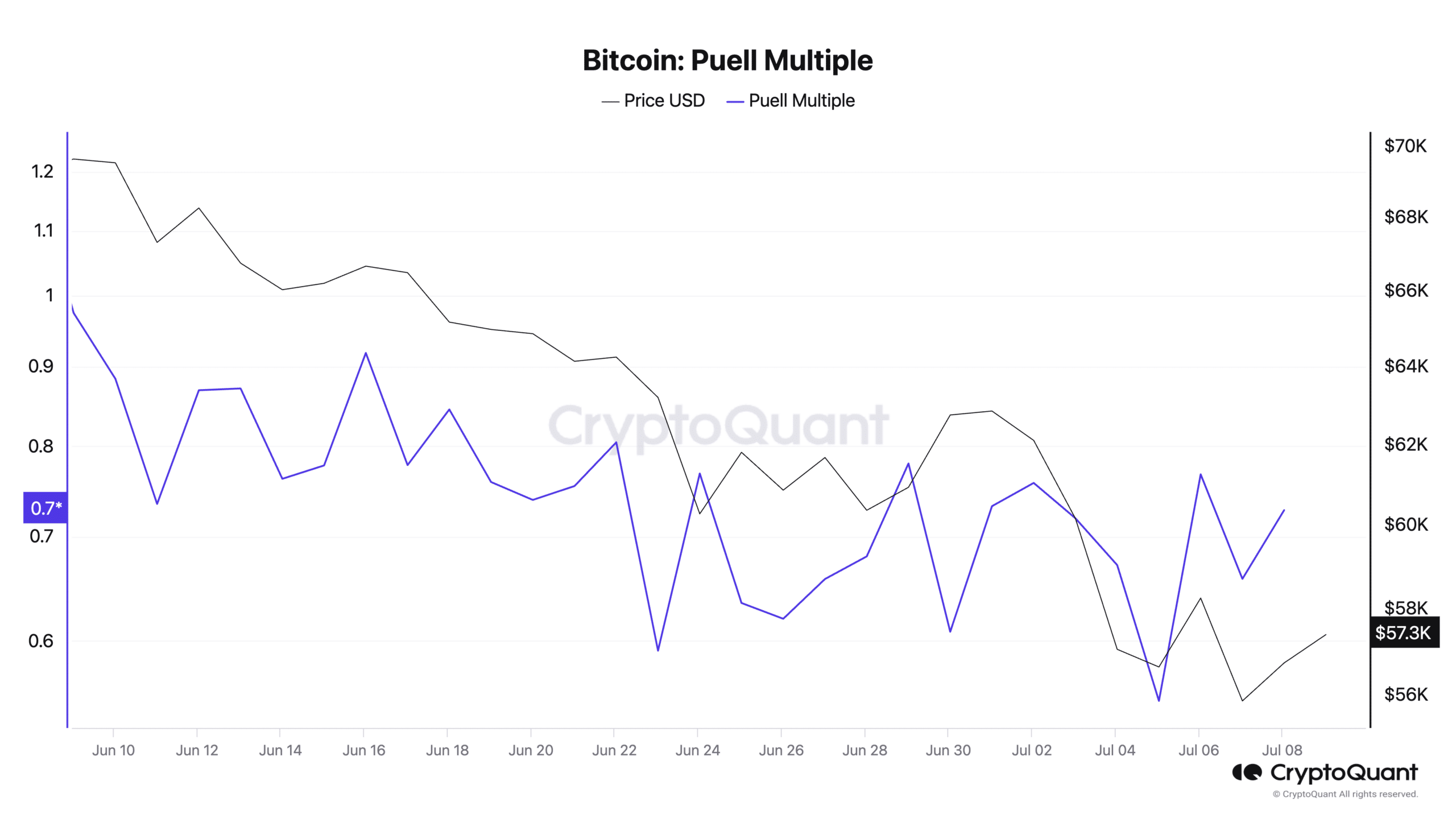

- Bitcoin’s Puell Multiple has been on a decline in the last month.

- This provided a buying opportunity for market participants.

The recent decline in Bitcoin’s [BTC] Puell Multiple hinted at the possibility of a new bull cycle, pseudonymous CryptoQuant analyst Crypto Dan found in a new report.

BTC’s Puell Multiple tracks the profit miners on the network make by comparing BTC’s daily issuance value to its 365-day moving average.

When BTC’s Puell Multiple surges, it indicates that the coin’s daily issuance is significantly above the yearly average. This often corresponds with market peaks and signals that BTC is overvalued and due for a decline.

Conversely, when this metric declines, it suggests that the daily issuance value is below the yearly average, indicating potential BTC undervaluation.

It is often followed by a BTC price spike as market participants “buy the dip.”

As of this writing, BTC’s Puell Multiple was 0.80. It initiated its current cycle of decline on the 6th of June and has since fallen by 54%.

Dan assessed BTC’s historical performance and found that when its Puell Multiple plunged during the bull cycle in 2016 and 2020, it was “followed by the beginning of Bitcoin’s strong rise.”

According to Dan, this can happen in the current market cycle.

“In 2024 Currently, similar movements have been detected. Although the exact end of the adjustment period is difficult to be certain, it can be expected that it is not far away. It is likely that we will see the start of a bull rally within the 3rd quarter of 2024,” Dan noted.

What are BTC miners up to?

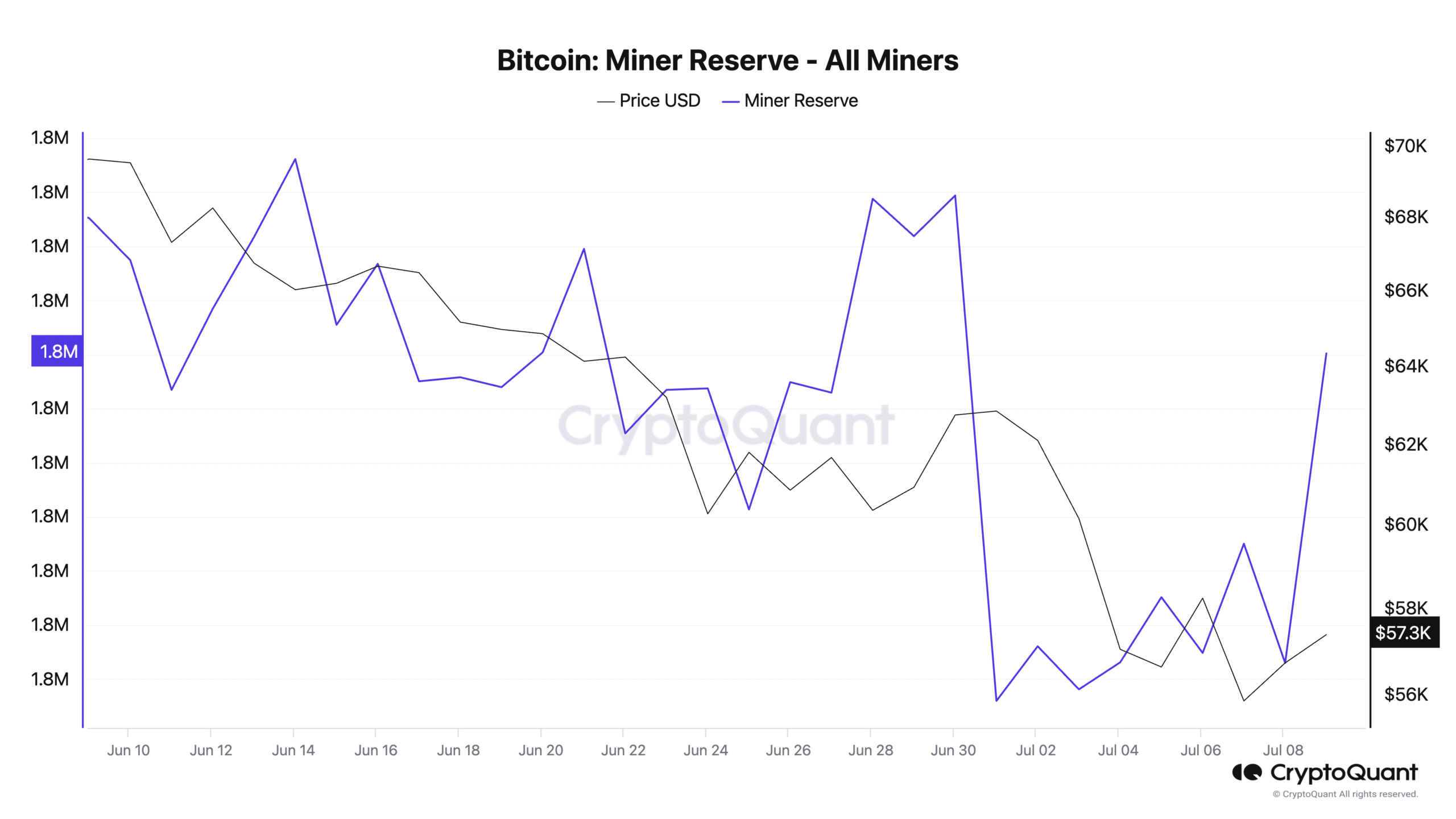

The past 24 hours have been marked by a surge in BTC’s miner reserves. This metric measures the amount of coins held in affiliated miners’ wallets. Its value indicates the reserve that miners have yet to sell.

At press time, 1.82 million BTC, valued at $104 billion at press time market prices, were held across miner wallets.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

In the last 24 hours, the BTC miner reserve has spiked by 1%. When this increases, it means that miners are holding onto their coins instead of selling them on the market.

It may be due to the anticipation that the coin’s price will rise in the short/mid-term.