again.

This time around, however, the landscape is vastly different. Bitcoin’s market value has surged by an impressive 226%.

Some speculate that the now-defunct FTX exchange was manipulating cryptocurrency prices in late 2022.

Since its collapse in November of that year, however, a trend has emerged. There seems to be a correlation between the number of wallets holding more than 10 BTC and the overall market value of the coin.

This renewed interest from these whales could be a sign of a bullish sentiment suggesting they see Bitcoin as still extremely undervalued despite high prices.

It also indicated that they are accumulating in anticipation of future price increases. Their large holdings give them the power to influence market sentiment.

If they continue accumulating, it could drive up demand and push the price even higher.

It’s also possible that these whales are simply taking advantage of the current price point to rebalance their portfolios, not necessarily signaling a long-term bullish outlook.

Additionally, if these whales decide to sell their holdings in a coordinated manner, it could trigger a significant price drop.

At the time of writing, BTC was trading at $66,187.79 and its price had declined by a meager 0.04%.

Some causes for concern

Despite BTC’s price movement remaining relatively stable, the interest in Bitcoin’s ecosystem was declining. One of the major indicators of the same was the waning interest in Bitcoin NFTs.

Over the past month, the number of NFT sales made on the ecosystem had fallen by 60.93%. Moreover, the number of buyers had also decreased by 50.1% during the same period.

Read Bitcoin (BTC) Price Prediction 2024-2025

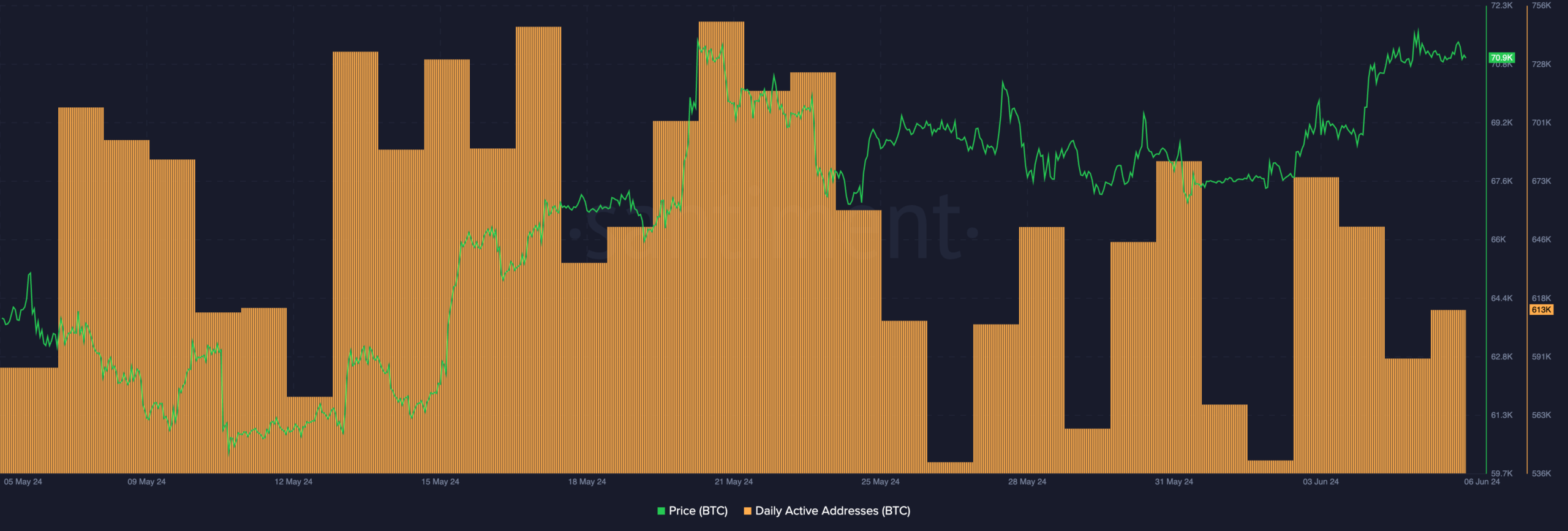

Moreover, the number of daily active addresses on the ecosystem also fell significantly from 700,000 to 613,000 over the past month.

This decline in activity on the Bitcoin network can hurt the price of BTC in the long run.