- Notcoin possessed short-term bullish potential, but demand was missing.

- The higher timeframe price action showed that another move downward was likely.

Notcoin [NOT] experienced some gains over the past two days, even as Bitcoin [BTC] struggled to stay above the $61k mark.

On the 16th of June, AMBCrypto noted that the social sentiment and price trajectory were bullish in the short term.

The price action since then has reinforced a bearish trend. The past 24 hours saw a short-term shift, but the bears will likely come out on top shortly.

The trendline resistance could rebuff bulls

A trendline resistance (orange) was plotted from the highs made in early June. This trendline served as resistance in mid-June when the token was bullish, and it is likely to serve as resistance once again.

Based on the rally in the second half of May, a set of Fibonacci retracement levels were plotted.

They showed that the $0.0171 level would likely act as resistance, and a move to the $0.0101 or the 78.6% retracement level is likely to occur next.

The white dotted line indicated the price making a new lower timeframe higher high, thus breaking the bearish structure.

However, NOT is still expected to collect the liquidity around the $0.016-$0.0165 region before making a bearish move.

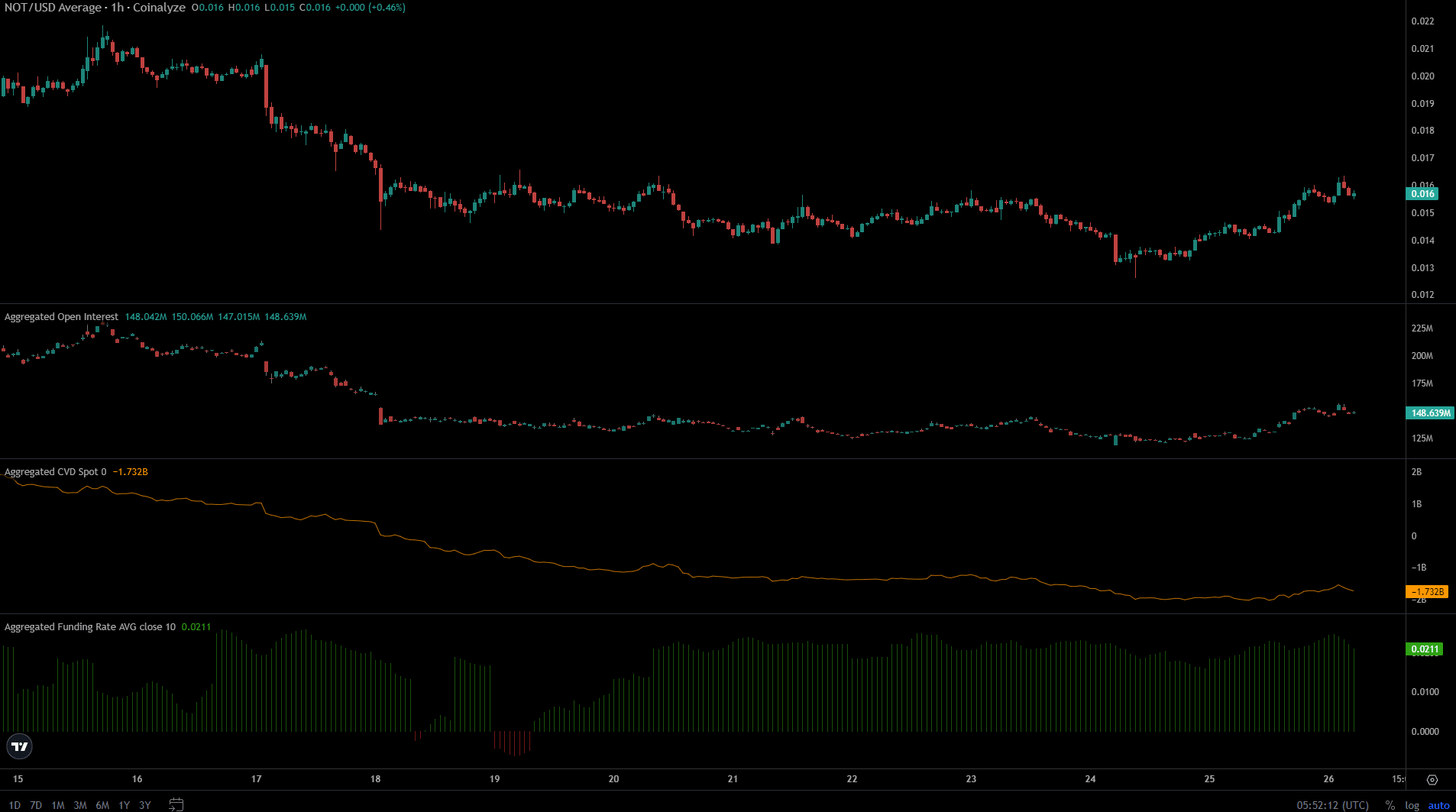

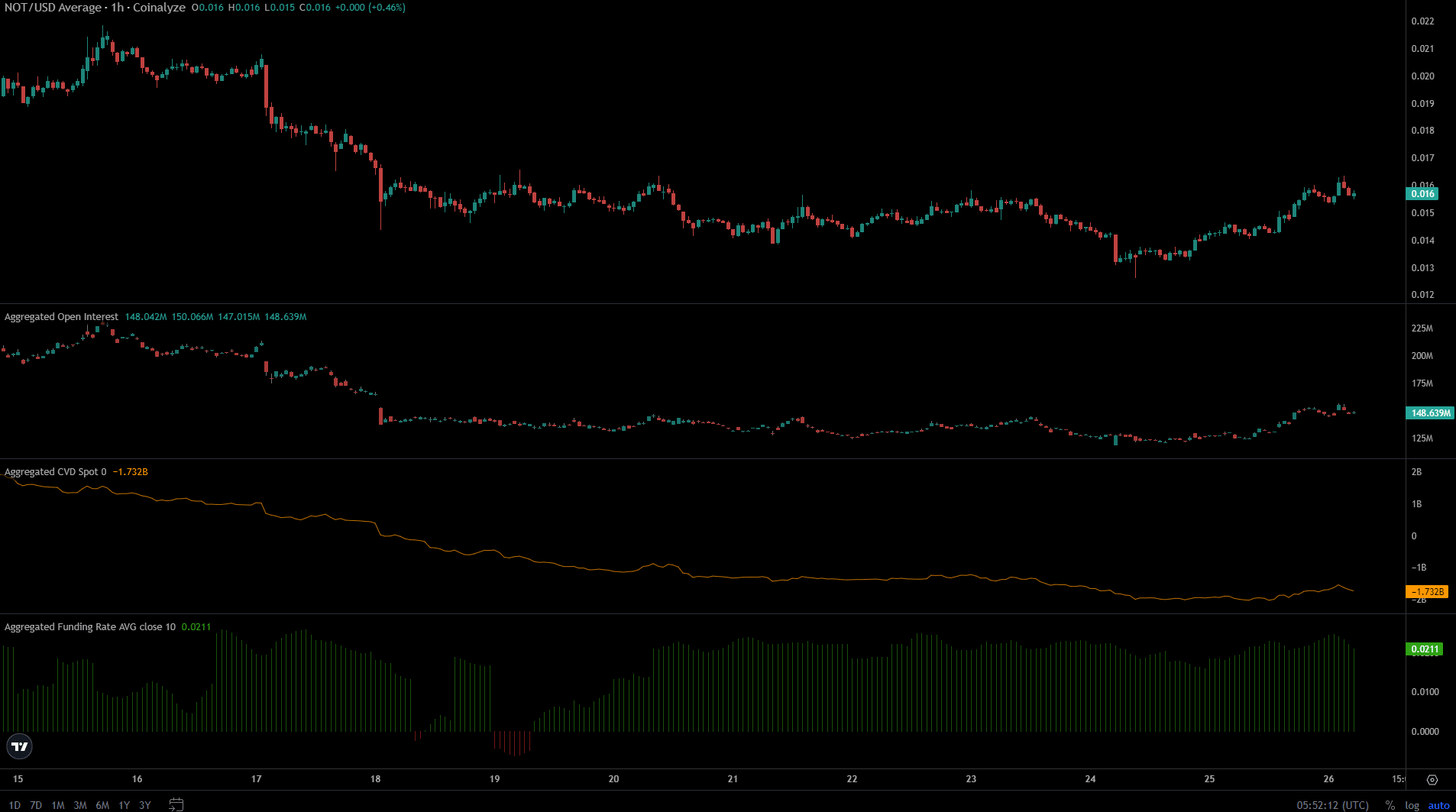

Futures data does not signal bullish conviction yet

Source: Coinalyze

The data from the Futures market did not counteract the bearish expectations from the price chart. The spot CVD continued to trend downward, although it saw a slight bounce in the past two days.

The Open Interest showed a spark of like and climbed higher, but without spot demand, bullish speculators waiting for a recovery might be left disappointed.

Is your portfolio green? Check out the NOT Profit Calculator

The Funding Rate was positive, but not extraordinarily so. For example, the rally from $0.011 to $0.028 in early June saw the Funding Rate climb to +0.12, and stay thereabouts for a week.

At press time, the rate was closer to +0.021, with +0.025 being the norm since the 9th of June.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.