- Solana to lead Real World Assets (RWA) tokenization.

- Sol has surged by 7.33% in 7 days as market sentiment shift.

Solana [SOL], the fifth largest cryptocurrency by market cap has experienced very tough few months. However, as crypto market has attempted to recover since the Fed rate cuts, SOL has also made significant recovery on its price charts.

In fact, as of this writing, SOL was trading at $147 after a 7.33% increase over the past week. Although September has seen Solana hit a local low of $120, the past week has pushed the altcoin to recover from all monthly losses to soar by 3.03% on monthly charts.

While Solana has experienced challenging months, its resilience is widely attributed to the adoption of the Solana blockchain especially in Real-world asset tokenization. This increased adoption has seen key players predict Solana as the future leader in RWA tokenization.

Solana to lead in assets tokenization

According to the well-known Crypto advocate and founder of SkyBridge Capital Anthony Scaramucci, Solana will lead RWA tokenization. In his argument, Scaramucci pointed out that asset tokenization is playing a critical role in the streamlining of global financial systems.

He posited that financial markets use $7 billion annually on transaction verification. Thus, according to his claim, the adoption of asset tokenization will eliminate the need for intermediaries thus reducing unwanted friction in transactions.

As the assets tokenization wave takes the digital financial systems, Scaramucci praised Solana for its role in tokenization. He explained that Solana will lead the future developments in the tokenized assets space.

With Solana leading the way, tokenization will make the trading of assets more flawless and effective compared to current systems.

What it means for SOL

Undoubtedly, increased adoption and usage of a network are central to its price growth. Therefore, when the Solana blockchain is widely used, SOL prices will rise.

As Scaramucci predicts further growth for the Solana blockchain, the past week’s price movements could set SOL for further gains.

For starters, AMBCrypto’s analysis shows Sol is enjoying a strong upward momentum on weekly charts. This is illustrated by the positive index on the Directional Movement Index.

The positive index at 27.2 sits above the negative index at 21.3. This suggests a sustained uptrend.

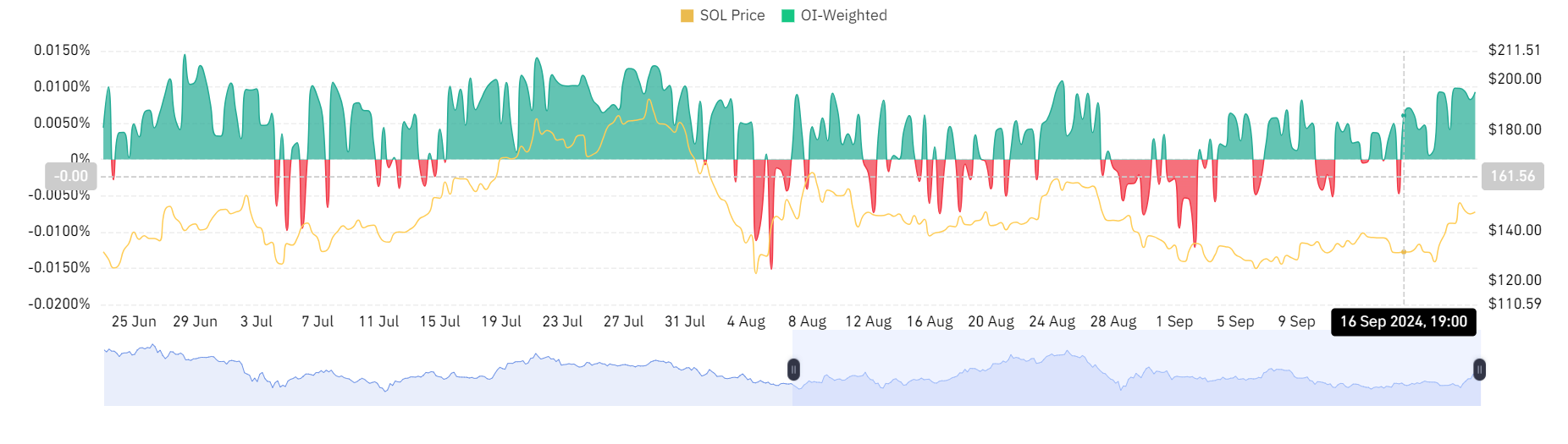

Source: Coinglass

Additionally, Sol’s OI-weighted funding rate has been positive for the last 5 days. This shows a growing demand for long positions, with these holders paying for shorts. This is a bullish signal as it shows confidence in Sol’s future value.

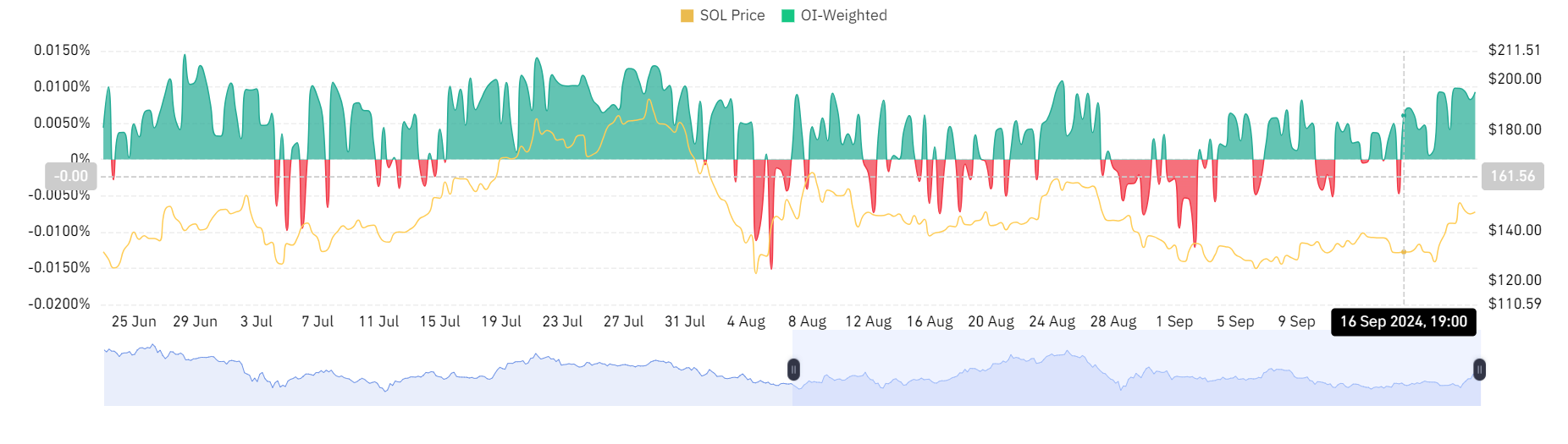

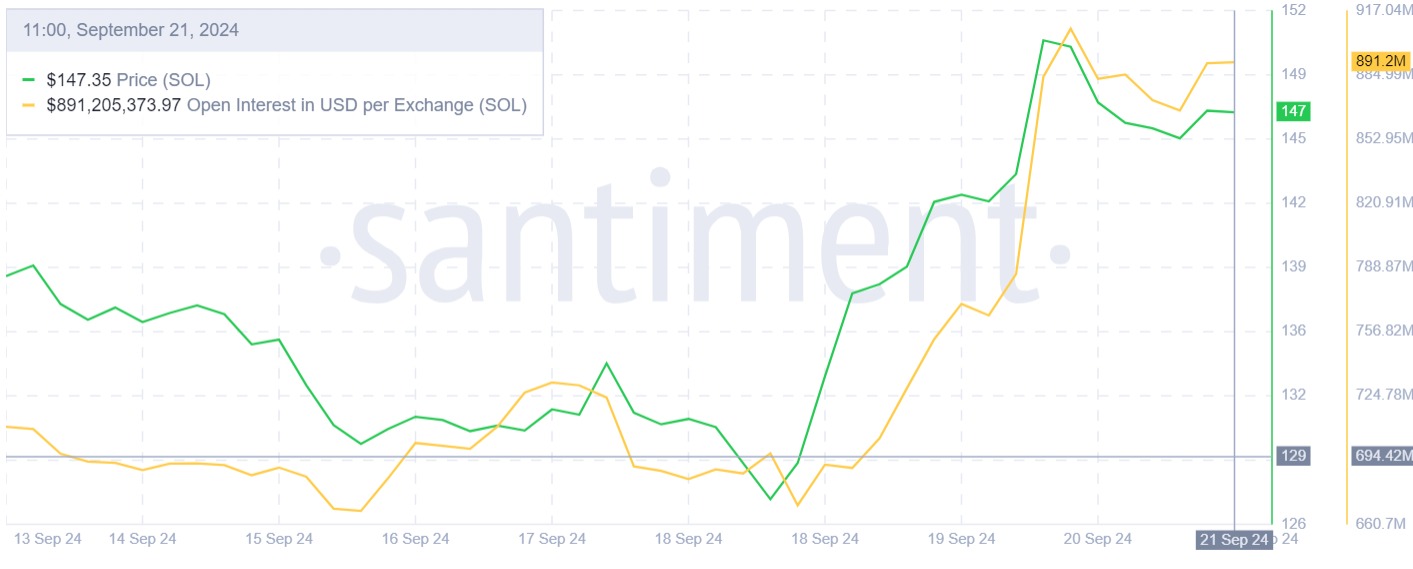

Source: Santiment

Equally, this phenomenon is further supported by a positive funding rate aggregated by the exchange. This implies investors are anticipating prices to rise and are willing to pay a premium to hold their positions.

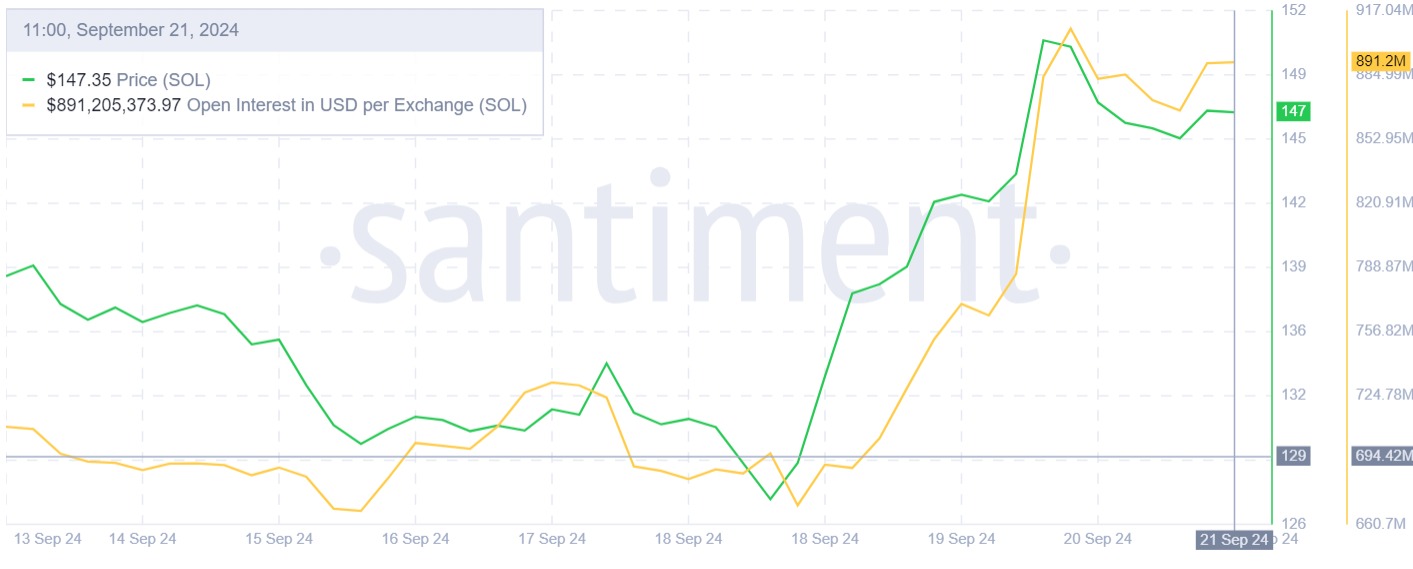

Source: Santiment

Finally, Solana’s open interest per exchange has been on an uptrend over the past week. Open interest per exchange has increased from a low of $667 million to $891.2 million at press time.

Read Solana’s [SOL] Price Prediction 2024–2025

This shows new funds are entering the market indicating a rise in investor’s participation and confidence in future prospects.

Simply put, although Sol has been struggling to reclaim higher resistance levels, the market sentiment has shifted. Thus, if the prevailing sentiment holds, will attempt a $162 resistance level that has proven stubborn in two previous rounds.