Avangrid, Inc. (NYSE:AGR) is among the largest solar and wind generators in the United States with operations in 24 U.S. states. Its long-term capital expenditure plans, strategic investments for expansion in clean energy, share repurchase and low debt will boost the performance of the company.

AGR currently has a Zacks Rank #3 (Hold). Let’s take a look at the factors that could impact the performance of the company.

Tailwinds

Avangrid continues to pursue its organic growth strategy. In the first quarter of 2024, the company submitted proposals in the tri-state off-shore wind request for proposals. It executes its multi-rate plans in New York and Maine to increase its top-line growth.

The company also focuses on regulated and contracted investments to ensure earnings growth. It launched a new electric vehicle portal and self-service payment tool, which helps increase customer satisfaction, reduce costs to customers and improve cash flow.

AGR invested $3 billion in 2023, to upgrade its Networks segment, renewables segment and others. It further invested $872 million in the first quarter of 2024.

The company is focused on the Vineyard Wind 1 project, an 806 MW utility-scale offshore wind project in Lease Area 501. The project is expected to generate an amount of clean energy equivalent to that used by more than 400,000 households and businesses in Massachusetts and reduce carbon emissions by over 1.6 million tons per year. The company plans to create a clean-generation portfolio and achieve Scope 1 and Scope 2 carbon neutrality goals by 2035.

Headwinds

The company is highly regulated, with – numerous federal, state and local laws and regulations. The changes in the existing or new laws or regulations. The cost of compliance with the regulations could increase the cost of operations. Even though the regulated utilities have provisions in place to recover the costs, increased costs might significantly affect its earnings.

Price Performance

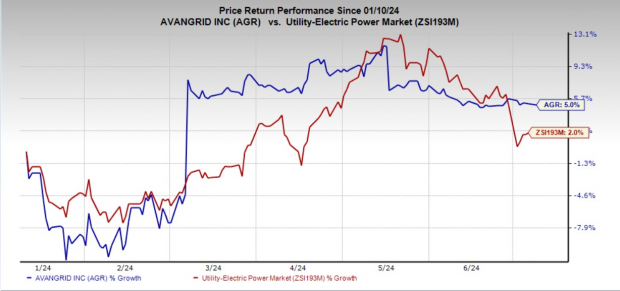

Shares of Avangrid have gained 5% in the past six months compared with the industry’s 2% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the industry are IDACORP, Inc. (NYSE:IDA), Vistra Corporation (NYSE:VST) and CenterPoint Energy (NYSE:CNP). Vistra Corporation currently sports a Zacks Rank #1 (Strong Buy), while CenterPoint Energy and IDACORP carry a Zacks Rank #2 (Buy), each, at present.

IDACORP has a dividend yield of 3.6%. The consensus estimate for earnings for 2024 and 2025 has gone up 0.19% and 0.35% respectively, in the last 30 days.

Vistra has a dividend yield of 0.97%. The Zacks Consensus Estimate for its 2024 and 2025 earnings per share increased nearly 3.95% and 18.24%, respectively, in the last 30 days.

CenterPoint’s long-term (three to five years) earnings growth is pinned at 7%. The Zacks Consensus Estimate for earnings for 2024 and 2025 earnings indicates year-over-year growth of 8% and 7.28%, respectively.

To read this article on Zacks.com click here.