- Notcoin declined 12.20% in seven days, with 2.95% daily gains.

- Market sentiment remained negative as altcoins declined due to Bitcoin’s volatility.

Notcoin [NOT] has experienced a downside in the last seven days with a 12.20% decline. However, during the previous 24 hrs, it has experienced a 2.95% surge.

At press time, NOT was trading at $0.01588 with a 21.89% decline in trading volume to $527M. According to CoinMarketCap, NOT’s market cap was $1.6B.

The recent decline in NOT and other altcoins has captured the attention of various crypto analysts. One such figure is Altcoin Sherpa, who formally shared on X (Twitter) that most altcoins will face a downside.

In his tweet, he said,

“Most Alts probably have a bit more downside to go, and I’m more waiting for BTC to be in a super healthy state before alts start to move.”

So, altcoins will continue to decline since Bitcoin [BTC] is currently underperforming. It traded at $65k at press time, a 2.84% decline in seven days.

Bitcoin affects altcoins

Various altcoins have experienced a considerable decline. For instance, Solana has declined by 10.2% in seven days, Dogecoin [DOGE] by 12.67%, Cardano [ADA] by 9.74%, and Shiba Inu [SHIB] by 14.11%.

Most altcoins were facing a hit because of BTC’s volatility, with investors fearing other cryptocurrencies after BTC fell from $72k to $65k.

However, other analysts have experienced optimism, sharing positivity regarding NOT. For instance, Gbemileke, a crypto analyst, shared a tweet arguing that,

“NOT is currently at a POI. I expect it to break out of the zone; that will be bullish.”

He posited that the current point of interest will turn bullish despite the current market sentiment.

Why is Notcoin distinct?

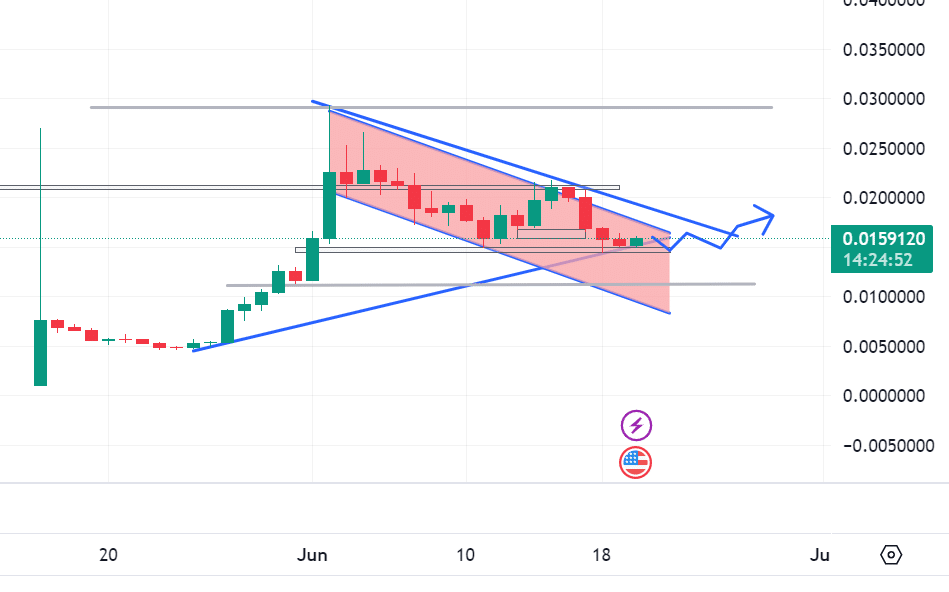

AMBCrypto’s analysis indicated that NOT was in the consolidation phase at press time.

With the current support level at $0.0150, the prices will move sideways to around $0.018, showing the consolidation phase without any significant gains or reductions.

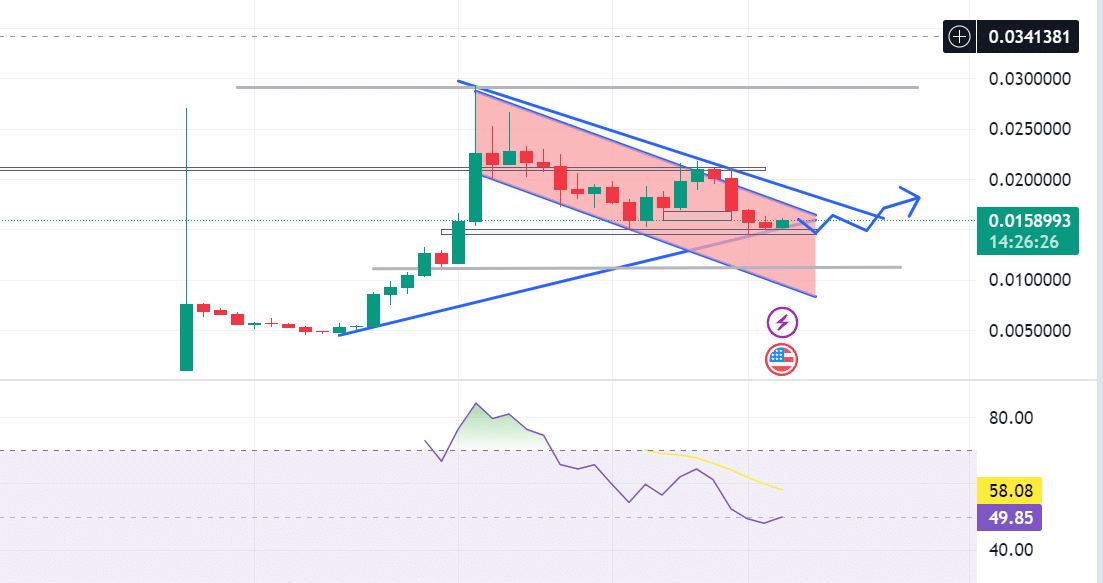

Also, the RSI analysis indicated that NOT stood against all odds. With an RSI of 50 and an RSI-based MA of 58, NOT was in a neutral zone.

The 50 RSI is mostly viewed as a bullish market sentiment, but the indecisiveness at this point can lead to a downside.

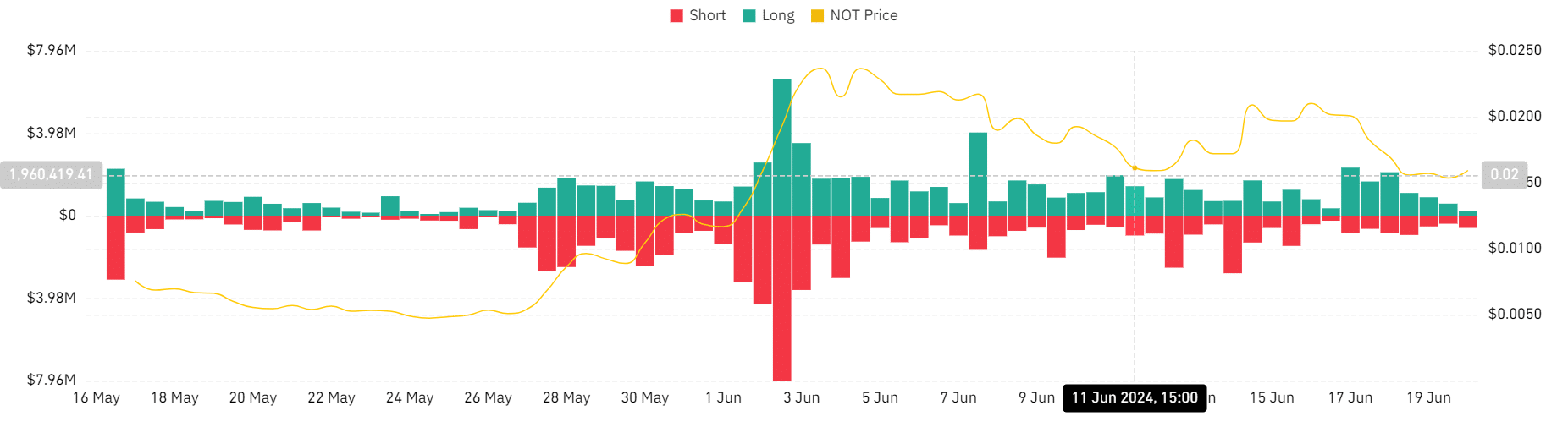

According to Coinglass, total liquidation data shows higher short than long positions. Short position liquidation was at $593k at press time, compared to $244k for long positions.

These market sentiments showed a bearish market sentiment with a potential further downside.

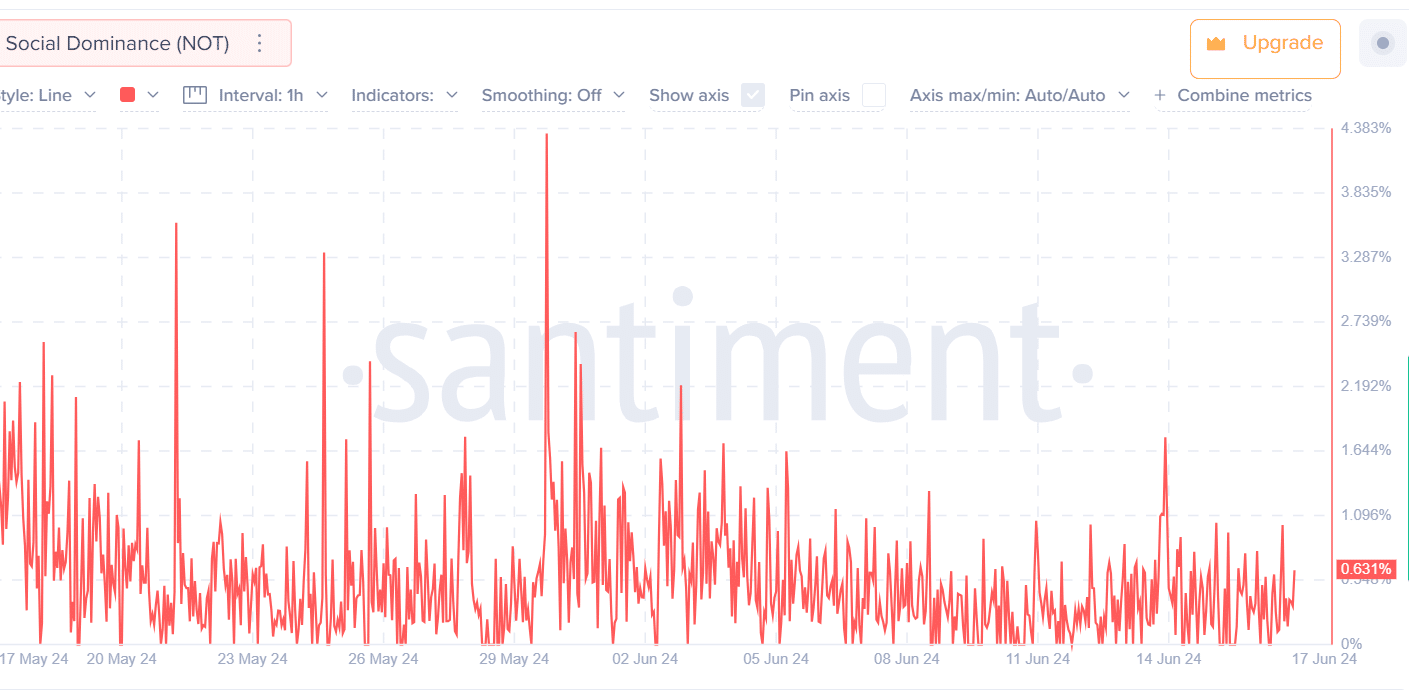

Data from Santiment further showed that NOT was in a consolidation phase with lower social dominance.

Lower social dominance implied reduced market interest and negative, resulting in low trading volume and reduced price volatility.

At press time, NOT was enjoying market stability with increased positive market sentiments.

With the critical support level around $.150, accompanied by gains on daily charts, the altcoins can continue with the momentum and build on the gains.

However, with the consolidation phase, it will most likely shift to around $0.18 in the short term.