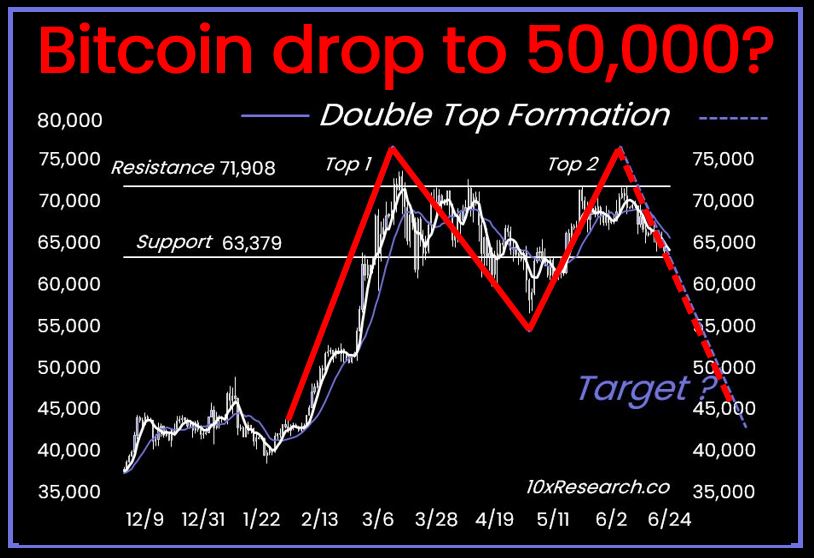

- Bitcoin shows a “double-top” pattern, hinting at a possible fall to $50K.

- Despite bearish trends, optimistic long-term projections suggest a significant future rise in Bitcoin’s value.

Bitcoin [BTC] was hovering above $61,000 once again at press time, after briefly dipping to $58,000 levels the previous day, showing signs of recovery with a 24-hour high of $62,949.

However, at the time of writing, Bitcoin was trading at $61,200, reflecting a decrease of 1.2% over the past 24 hours.

This pattern of quick recoveries followed by setbacks is sparking debate among crypto analysts, who foresee a possible further decline to the $50,000 level.

Double top shows further drop To $50k

This bearish sentiment is bolstered by the formation of a “double-top” price pattern, a technical indicator that often heralds forthcoming bearish trends.

The pattern, characterized by two consecutive peaks of similar height separated by a trough, suggests that Bitcoin might not only revisit but possibly break below the $50,000 threshold.

This scenario is seen as increasingly likely given Bitcoin’s struggle to surmount established resistance levels, pointing to potential vulnerabilities in its current market strength.

The concept of a double-top pattern in trading is significant as it typically indicates a reversal from a prior uptrend.

10x Research has highlighted that Bitcoin is manifesting this pattern, which has historically preceded substantial price declines.

According to their analysis, if Bitcoin fails to hold above the critical ‘neckline’ support level, it could lead to a sharp decrease, possibly reaching as low as $45,000.

Market insights from the firm suggests that this bearish pattern is solidifying, supported by observations of range trading between $60,000 and $70,000.

The potential transition from this trading range into a topping formation could spell trouble for retail investors, particularly as many altcoins tend to follow Bitcoin’s lead and could also face significant drops.

Other analysts, including Dylan Leclair, have noted signs that could point to a potential drop in Bitcoin’s price to around $50,000.

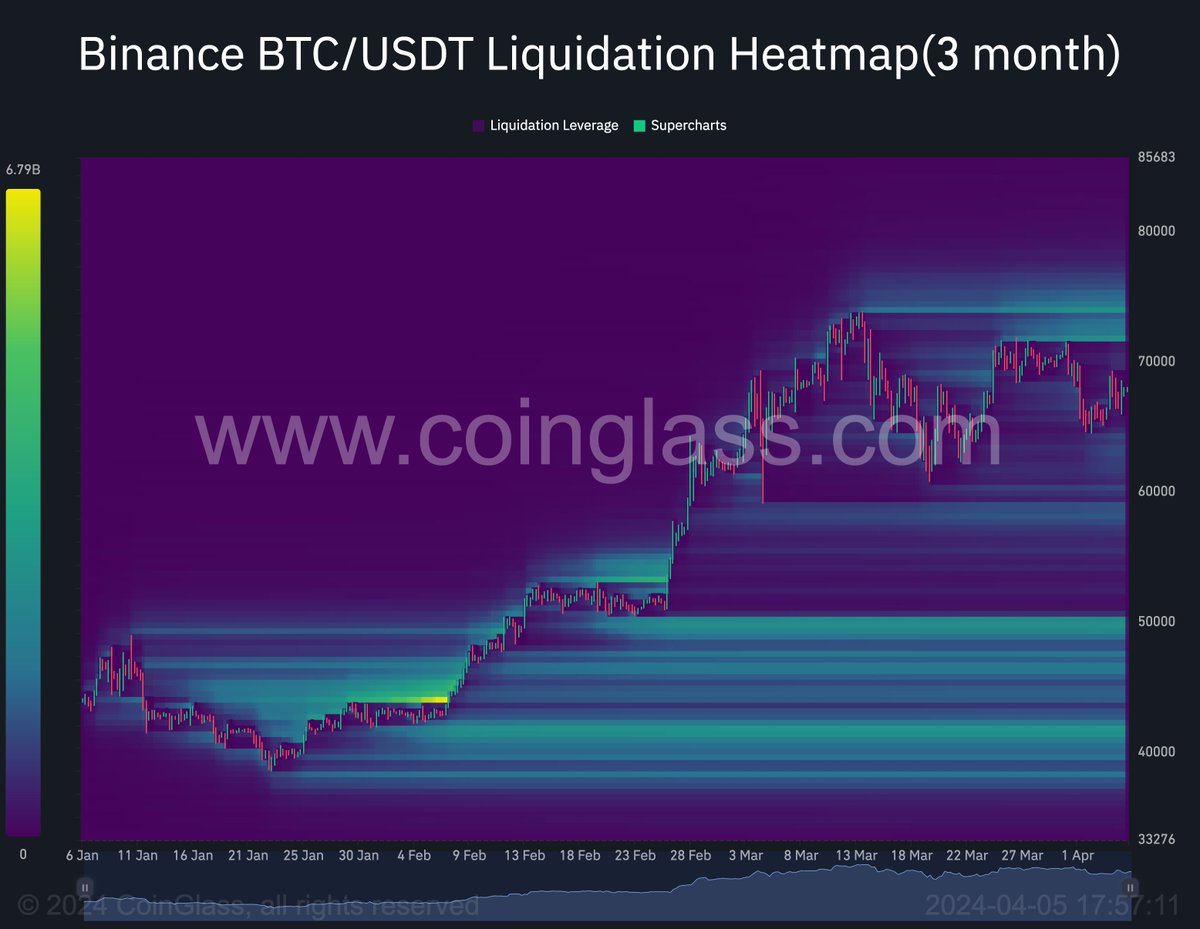

Leclair highlights recent trends in the derivatives market, such as a decrease in perpetual futures open interest and funding rates as Bitcoin stabilizes below its previous high of $69,000.

This stabilization has led to fewer leveraged longs chasing the all-time high breakout, and although there is a risk of long positions being liquidated around $50,000.

Leclair noted,

“ I find it pretty unlikely we revisit that level (but not impossible of course!).”

Source: Dylan Leclair on X

Bitcoin fundamentals: Backing up the bearishness?

The looming question now is whether Bitcoin’s fundamentals suggest a further decline. A deep dive into Bitcoin’s key fundamental metrics sheds some light.

For instance, Santiment data on BTC’s social volume reveals a peak in mentions of “bottom,” suggesting increased bearish sentiment.

This is one of the highest social volume and dominance spikes for the term in the past year, hinting at potential further downside.

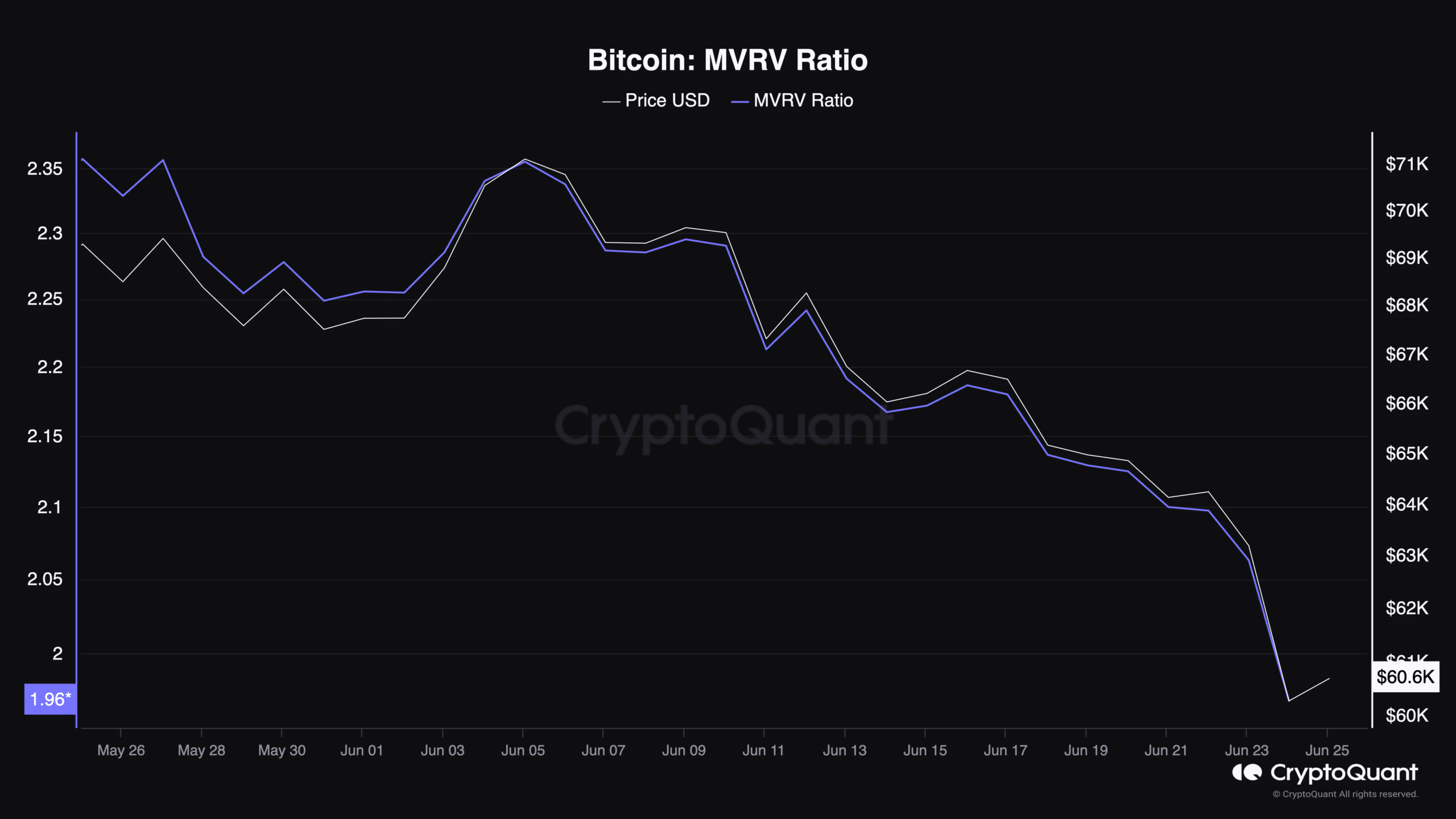

Moreover, CryptoQuant data indicates that Bitcoin’s MVRV ratio—a metric that compares the market value of Bitcoin to its realized value—is closely following the price downtrend, currently standing at 1.96.

Read Bitcoin’s [BTC] Price Prediction 2024-2024

The ratio suggests that Bitcoin’s market value is nearly double its realized value, which can indicate that the price is relatively overvalued and might correct further.

Despite these bearish indicators, Jack Mallers, CEO of Strike, maintains an optimistic long-term view, envisioning a future where Bitcoin reaches $1 million per coin.