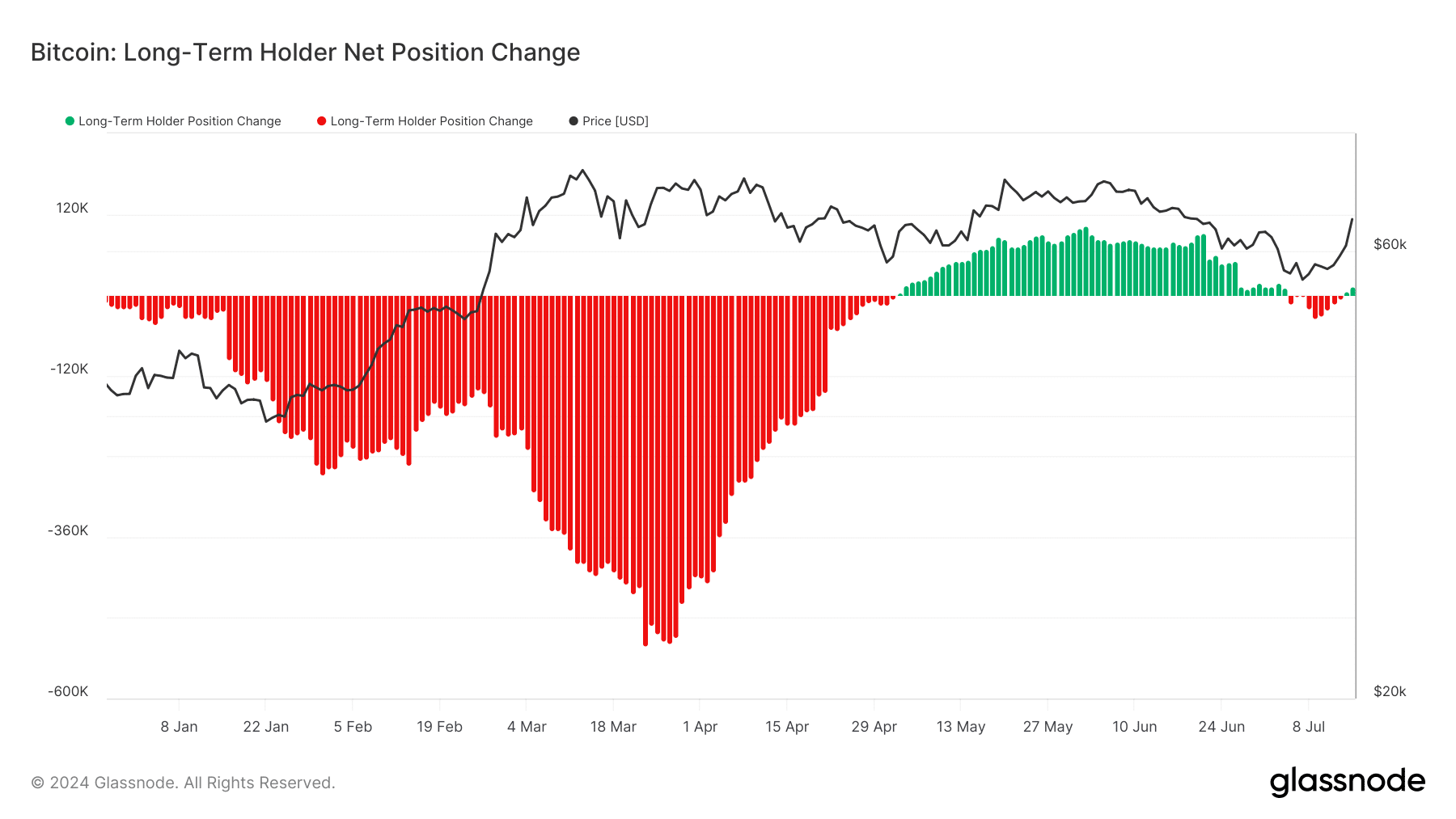

- The net position change for long-term holders has switched to positive.

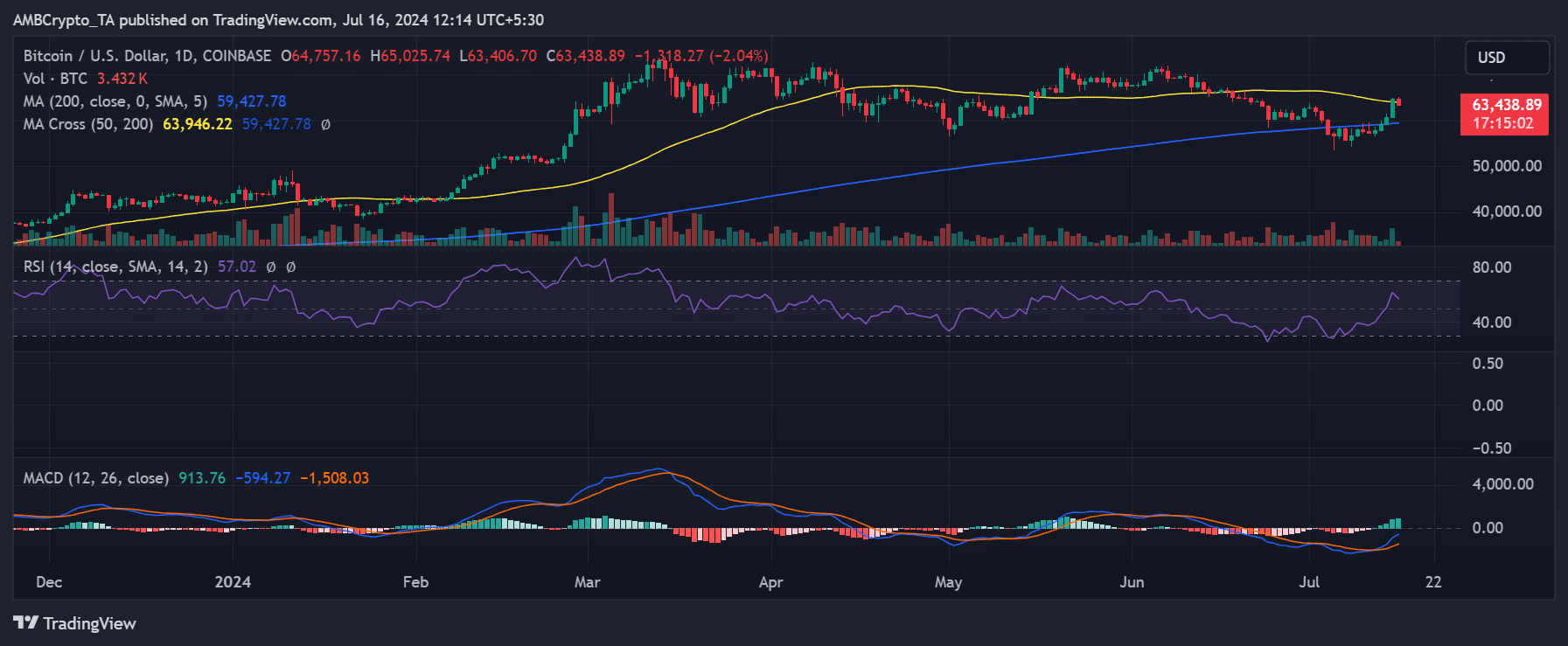

- BTC has flipped its previous immediate resistance to support.

Bitcoin [BTC] successfully surpassed the $60,000 mark, buoyed by increasing confidence among investors and a predominantly bullish sentiment in the market.

Alongside new buyers, long-term holders are also re-engaging with the market, signaling a return to form for the king coin.

Buy Bitcoin!

Data from Santiment indicates that Bitcoin traders are regaining their confidence, as reflected in the social volume metrics, particularly in buying activities.

Specifically, the buy social volume experienced a significant spike, illustrating heightened buyer interest and activity.

On 15th July, the buy sentiment score reached around 117, surpassing the sell social volume, which stood at approximately 92 during the same period.

This disparity between buy and sell volumes suggests that the market sentiment is currently skewed towards buying, with more participants opting to acquire BTC rather than sell.

This trend indicates the current Fear of Missing Out (FOMO) sweeping through the market as traders and investors rush to capitalize on the perceived upward trajectory of Bitcoin’s value.

Such dynamics often contribute to sustaining and potentially accelerating price increases as demand outstrips supply.

Bitcoin welcomes back long-term holders

Recent data from Glassnode on Bitcoin’s long-term holders’ net position change metric offers insightful evidence of the cryptocurrency’s current bullish trend.

Previously, this metric was negative, indicating that long-term holders were reducing their positions — essentially, they were selling more than they were buying.

This net selling trend persisted for the better part of the month, contributing to a bearish sentiment among established investors.

However, there has been a notable shift in this dynamic recently. The trend has reversed, and the metric now shows a positive value.

As of the latest analysis, the net position change is nearly 13,000. This positive shift indicates that long-term holders are accumulating Bitcoin once again.

The trend signals their renewed confidence in its potential for further appreciation. This accumulation phase by seasoned investors is typically a strong bullish signal.

BTC breaks $60,000

According to AMBCrypto’s analysis of the daily time frame chart for Bitcoin, it experienced a significant uptrend on 15th July. BTC climbed by almost 7% to trade at around $64,757. Also, this marked the first instance within the month that it reached this price level.

Additionally, it was the first time in almost a month that Bitcoin surpassed its short moving average (yellow line), which had previously acted as a resistance level in this price range.

As of this writing, BTC was trading at around $63,400, reflecting a decline of over 2% from its recent high.

Read Bitcoin (BTC) Price Prediction 2024-25

Despite this slight downturn, it has remained above the short-moving average, suggesting that the yellow line might now act as a support level.

This shift from resistance to support could indicate a potential stabilization or further gains if Bitcoin maintains its position above this critical threshold.