- KAS surged by 19.54% in seven days and 10.31% in 24 hrs.

- Marathon, the largest mining company, has joined the Kaspa mining race.

The crypto market has experienced a downside in the last 30 days. However, Kaspa [KAS] has defied market trends and continued to sustain its bullish trend.

At press time, KAS was trading at $0.1757, which is a 10.31% surge in 24 hours. Equally, it has surged by 19.54% in the last seven days.

According to CoinMarketCap, KAS has a $4.2B market cap, which is a 10.35% surge in 24 hrs.

Notably, the continued KAS sustained growth while other altcoins are experiencing a downside has captured the attention of the crypto community regarding the factors driving the surge.

One notable factor driving KAS’s recent surge is the announcement by the largest crypto mining firm, Marathon.

On their official X (formerly Twitter) page, they shared about current investment in Kaspa, stating that,

“Today, we’re announcing that we have been actively mining Kaspa. Diversification has been key to our investments in energy solutions and tech innovations, and it remains crucial in our digital asset computing operations.”

The announcement by Marathon is a big deal because the firm has only mined BTC since 2010. Thus, with the announcement, KAS becomes the only PoW it has mined besides BTC.

Following the Marathon announcement, Michael Saylor, the world-renowned crypto investor, announced he was buying KAS. In a tweet on X (formerly Twitter), he said that,

“Take a bite.”

Saylor’s announcement has left KAS enthusiasts optimistic, with Cr7ptopreneur sharing that,

“The only thing more bullish than @MarathonDH announcing that they’re mining $KAS is if @saylor himself came out and told everyone he’s buying #KASPA – oh wait, I think he just did??”

What Kaspa fundamentals indicate

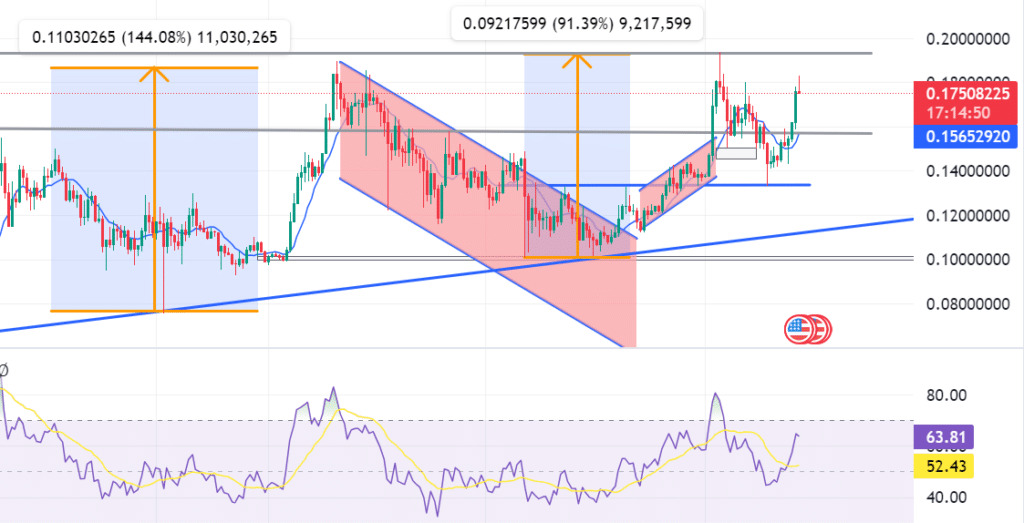

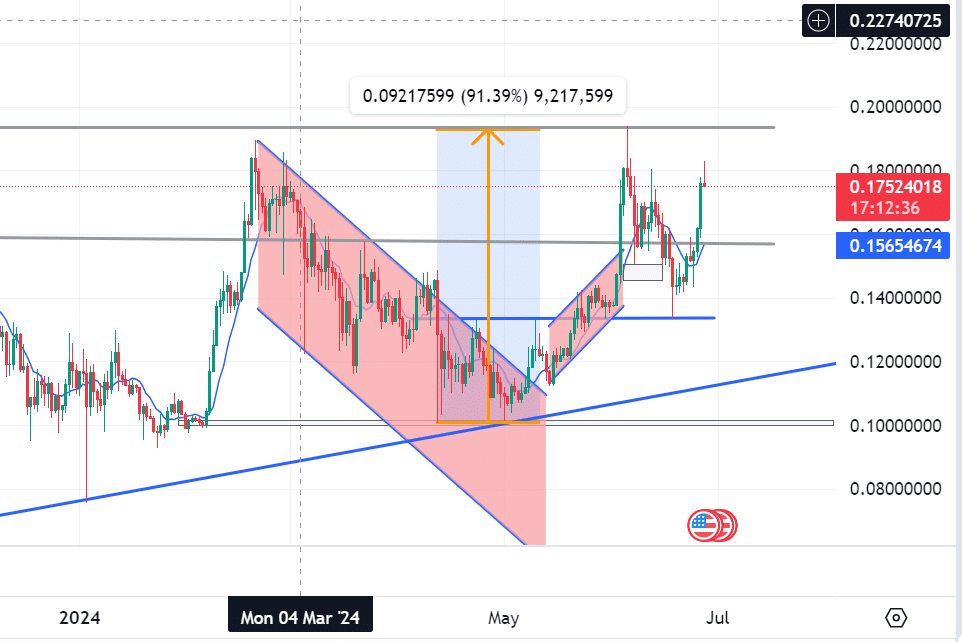

AMBCrypto analysis shows KAS is well positioned for a sustained uptrend. At press time. KAS has an RSI of 65, which has been experiencing an upward momentum.

This indicates the prices have been rising, and the trend is likely to continue as there is still room before it reaches overbought territory.

Equally, SMA shows a bullish momentum after falling below the prices on 21st June. Thus, for the last 5 days, KAS has experienced positive market sentiment and upward price movement.

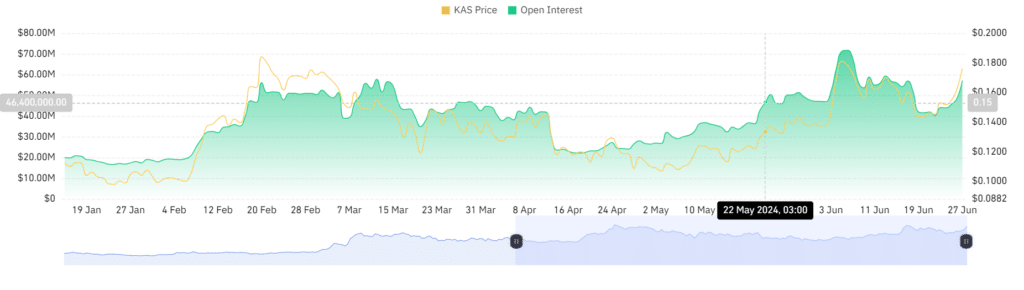

Looking further, our analysis of coinglass shows that Kaspa has experienced rising open interest in the last 7 days. In the last week, it has increased from $40.4M to $57.15M. The rising open interest implies that traders are opening new positions without closing the existing positions.

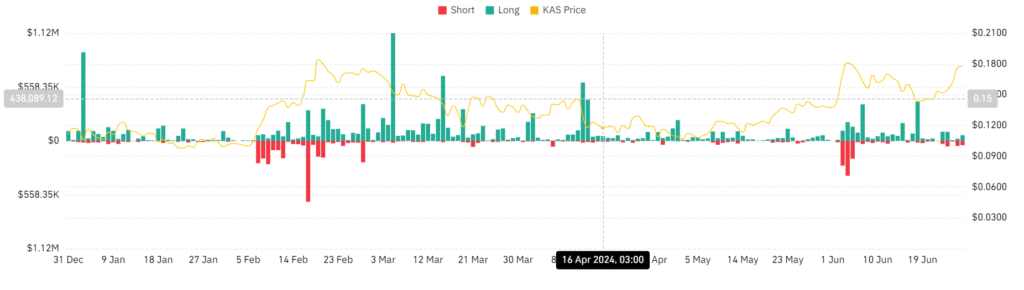

Also, Kaspa has experienced declining liquidation in the last 7 days for both short and long positions. In the last 24 hrs, it has experienced $58k liquidation for long positions and $44k for short positions.

Read Kaspa [KAS] Price Prediction 2024-25

These low liquidations show investors’ confidence in the assets, and they are holding their positions while new positions emerge, resulting in the stability of the current trend.

If the positive market sentiment is maintained, KAS prices will reach $0.192, which is the next resistance level. If KAS experiences a correction, the prices will decline to $0.158, which is the next critical support level.