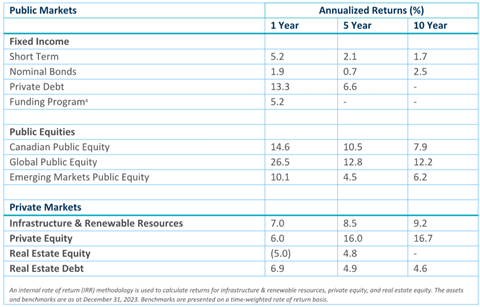

British Columbia Investment Management Corporation (BCI) posted a 7.5% return for its combined C$250.4bn (€171bn) portfolio during the 2024 fiscal year despite its real estate equity portfolio recording negative returns.

The Canadian pension fund’s C$28.1bn infrastructure and renewable resources portfolio recorded a 7% return for the year ended 31 March compared with the benchmark’s 6.3% the same period, a performance it attributed to strong cash yields and capital gains in the portfolio.

“Cash yield, the interest income and dividends from the portfolio is an important element of portfolio returns and is driven by our investment bias to core infrastructure assets and companies,” BCI said.

Over the one-year period, BCI’s C$8.9bn real estate debt portfolio – managed by QuadReal Property – recorded a 6.9% return, beating the benchmark’s 6.1%.

However, the returns for pension fund’s much larger C$35.1bn real estate equity portfolio, also managed by QuadReal, was -5% compared with the 6.8% recorded by the benchmark.

BCI said the portfolio saw valuation declines alongside the global real estate market, which experienced price adjustments across all sectors and regions.

It said despite the negative performance of the real estate equity portfolio, income returns from the operating portfolio helped offset the poor performance.

BCI said the real estate equity portfolio experienced moderate year-over-year growth thanks to operational fundamentals, including leasing activity, which remained robust and even improved in some areas. Notably, exposure to data centres in the US and residential properties in the UK performed particularly well, benefitting from tailwinds in e-commerce and demographics, it added.

Gordon J Fyfe, BCI’s CEO and CIO, said: “We delivered solid absolute results even through challenged markets this year, said: “All asset classes generated positive returns apart from real estate equity, where sustained market headwinds affected valuations.”

Fyfe said opportunities in infrastructure debt increased, and three transactions were closed, increasing European exposure.

He added that within the infrastructure and renewable resources and private equity programmes, an increasing focus on asset management boosted portfolio valuations and created C$17.6bn in value over five years and returned C$31.1bn in cash distributions to clients.

BCI’s real estate equity and real estate debt are managed by its arm QuadReal Property.

To read the latest IPE Real Assets magazine click here.