The Autumn Budget offered a mixed picture for the drinks industry, with the incoming increase in non-draught duty leaving a bitter taste for many in the sector.

Ahead of today’s budget, the first for the Labour Government which was elected in July, there was a great deal of consternation from the drinks industry as to whether its concerns, especially those surrounding the highly contentious alcohol duty system introduced under Rishi Sunak, would be answered.

Addressing the House of Commons, Chancellor of the Exchequer Rachel Reeves, eschewing the historic tradition of having a drink at the despatch box, opened by saying that the “country voted for change” at the 4 July General Election, and that the Government would “restore stability to our economy, and bring a decade of national renewal”.

In a Budget which focused on “rebuilding our public services” and helping “working people”, Reeves also cited “very difficult decisions” around tax.

“I can confirm that alcohol duty rates on non-draught products will increase in line with RPI [Retail Price Index, at 2.7% in September 2024] from February next year,” Reeves stated. “But nearly two-thirds of alcoholic drinks sold in pubs are served on draught, so today, instead of uprating these products in line with inflation, I am cutting draught duty by 1.7%, which means a penny off the pint in the pub.”

This last point was met with a loud cheer, but for those in the wine and spirits sector, there does not seem to have been much worth cheering about.

‘Bitterly disappointed’

Miles Beale, chief executive of the Wine and Spirits Trade Association (WSTA) described Reeves’ Budget as a “real kick in the teeth for both businesses and consumers”.

“We simply cannot understand why Government has said they are trying to protect income and in the next breath raising alcohol duty in a move that is totally counterproductive,” he declared in a statement. “Recent history has shown us that duty increases lead to price rises for consumers, a dip in sales and, as a result fewer receipts for the Treasury. The near £500 million loss in alcohol duty receipts, in the last six months, couldn’t make that clearer.”

“We are bitterly disappointed that Labour, despite their manifesto pledge to prioritise growth, has chosen not to listen to business – especially SMEs, which will be hit hardest of all,” Beale continued. “Instead of reversing the last Government’s damaging plans to bring in unnecessary, complex and costly changes to the way wine is taxed, Labour wants to plough ahead. And for what?”

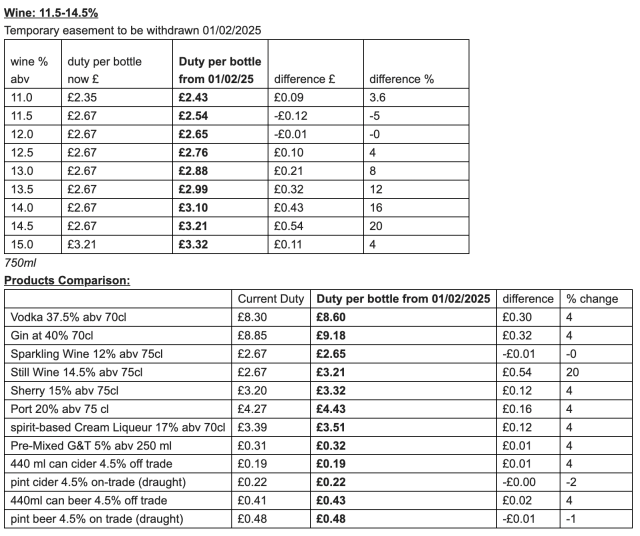

The WSTA also released data to show how dramatically duty would increase under Reeves’ proposals, based on a forecast RPI rate of 3.65% in Q2 2025:

As evidenced by the above figures, still wine with and ABV of 14.5% is predicted to see a 20% increase on the current duty paid, up to £3.21 per bottle, while wine of 11.5% would see a 12 pence duty decrease – the overall picture from the numbers is one of significant increases in duty.

The Wine Society CEO Steve Finlan dubbed the Budget an “assault on the wine industry”, and WineGB CEO Nicola Bates said that the group anticipates “that the more than £230 million fall in duty receipts for wine as a result of reduced sales seen last year will be repeated”.

Simon Shelbourn, chief financial officer of Kingsland Drinks, which works with more than 40 wine producers, added that the increase non-draught duty was an example of the consumer “being further penalised despite already bearing the weight of the cost-of-living crisis, and much of the drinks industry will once again have to prove its resilience despite being positioned to drive economic growth”.

‘No economic purpose’

Mark Kent, chief executive of the Scotch Whisky Association (SWA) was scathing about the announcement, dubbing it a “hammer blow” which “runs counter to the Prime Minister’s commitment to ‘back Scotch producers to the hilt’ and increases the tax discrimination of Scotland’s national drink”.

“On the back of the 10.1% duty increase last year, which led to a reduction in revenue for HM Treasury, this tax hike serves no economic purpose,” Kent continued. “It will damage the Scotch Whisky industry, the Scottish economy, and undermines Labour’s commitment to promote ‘Brand Scotland’. She has also increased the tax discrimination of spirits in the Treasury’s warped duty system, and with 70% of UK spirits produced in Scotland, that will do further damage to a key Scottish sector. The disastrous 10.1% duty hike last year has now been compounded. This further tax rise means the lessons have not been learned, and the Chancellor has chosen continuity with her predecessor, not change.”

The UK Spirits Alliance (UKSA) slammed how Reeves’ comment on the “two-third of alcoholic drinks sold in pubs” being on draught, with spokesperson Stephen Russell stating: “Pubs are more than pints – a third of all alcoholic drinks sold across hospitality are spirits. Today’s decision won’t stop thousands more pubs and distillers closing down. We need action not gimmicks, and we need a government to stop discriminating against the iconic British spirits industry.”

‘Gamechanger’

With a more positive view was the Campaign for Real Ale (CAMRA). Chairman Ash Corbett-Collins said that the group was “pleased” with the draught duty cut: “This will help pub goers as well as independent breweries and cider producers who sell more of their products into pubs, and recognises that drinking in the community setting of the local pub is far preferable to the likes of cheap supermarket alcohol.”

The Society of Independent Brewers and Associates (SIBA) called the cut a “positive step which shows a continued support for breweries and beer in pubs”.

Corbett-Collins also described Reeves’ announcement of 40% relief on business rates for the retail, hospitality and leisure industry in 2025-26, up to a cap of £110,000 per business as “a gamechanger for pubs in England”: “If this is done right and we get a fairer rates regime which ends the system where our pubs are penalised with unfair bills, this would help save community locals up and down the country.”

“While a reduction in draught duty is welcome, in reality it is a drop in the ocean compared with the cost impact of lowering the threshold for national insurance contributions and increasing the rate paid by employers,” argued Greene King CEO Nick Mackenzie. “I would urge the Chancellor to work with the industry to help reduce the cost of doing business as a matter of urgency, with the possible changes to business rates for hospitality in 2026 needing to happen sooner to end the unfair taxation of the nation’s locals.”

Brewers and pub operators seem to have taken the budget fairly well, with the share price of Young’s up by 10% today, and Marston’s up by 3.15% at the time of writing.

UKHospitality chief executive Kate Nicholls was also largely positive about “avoiding the business rates cliff-edge next April”, but said that the “reduced level of 40% is another cost that businesses have to deal with”.

Night Time Industries Association (NTIA) CEO Michael Kill described the 40% relief on business rates as a “minor concession amongst the array of tax increases and fiscal shifts, which will take some time to evaluate and consider regarding sector impacts”.

Related news

Are there reasons for ‘cautious optimism’ for the fine wine market?