- Bitcoin witnessed a significant uptick in price, causing bears to get liquidated.

- Overall long positions grew, and interest in ETFs surged.

After hovering around the $60,000 mark for quite some time, Bitcoin [BTC] witnessed some positive price movement, injecting hope into optimistic bulls.

Short sighted

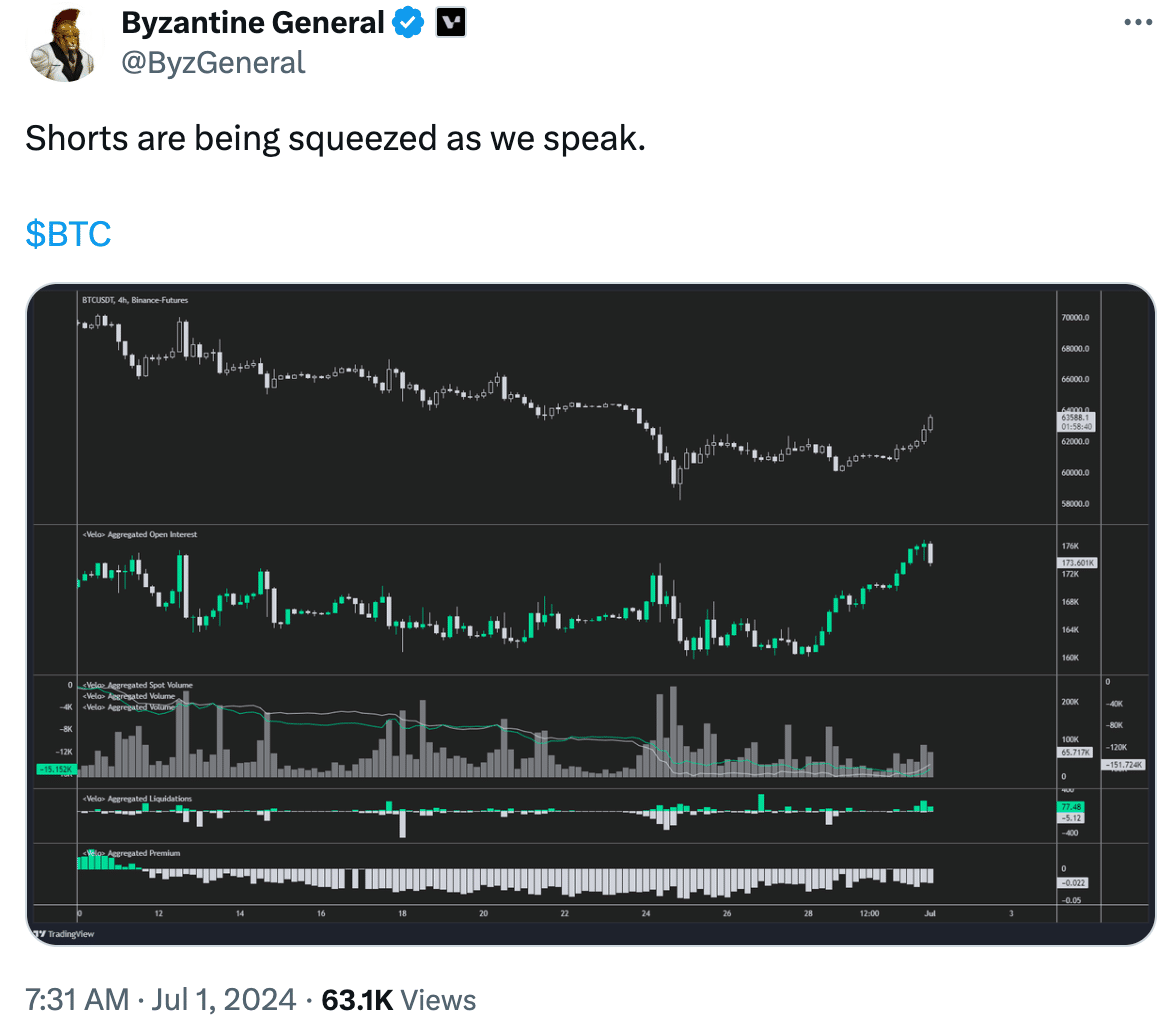

Even though the bulls rejoiced, the bears got the worst end of the deal. A massive number of short positions were liquidated over the last 24 hours. This can result in a short squeeze.

As the price goes up, short sellers face margin calls from exchanges to maintain their positions or are forced to buy back BTC to close their shorts. The buying by desperate short sellers to exit their positions pushes the price even higher, attracting new buyers chasing the upswing.

This cycle can lead to dramatic price increases for BTC, exceeding initial expectations.

Even though short sellers can experience significant losses, the market can become highly volatile with potential corrections as some investors take profits.

While a short squeeze can be positive for bulls positioned correctly, it’s a high-risk situation for everyone involved due to the potential for the market to reverse course and liquidate traders as prices move violently.

However, these factors haven’t slowed down the bulls one bit.

Bulls march ahead

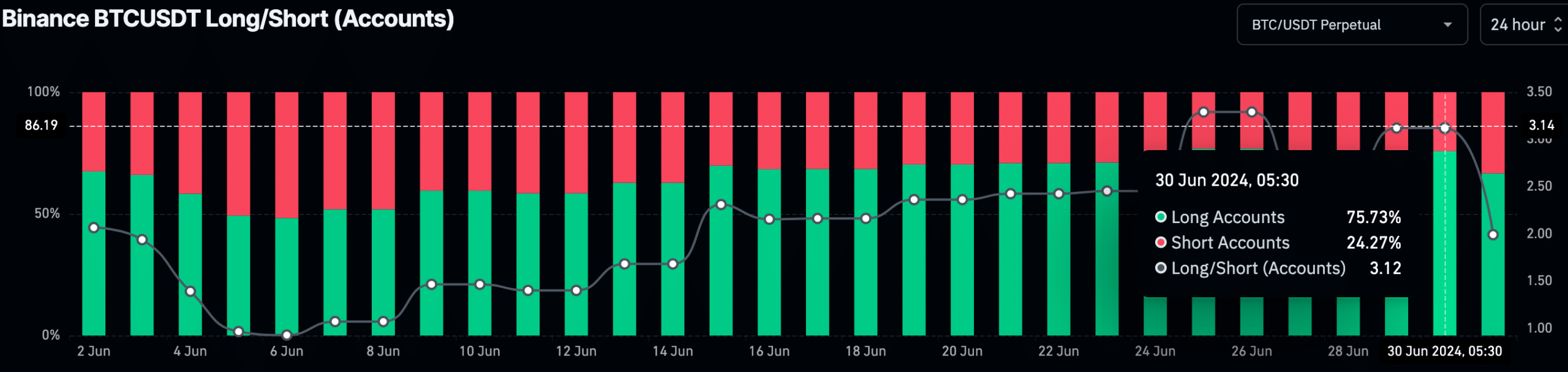

There is a strong sense of optimism among Bitcoin traders on Binance. AMBcrypto’s recent analysis of Coinglass’ data showed that a whopping 75% of open positions on the platform in the last 24 hours were long bets, indicating a bullish bias.

This sentiment is particularly evident for BTC/USDT perpetual contracts, the most heavily traded crypto pair on Binance.

The trend suggests that many retail traders on Binance believe in Bitcoin’s potential for growth, even amidst the current market uncertainties.

They are likely looking past the short-term volatility, and are expecting a further surge in price.

Institutional interest rises

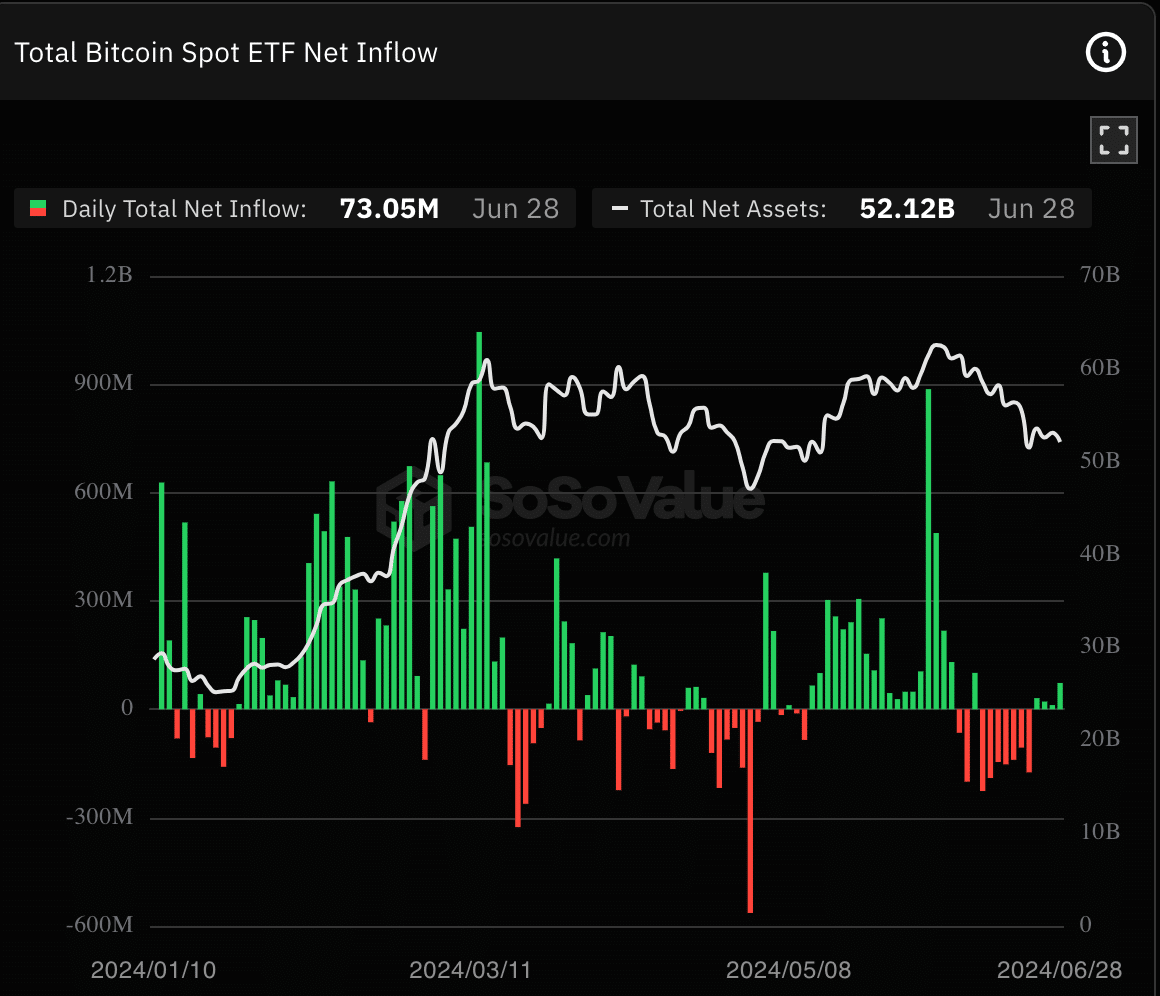

Adding to this positive sentiment, Wall Street is also showing renewed optimism around BTC.

After a few days of negative net inflows into Bitcoin ETFs, the trend has reversed, with overall inflows turning positive again.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A rising amount of retail interest coupled with institutional confidence can help BTC rally further.

At the time of writing, BTC was trading at $62,784.09 and its price had grown by 2.17% in the last 24 hours.