- The weakening Yen may boost Bitcoin amid liquidity injections and currency devaluations.

- Despite bearish signals, Bitcoin edged up to $62K, with eyes on $64K resistance.

A month ago, Arthur Hayes, founder of BitMEX exchange, expressed optimism about the weakening Japanese Yen (JPY), seeing it as a potential catalyst to inject liquidity and boost Bitcoin [BTC] and the broader crypto market.

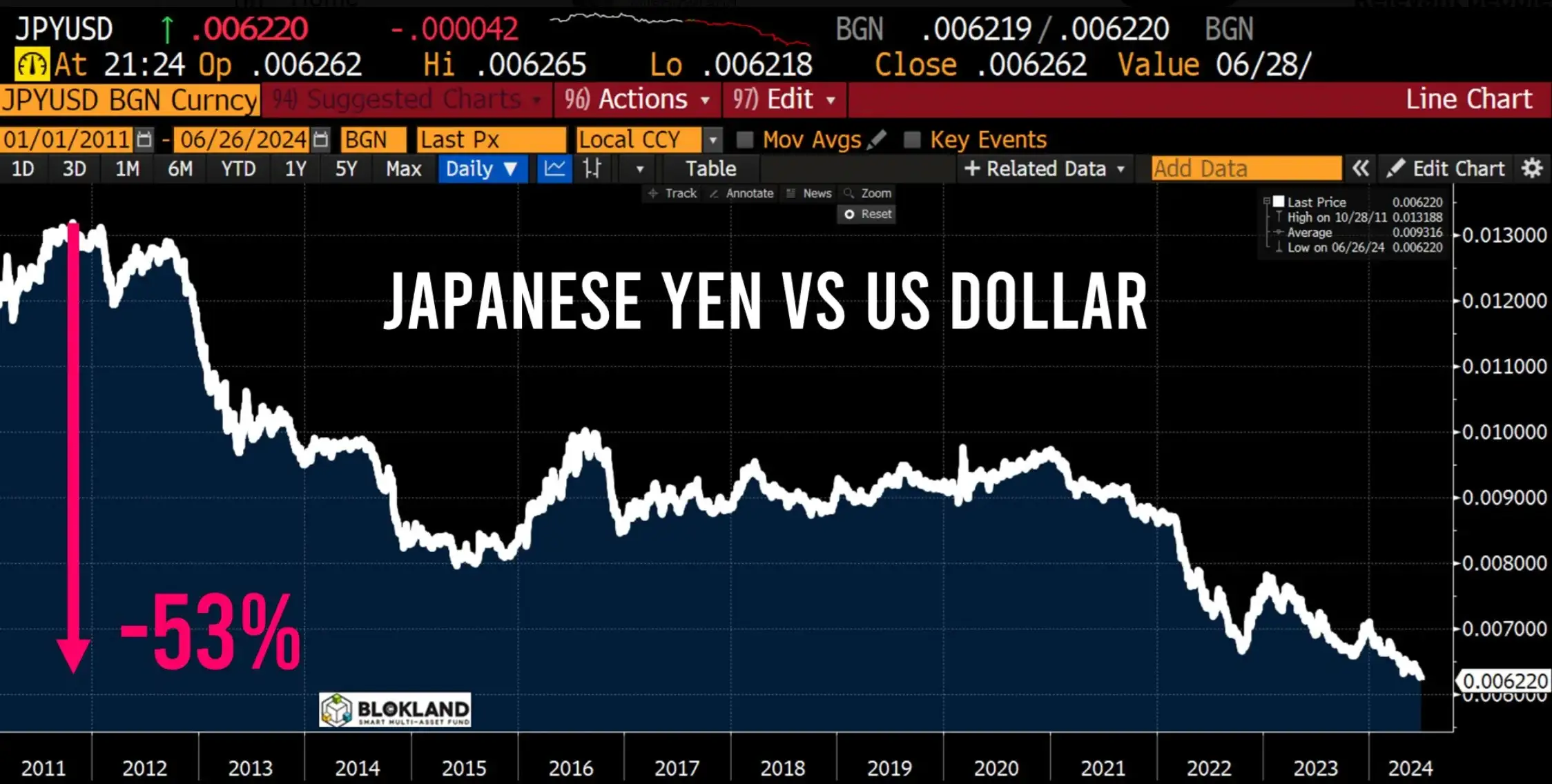

Yen falls to historic low against USD

Fast forward, as of 26th June, the JPY reached its lowest point against the U.S. dollar, marking the lowest in nearly 38 years. This prompted speculation about potential interventions by authorities in the currency markets.

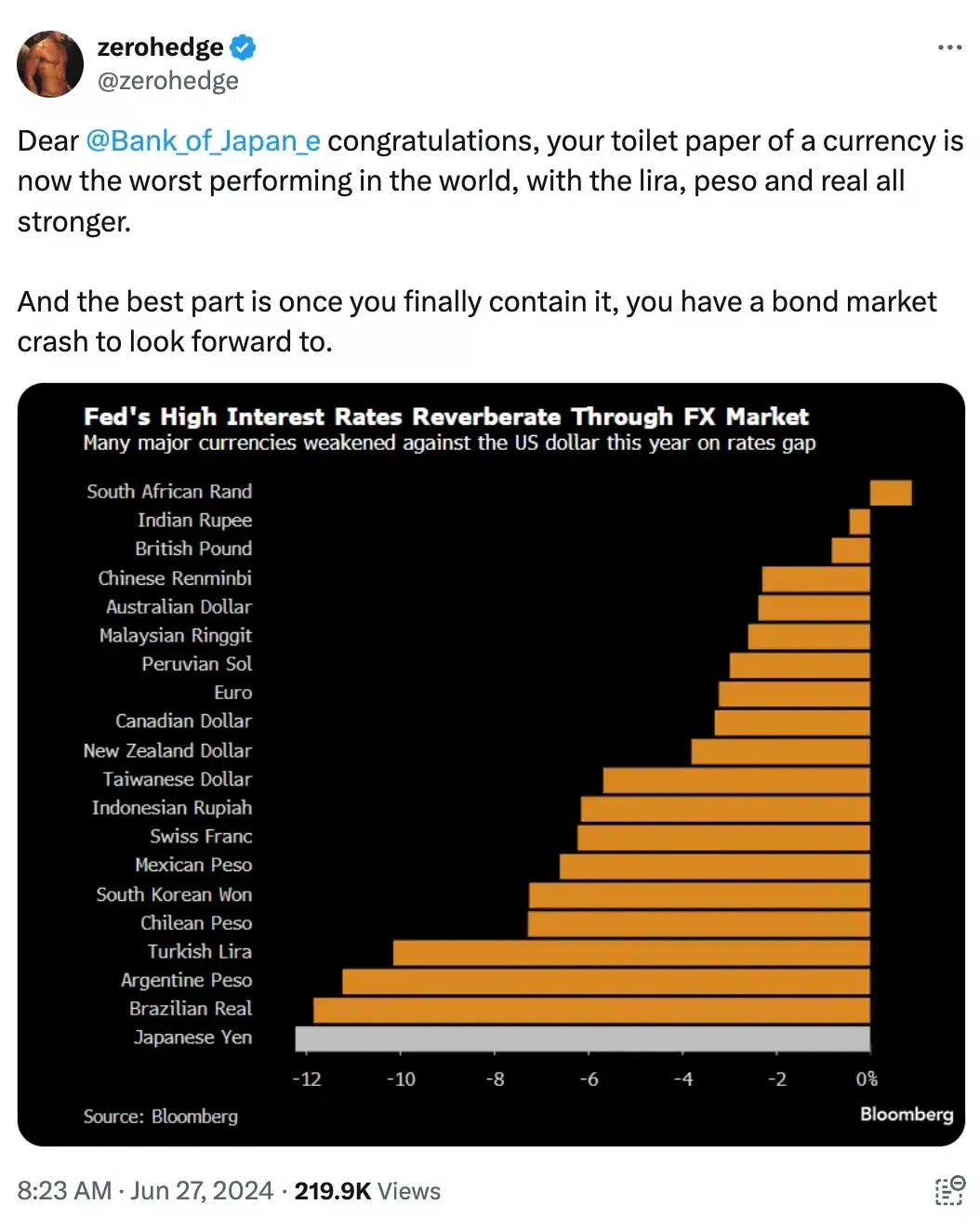

Many attribute this to the Federal Reserve’s decision to maintain high interest rates, which has resulted in the JPY ranking among the world’s poorest-performing currencies.

Remarking on the same and echoing Hayes’ views, The Bitcoin Therapist said,

“Is Japan printing Yen to secretly buy #bitcoin? If so it would be the smartest move in the history of Japan. If not they will become a third world country really soon.”

According to data from FactSet, the Yen weakened to 160.82 against the dollar, surpassing the previous record of 160.03 set on 29th April, and marking its weakest level since 1986.

Adding further to this data set, Jeroen Blokland, Founder & manager of the Blokland Smart Multi-Asset Fund noted,

“Over the last 12.5 years, the Japanese #Yen has lost a whopping 53% of its value against the US Dollar!”

This caused a lot of ripple effects within the financial community as highlighted by ZeroHedge, who commented with a touch of sarcasm, and stated,

A good sign for Bitcoin?

But despite this Hayes sees that a weakening Yen might trigger competitive currency actions among major economies, such as Japan and China, potentially leading to currency devaluations and increased liquidity injections (printing money).

This implies that Bitcoin, which is perceived as a hedge against fiat currency devaluation, could benefit from these macroeconomic conditions.

Hayes anticipates that Bitcoin would perform well in such a scenario, highlighting it as a resilient asset amidst global fiat currency instability.

Hence, Hayes best put it when he said,

“Crypto booms, as there is more dollar and yuan liquidity floating in the system.”

Meanwhile, as the Yen faced bearish pressure, BTC appreciated by 0.56%, reaching a trading price of $62,130.05.

However, the Relative Strength Index (RSI), significantly below the neutral level, indicated a strong bearish sentiment. But, if Bitcoin manages to surpass the resistance level at $64,817, it could signal a potential shift into a bullish phase.