Skift Take

— Dennis Schaal

When an online travel company has a fast-growing business unit, it usually doesn’t take much prodding to get officials to tout it. But that’s not the case with Booking Holdings and its nine-year old business unit, Booking.com for Business.

Booking.com for Business has an exclusive partnership with travel-management company CWT, which provides it with 24/7 customer service and fulfillment, as well as flight, car rental and hotel inventory, including loyalty rates and rewards from the big chains that are usually only available on hotel websites.

With CWT slated to be acquired by American Express Global Business Travel, we asked Booking.com what would happen to the partnership.

We also wanted to know more about the strategy and details about the unit’s growth, and how business travel might relate – or not relate – to Booking’s Genius Rewards program.

Booking.com doesn’t break out any numbers for Booking.com for Business, which has its product team located in Singapore, and declined to comment for this story. Amex GBT also wouldn’t comment.

Booking.com for Business By the Numbers

However, Skift found some numbers for Booking.com for Business through its partner, Serko, which powers the Booking.com for Business platform. Serko is a public company that trades in New Zealand and Australia.

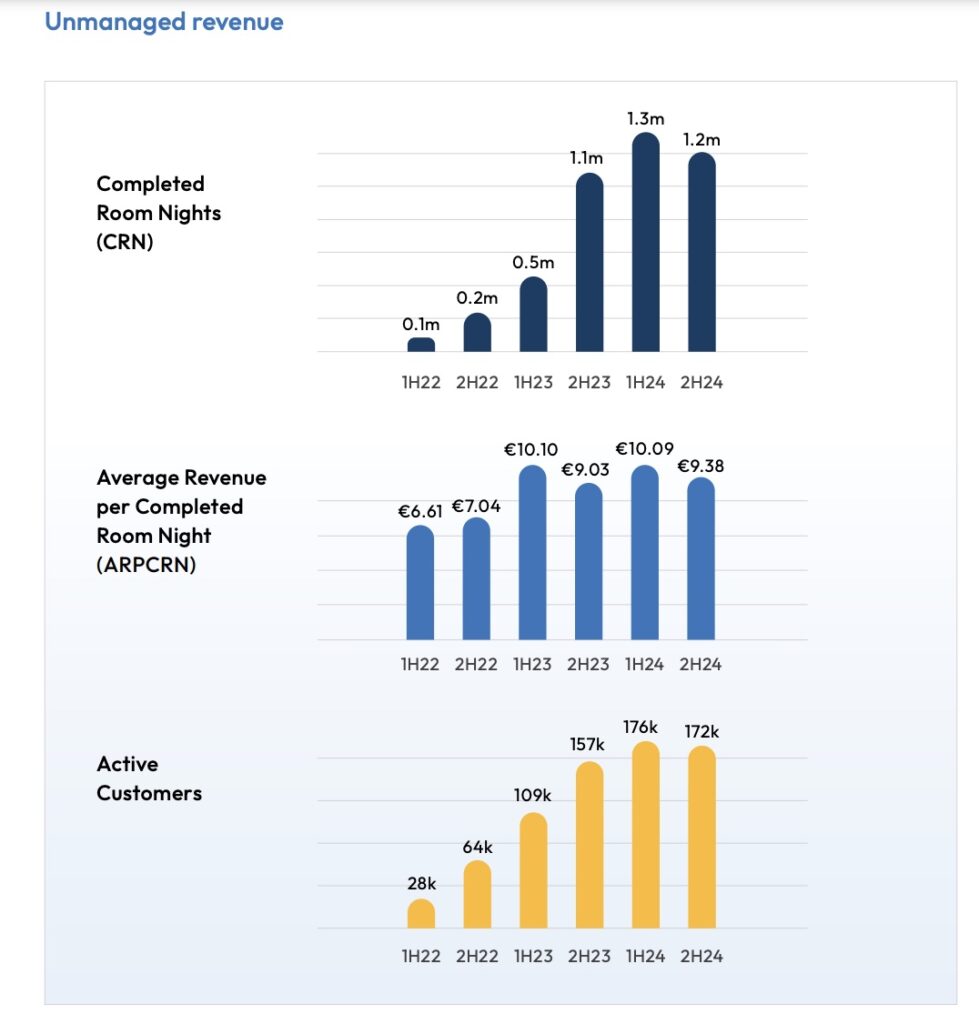

As seen in the chart below, Booking.com for Business saw its completed room nights (net of cancellations) jump 65% to 2.5 million in fiscal 2024, which ended March 31, according to Serko’s annual report.

Booking.com for Business gets inventory from multiple sources, including direct hotel relationships, bed banks, CWT, and global distribution systems. Serko’s completed room night figures do not include room nights from global distribution systems when Booking’s customers book them on its platform. So the actual number of Booking.com for Business’ completed room nights might be higher than 2.5 million.

Booking.com for Business makes up virtually all of Serko’s activities in unmanaged business travel, which means small- to medium-size businesses without formal corporate travel policies. These types of businesses are Booking.com for Business’ target customers.

Booking.com for Business’s room nights makes up just a tiny portion of those at Booking Holdings, which had revenue in 2023 of more than $20 billion. The completed room nights that Serko cites for Booking.com for Business are fewer than 1% of Booking Holdings’ room nights.

Instead of commenting on Booking.com for Business, Booking Holdings may want to emphasize that it is focusing on its core leisure travel business, as well as expanding flights and AI-related products.

Booking.com for Business Room Nights and Active Customers

The accompanying chart also shows that Booking.com for Business’ roster of active company clients grew 10% in fiscal year 2024, to 172,000. (Note that the number of active clients fell by 4,000 in the second half of the year compared with the first half.)

Clients include the University of Chicago, Rt Motorsports, New York Institute of Finance, softserve, and Mark Miller Subaru in South Towne, Utah, according to the Booking.com for Business website.

Serko’s revenue, primarily consisting of hotel commissions, grew 4% in fiscal year 2024, the company stated. The chart shows that Serko’s average revenue per Completed Room night was 10.09 euros ($11) in the first half of fiscal 2024 and 9.38 euros ($10.22) in the second half.

No one has disclosed Booking.com for Business revenue, or CWT’s from the partnership.

Booking.com for Business Strategy

In April, Serko announced that it had renewed a 5-year partnership with Booking.com.

“Our renewed partnership with Booking.com for a further five years, as announced on 30 April 2024, is a major milestone – providing a strong foundation for future global scale,” Serko stated. “We are executing plans with Booking.com to deliver further growth through customer acquisition and activation, and expansion of the product offering.”

Serko stated in public filings that other elements of Booking.com for Business’ growth strategy are to up the use of incentives and loyalty offerings to increase road warriors’ repeat business, and to improve the post-booking experience to retain customers.

Booking.com also plans to add features for managed travel programs, which would mean trying to attract larger corporations.

Serko announced this week that it hired David Holyoke, formerly head of commercial strategy at Airbnb, to lead its unmanaged business travel unit.

Although Booking Holdings didn’t want to comment for this story, Joshua Wood, Booking.com’s director of business travel, has given at least a couple of talks at Serko events over the past couple of years about the partnership and strategy.

See one of the interviews in the video below.

Photo Credit: Exterior of a Booking.com office in Amsterdam. Booking.com for Business saw its roster of room nights booked jump 65% last year.