- BTC has fallen to the $62,000 price range.

- Miners are feeling the heat as revenue drops to record low.

Bitcoin [BTC] is experiencing a significant phase, reflected in the fluctuating price trends and the economic conditions impacting its miners.

Over the last few days, there has been a notable decline in miners’ revenue, which could be due to different factors.

Additionally, there has been a decrease in the reserves held by miners, likely due to them selling off assets to maintain operations or cash out during uncertain market conditions.

Bitcoin miner revenue hits record low

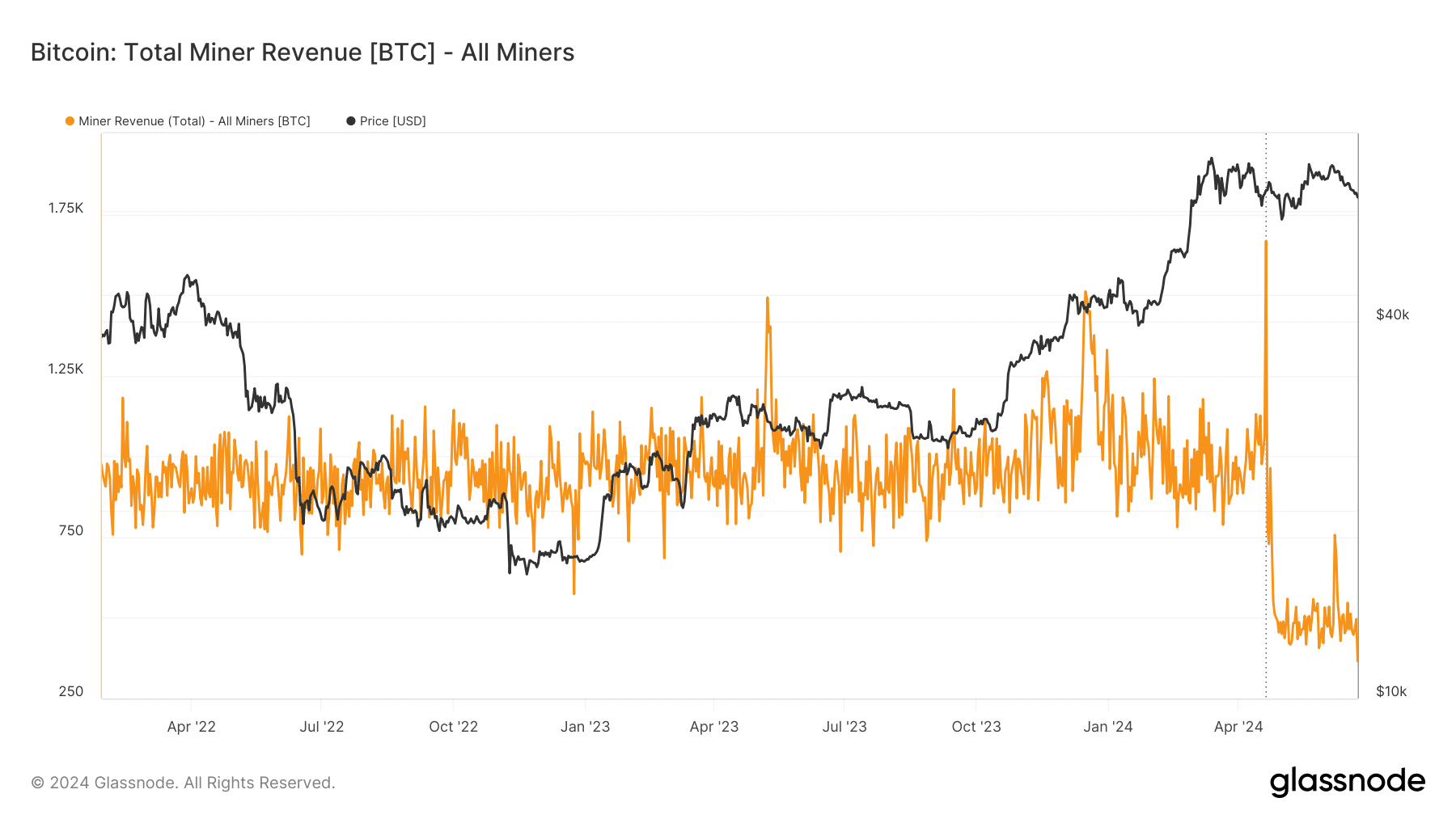

AMBCrypto’s analysis of the Bitcoin miner revenue chart on Glassnode indicated a significant decline in revenue over the last 24 hours.

At of the end of the 23rd of June, the revenue was approximately 365 BTC. This translated to around $23 million, based on the closing price of Bitcoin on that day.

While at first glance, this might seem like a substantial amount, a deeper analysis reveals that this figure represents a deviation from the norm.

A deeper analysis of the Bitcoin miner revenue chart revealed that the recent figures represent a significant drop from the usual revenue trends.

Historical data from the chart showed that the last time revenues were near this low was in 2021. The chart showed that revenues were around 388 BTC.

However, the recent figures set a new record for the lowest revenue miners have experienced, surpassing the previous record low set in 2021.

Bitcoin miner reserve follows the same pattern

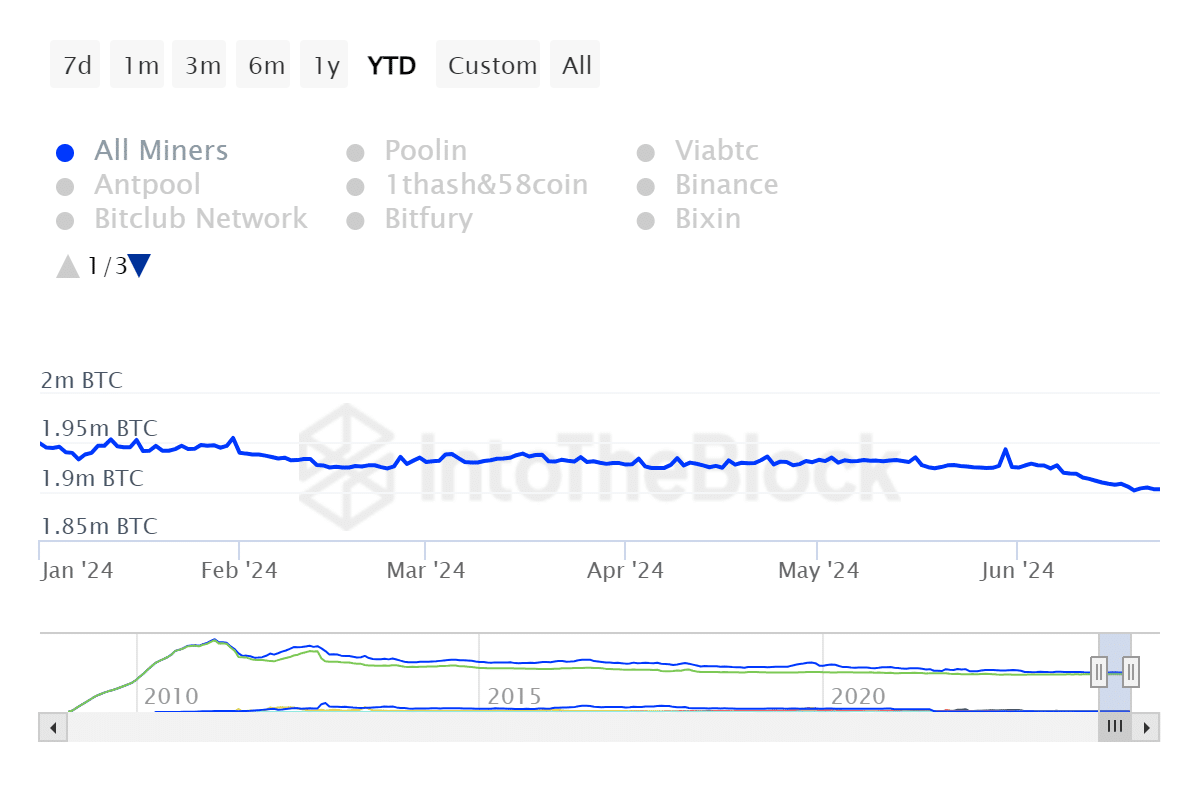

The analysis from Glassnode highlights that Bitcoin miner revenue has been experiencing a gradual decline, reflecting broader challenges within the mining sector.

This downturn in revenue, while maintaining around the $19 million level, has shown some minor yet significant declines.

Concurrently, the study of miner reserves indicates a reduction. It suggests that miners have been compelled to sell off their Bitcoin holdings to sustain operations or mitigate losses.

This sell-off in reserves can be largely attributed to the combination of recent Bitcoin halving events—which effectively reduce the reward for mining new blocks by half—and the current downtrend in Bitcoin’s market value.

BTC continues to break support

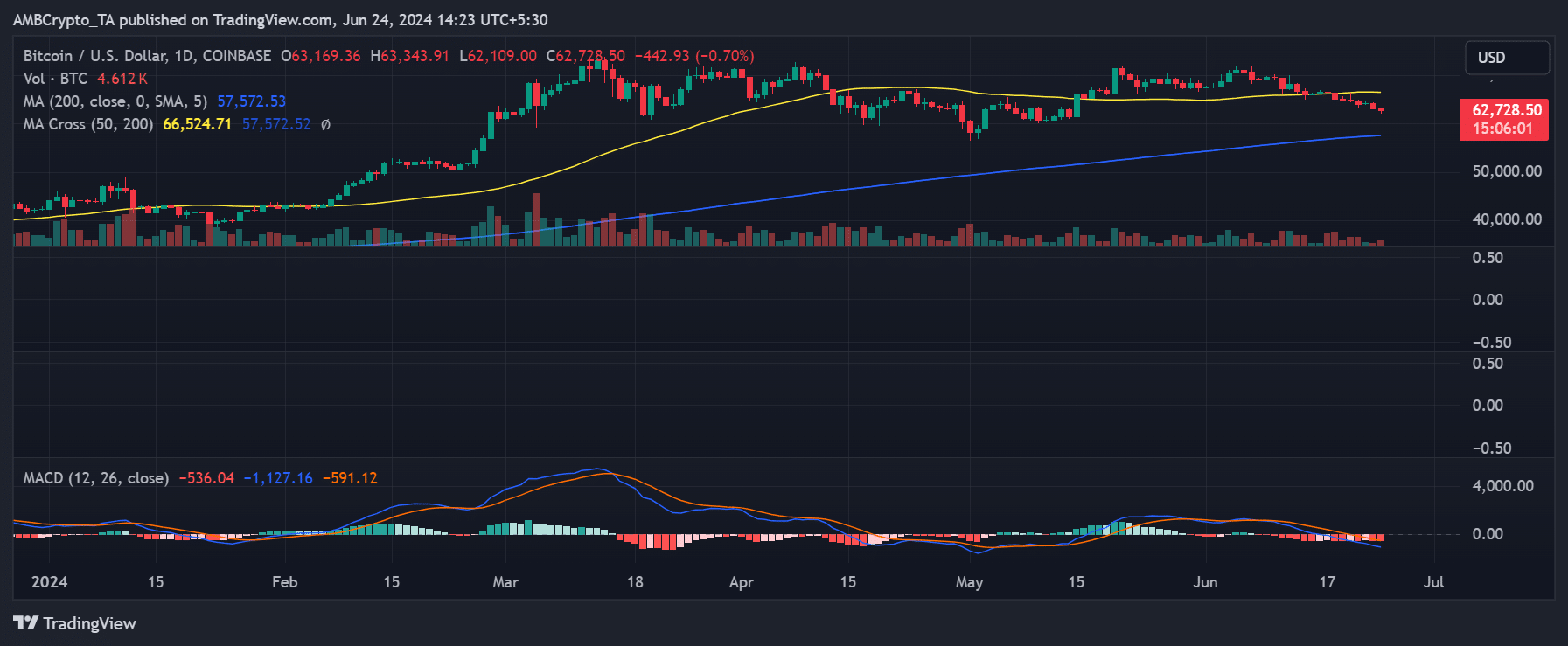

Bitcoin’s price trend indicated that it has been progressively breaking through various support levels. Moreover, price levels that previously acted as support are now becoming stronger resistance levels.

Notably, since Bitcoin dropped below the $66,000 range, this price has become a significant resistance level.

Read Bitcoin’s [BTC] Price Prediction 2024-25

At the close of trading on the 23rd of June, BTC had fallen to around $63,171, marking a decline of approximately 1.6%.

As of this writing, it continued to face downward pressure, trading at about $62,880 after experiencing further declines.