- Bitcoin’s projected target remains high at $91,539 according to the “Magic Bands” model.

- Recent whale activities and increasing active addresses suggest strong market support for this bullish outlook.

Despite recent fluctuations in the crypto market, Bitcoin [BTC] continued to exhibit signs of potential upward movement.

Following the latest U.S. CPI report, which indicated a slowdown in inflation, Bitcoin experienced a brief surge to $69,000.

At press time, it hovered around $67,505, reflecting a minor increase over the past 24 hours. This resilience came amid a backdrop of broader market corrections, with the asset experiencing a 4.7% decline over the week.

Bitcoin: Technical predictions

Amidst these price dynamics, CryptoCon, a pseudonymous technical analyst, remaind steadfast in their bullish outlook for Bitcoin, projecting a potential rise to $91,539 in the near future.

This target, according to CryptoCon’s post on social platform X (formerly Twitter), remains unchanged despite the Federal Reserve’s decision to maintain interest rates with only a minor planned reduction in 2024.

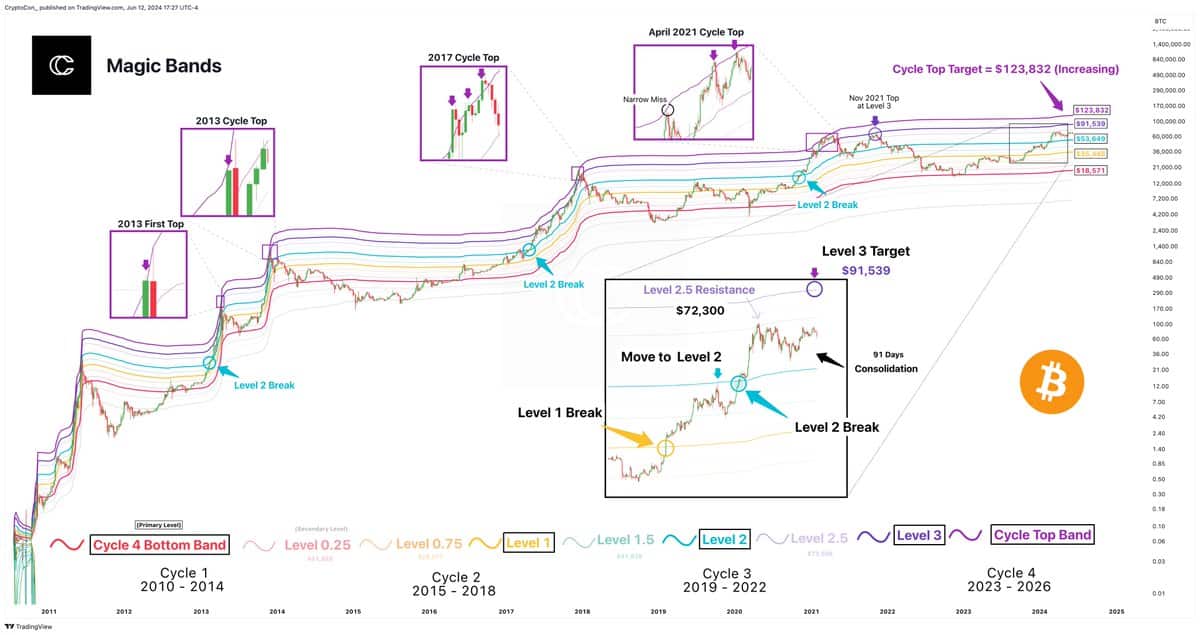

The prediction employs the “Magic Bands” model, which utilizes historical peak and trough patterns to forecast future price levels.

The “Magic Bands” model suggested that Bitcoin, currently navigating what is termed as ‘level 2.5’ of the cycle, was poised for a breakout that could propel it to $91,539.

This would mark a significant ascent from its current valuation and potentially pave the way to reaching what the model predicts as a ‘Cycle Top Target’ of $123,832.

Analyzing fundamentals

To gauge the feasibility of such a price leap, one can look at Bitcoin’s Open Interest and active addresses.

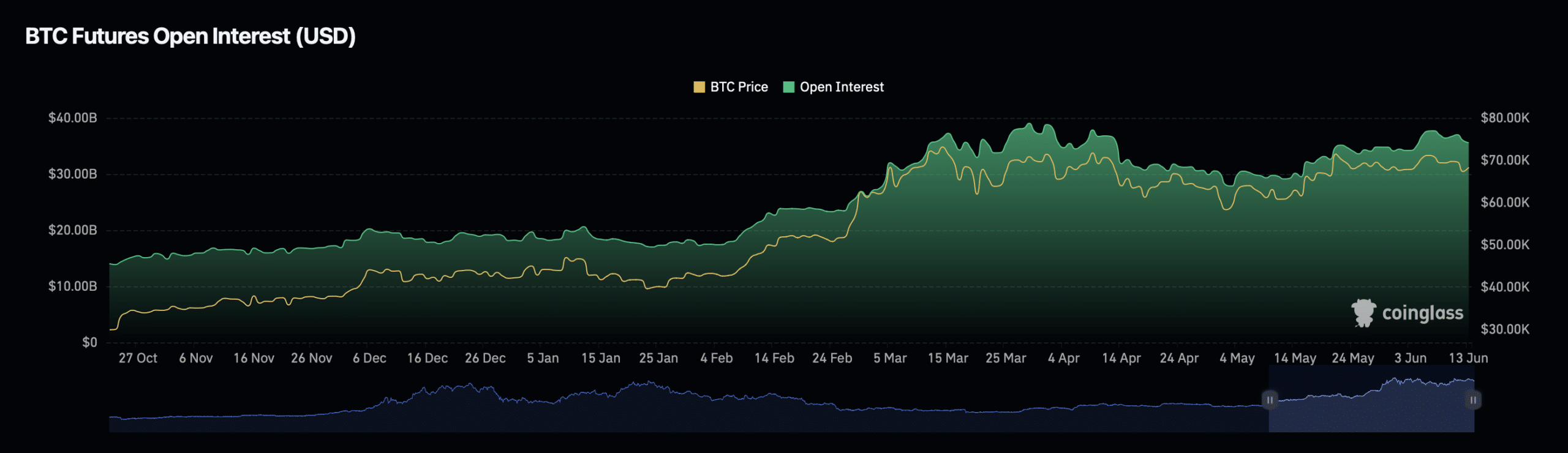

AMBCrypto’s analysis showed a mixed pattern in Open Interest, while the overall Open Interest declined by 3.11% in the past day.

The valuation significantly rose by 53.11% during the same period, suggesting a tightening market that could lead to price volatility.

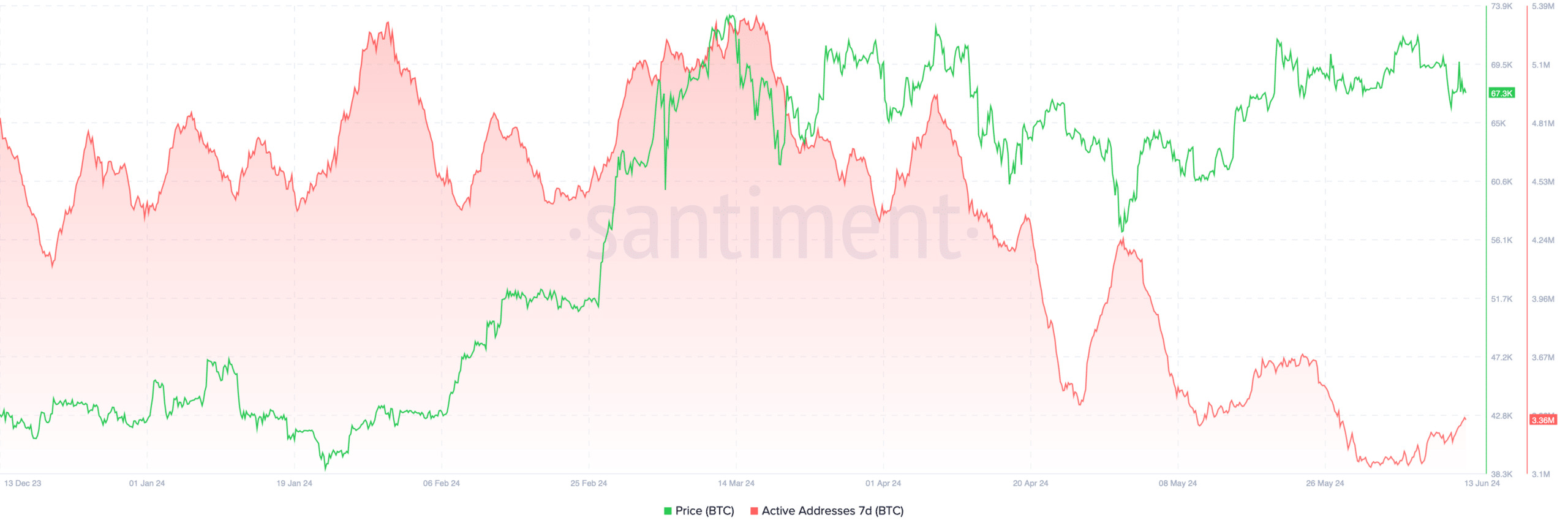

Moreover, the number of active Bitcoin addresses has increased from 3.14 million to 3.36 million in recent days.

Active addresses typically indicates a growing user base and can be a precursor to increased transaction volumes, which might support higher price levels.

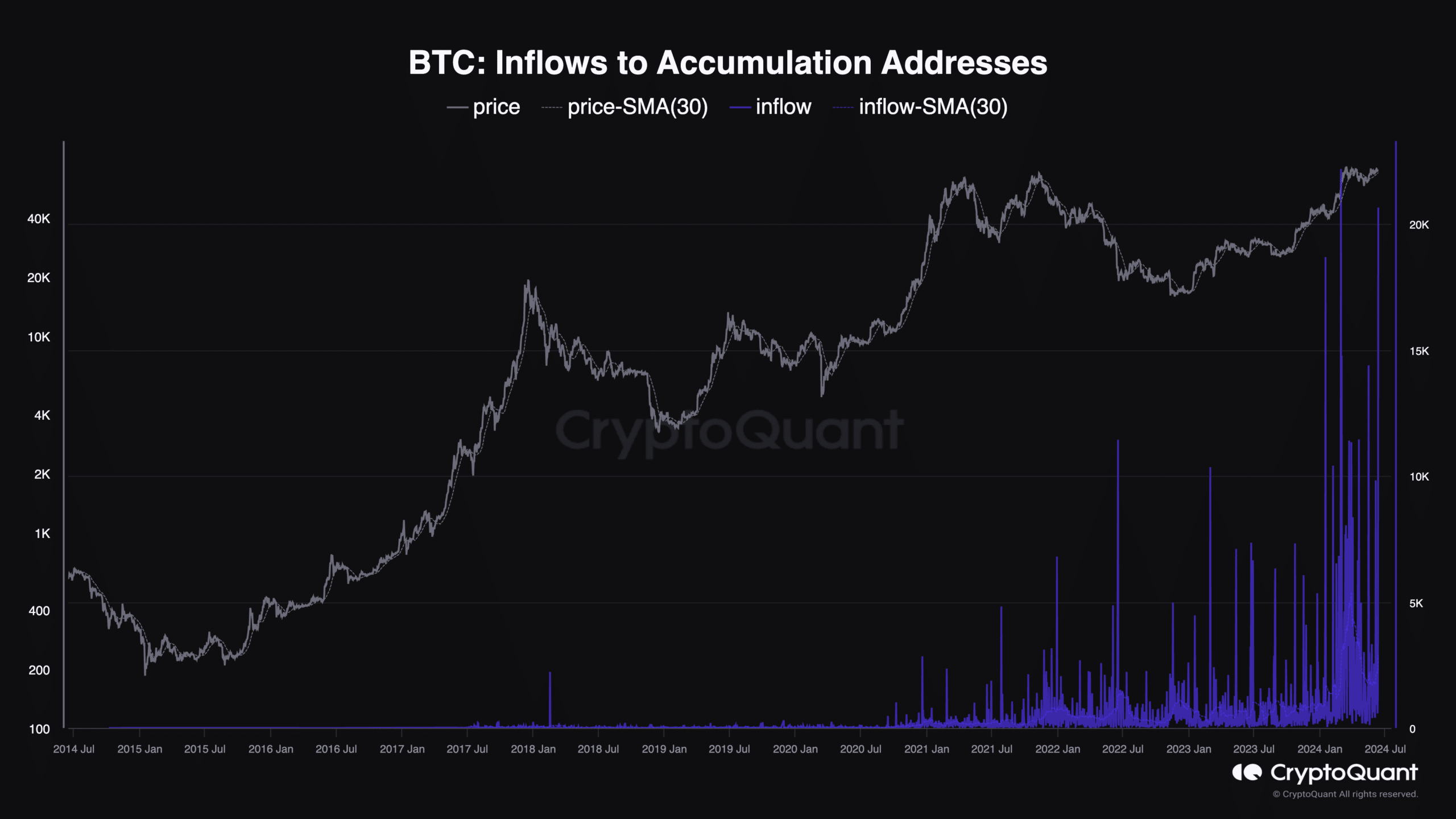

The behavior of Bitcoin whales also provided insight into market sentiment. On the 11th of June, during a notable price dip, whales accumulated an additional 20,600 BTC, worth approximately $1.38 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

This marked one of the most significant single-day purchases by large investors since February, suggesting that major players were seeing value at current prices and may be positioning for anticipated price increases.

Additionally, AMBCrypto has recently reported a notable resurgence in previously dormant Bitcoin addresses.