The average UK house price hit a new high in October, according to a latest index.

House prices increased by 0.2% in October, the fourth monthly increase in a row, Halifax reported.

The average house price was £293,999, surpassing a previous peak in June 2022.

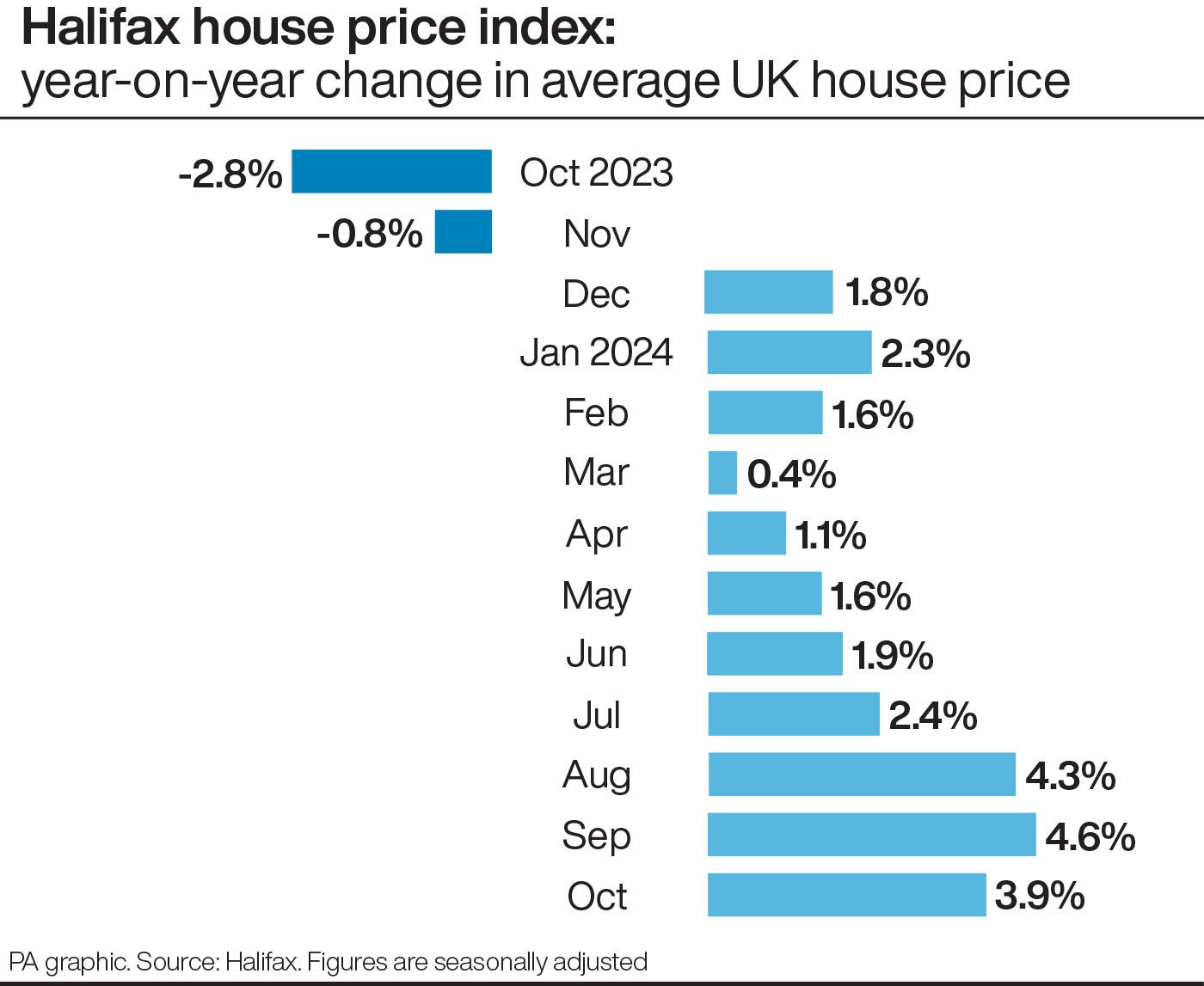

Property values increased by 3.9% annually, slowing from a 4.6% increase in September.

Amanda Bryden, head of mortgages, Halifax, said: “Average UK house prices nudged up 0.2% in October, continuing the positive momentum of recent months.

“This brought the annual growth rate to 3.9%, slightly lower than in September.

“The average property price has reached a record high of £293,999, surpassing the previous peak of £293,507 set in June 2022, towards the end of the pandemic-era ‘race for space’.

“That house prices have reached these heights again in the current economic climate may come as a surprise to many, but perhaps more noteworthy is that they didn’t fall very far in the first place.

“Despite the headwind of higher interest rates, house prices have mostly levelled off over the past two and a half years, recording a 0.2% increase overall.

“That’s a significant slowdown compared to the 21% rise we saw in the equivalent period from January 2020 to the summer of 2022.”

Ms Bryden continued: “Despite the affordability challenge, market activity has been improving.

“The number of new mortgages agreed recently reached its highest level in two years.

“This aligns with average mortgage rates dropping steadily since spring.”

Borrowing constraints remain a challenge for many buyers, she said, adding: “New policies like higher stamp duty for second home buyers and a return to previous thresholds for first-time buyers might also affect demand.

“While we expect house prices to keep growing, it will likely be at a modest pace for the rest of this year and into next.”

“The potential for a slower pace of interest rate cuts won’t be the news homebuyers will want to hear, particularly as they must also contend with tax rises.

Here are average house prices followed by the annual increase, according to Halifax (regional annual change figures are based on the most recent three months of approved mortgage transactions):

East Midlands, £242,189, 4.4%

Eastern England, £333,741, 3.1%

London, £543,308, 3.5%

North East, £172,730, 4.0%

North West, £235,587, 5.9%

Northern Ireland, £204,242, 10.2%

Scotland, £206,480, 1.9%

South East, £387,587, 3.2%

South West, £303,362, 3.3%

Wales, £225,543, 5.6%

West Midlands, £257,287, 4.7%

Yorkshire and the Humber, £211,629, 5.3%

Alice Haine, a personal finance analyst at Bestinvest by Evelyn Partners, an online investment service, said: “While the UK residential property market enjoyed a post-election resurgence over the summer as affordability concerns eased, the outlook from here is mixed.”

She added: “Mortgage rates may not behave as people hope. Volatile swap rates in the wake of the Budget have been a cause for concern as they raise the risk of borrowing costs edging up.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “The housing market has been significantly buoyed by lower mortgage rates, leading to more interest from prospective buyers and increased activity.

“Since UK gilt yields rose in the immediate aftermath of the Budget, this has had an effect on swap rates which underpin the pricing of mortgages, providing an indicator as to where interest rates will be.

“With the exception of a few lenders who purchased swaps before the Budget, mortgage pricing has edged upwards.”

Guy Gittins, chief executive of estate agent Foxtons, said of the house price index: “A fourth consecutive month of positive growth demonstrates the current strength of the UK property market and now that the dust has settled on last week’s autumn Budget, the outlook continues to be very positive.”

Nicky Stevenson, managing director at estate agent group Fine & Country, said: “We are currently in a buyers’ market,” adding that the increase in available properties, alongside affordability concerns, “means sellers must stay competitive, as offers generally fall below asking prices”.

Iain McKenzie, chief executive of the Guild of Property Professionals, said: “Our members are reporting healthy levels of housing supply, meaning that although prices are reaching a new peak, they are still being kept in check and not forcing people to shelve dreams of homeownership.”