- Several on-chain metrics suggested that BTC’s charts would soon turn green.

- Market indicators also hinted at a price increase.

Bitcoin [BTC] has been struggling of late as the bulls have failed to take control of the market. However, this sluggish price action hasn’t demotivated investors to hold at least 1 BTC.

The intent of investors holding 1 BTC clearly signifies that they expect the king of cryptos’ price to rise.

Demand for BTC is rising

CoinMarketCap’s data revealed that Bitcoin investors had a terrible month last month as the coin’s price dropped by more than 8%.

In fact, in the last seven days, the coin has witnessed a 4% price correction. At the time of writing, BTC was trading at $61,611.07 with a market capitalization of over $1.2 trillion.

Despite the latest price corrections, it was optimistic to see over 85% of BTC investors still in profit, as per IntoTheBlock’s data. Another interesting piece of data was revealed by a recent tweet from IntoTheBlock.

As per the tweet, there were more than 1 million addresses that were holding 1 BTC. This was a clear long-term trend, as more and more people aim to achieve whole-coiner status.

Apart from this, AMBCrypto’s assessment of Hyblock Capital’s data also revealed that investors were willing to hold BTC. As per our analysis, BTC’s cumulative liquidation data has declined sharply after touching -500k a few days ago. This meant that investors were expecting the coin’s price to rise again soon.

Bitcoin is showing signs of recovery

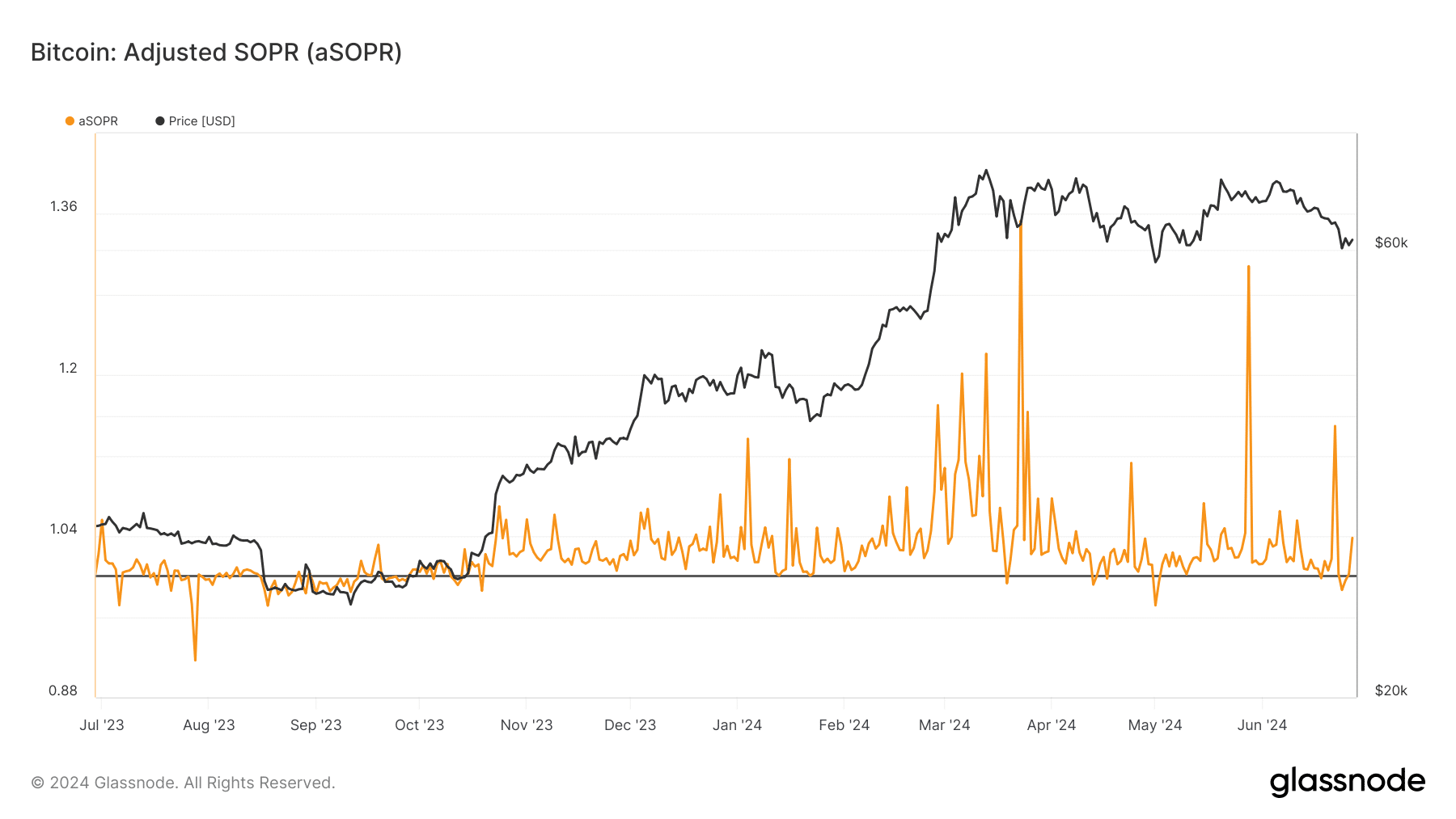

Investors’ confidence might have just started to pay off as BTC’s price moved up marginally in the last 24 hours. BTC’s aSORP had fallen under the 1.0 threshold on the 25th of June.

Whenever that happens, it indicates a possible bull rally.

AMBCrypto’s assessment of CryptoQuant’s data also pointed out quite a few bullish metrics. For instance, BTC’s Relative Strength Index (RSI) was in an oversold position. This might help increase buying pressure and, in turn, push its price up.

The other bullish metrics were active addresses and the number of transactions, as both of them increased in the last 24 hours.

Read Bitcoin’s [BTC] Price Prediction 2024-25

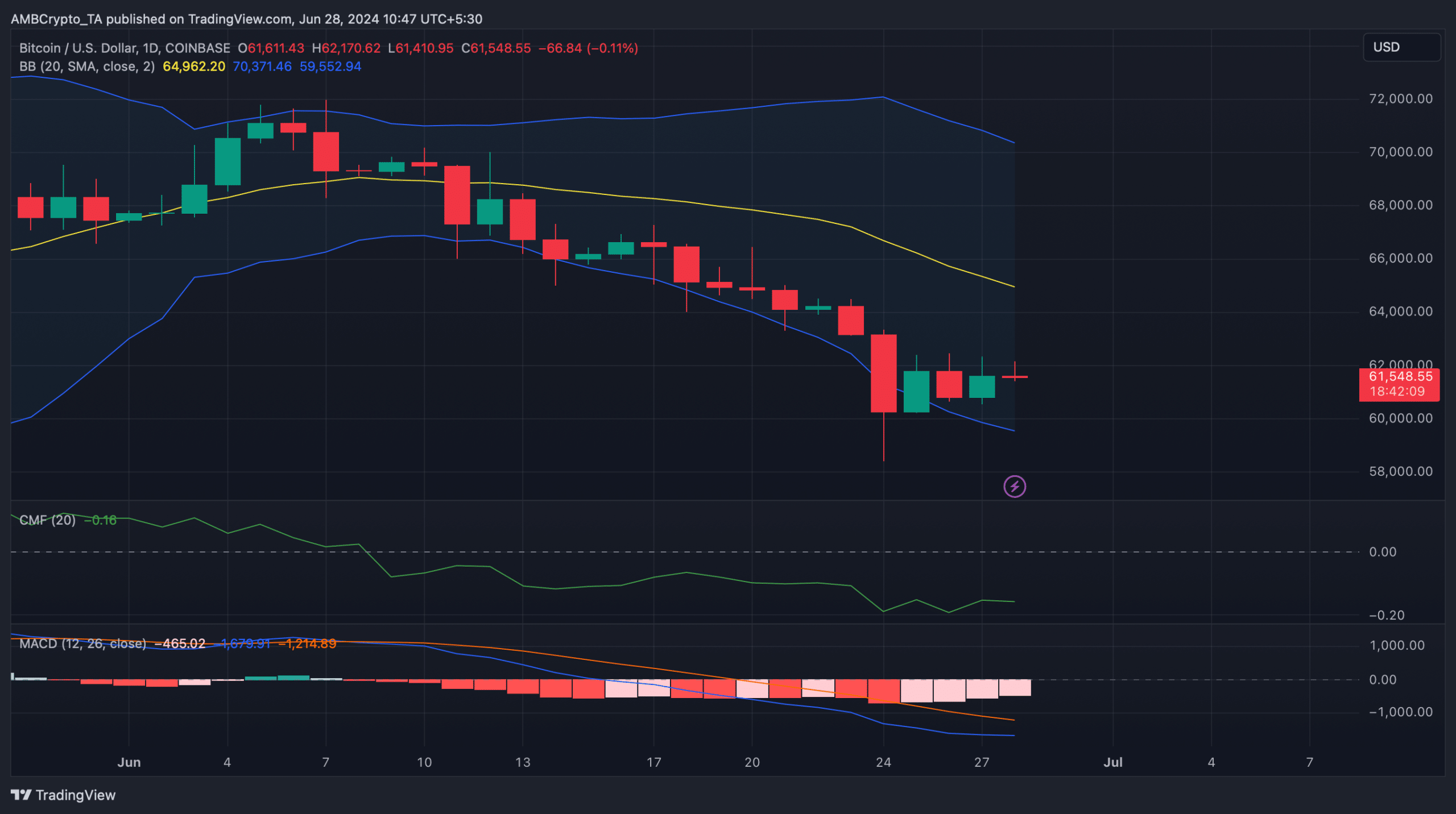

We then planned to have a look at Bitcoin’s daily chart to better understand whether it was about to begin a bull rally. We found that BTC’s price started to rebound after touching the lower limit of the Bollinger Bands. This often results in bull rallies.

The MACD also displayed the possibility of a bullish crossover in the coming days. However, the Chaikin Money Flow (CMF) remained bearish as it was resting well below the neutral mark.