- Bitcoin’s fall below $59,000 has triggered significant market liquidations, particularly impacting altcoins.

- Analysts advise caution, suggesting a pause in accumulating altcoins due to current market uncertainties and weak signals.

In a dramatic 24-hour period, the global cryptocurrency market witnessed a sharp 4.7% drop, driven by a significant downturn in Bitcoin’s [BTC] price, which fell below the critical $59,000 mark.

This decline has rippled through the market, impacting altcoins severely.

As Bitcoin struggles to maintain its footing, the altcoin sector experienced a substantial reduction in market cap from $1.03 trillion at the beginning of this month to just $953 billion at press time.

Bitcoin’s recent slip below $59,000 marks a critical juncture in the cryptocurrency market, reflecting broader uncertainty and triggering widespread sell-offs.

The downward trend has cast doubts about the sustained health of the bull market, with Bitcoin testing support levels multiple times—an indicator of potential market weakness.

On Crypto Banter’s “The Ran Show,” analysts highlighted the precarious position of Bitcoin at the lower end of its trading range, suggesting that repeated testing of these levels may signal an imminent market shift.

Steer clear from altcoins

During these tumultuous market conditions, experts are advising traders to exercise caution, particularly with altcoins.

Recent patterns and market data suggest a cooling period for altcoins, which have been significantly affected by Bitcoin’s prolonged price adjustments.

The analyst from Crypto Banter noted that while altcoins typically have periods of recovery, the current market conditions are not favorable for immediate rebounds.

Using Pendle [PENDLE] as an example, the analyst revealed that the altcoin has experienced a notable decline not due to protocol issues but because of external market pressures, illustrating the volatile nature of altcoin investments during uncertain times.

The advice from the analyst is to focus on robust on-chain data and avoid being swayed by fleeting social media trends.

The Crypto Banter analyst also made mention of FTX’s recent move, which could potentially return more funds to users than initially lost, hinting at a positive turn in market liquidity that might support recovery.

Comparing Bitcoin’s market cap growth to major financial institutions and traditional assets like gold, the analyst reinforced the long-term value proposition of Bitcoin despite short-term volatilities.

Solana: A case study in volatility

While the analyst recommended caution with altcoins, it makes sense to examine Solana [SOL], the third-largest altcoin on the market, as a specific case of the impact of the market’s downturn on altcoins.

Solana has been heavily impacted; over the last 24 hours alone, SOL’s price has decreased by 7.3%, trading at $134.83 at press time. This downturn followed a brief surge tied to excitement over potential ETFs.

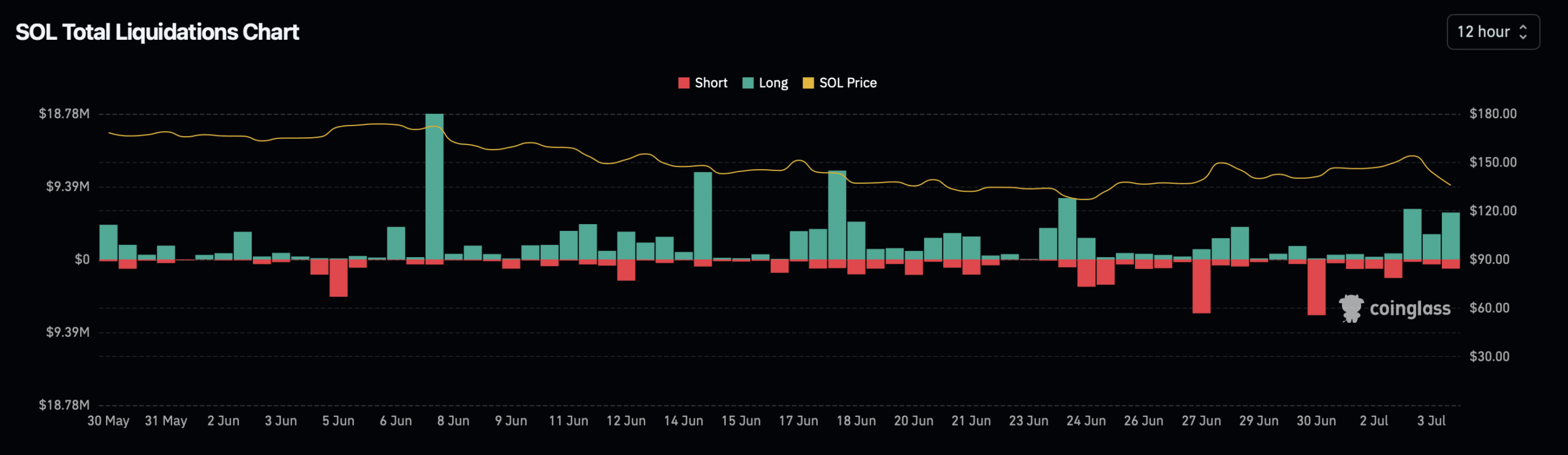

This decrease in Solana’s value has had a significant effect on traders. According to Coinglass, over the past day, 106,449 traders have faced liquidations totaling $289.26 million.

Of this, Solana-related liquidations amounted to approximately $12.55 million, predominantly from long positions. Specifically, Solana long liquidations totaled $10.76 million, compared to $1.80 million from short positions.

Read Bitcoin’s [BTC] Price Prediction 2024-25

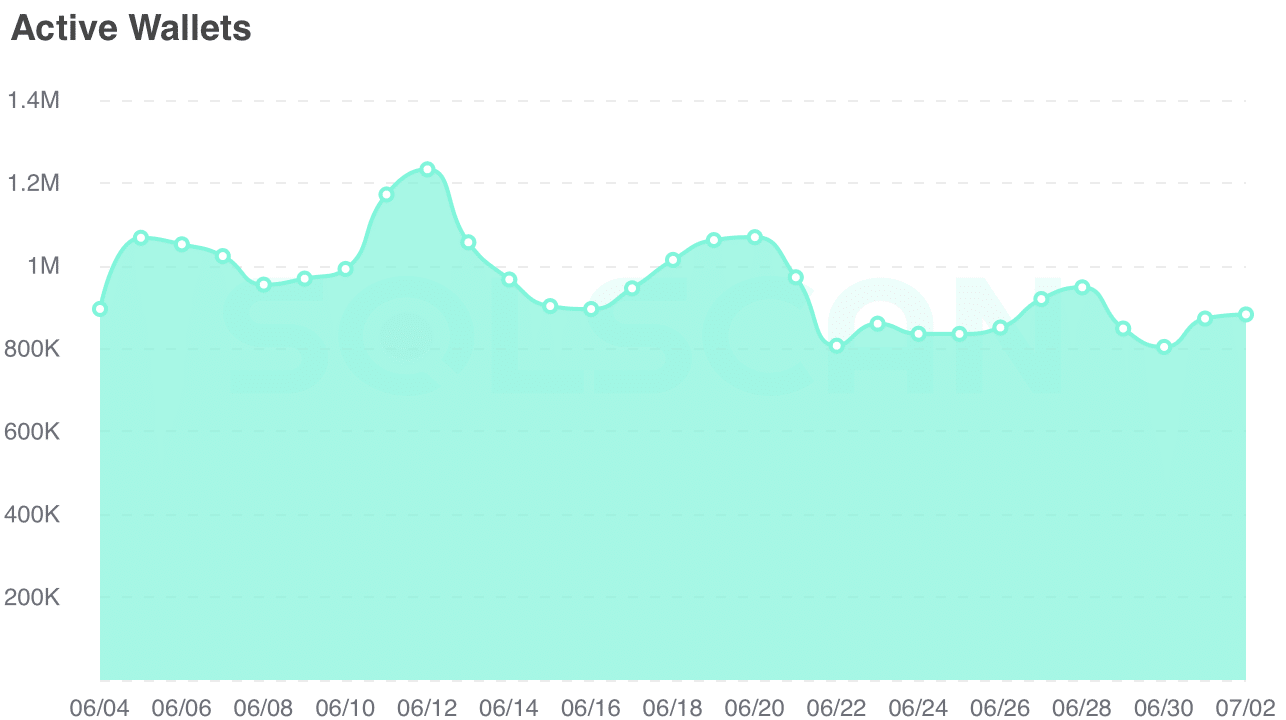

The downturn appears to be affecting Solana’s on-chain activity. AMBCrypto’s look at Solscan indicated a marked decline in the number of active addresses.

From over 1.2 million addresses last month, the number has dropped to 882,000 at press time, highlighting a waning user engagement amid current market conditions.