- MKR’s price declined after a phishing attack caused a decline in sentiment.

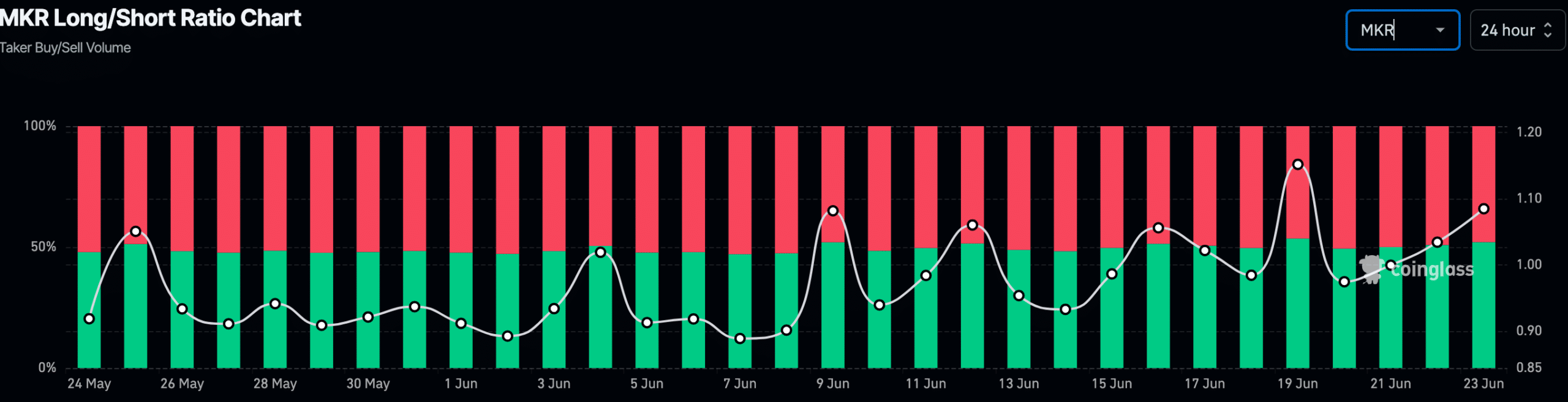

- Short positions taken against MKR surged.

MakerDAO [MKR] has been one of the most dominant protocols in the stablecoin and DeFi space. However, recent events could cause short-term problems for MKR going forward.

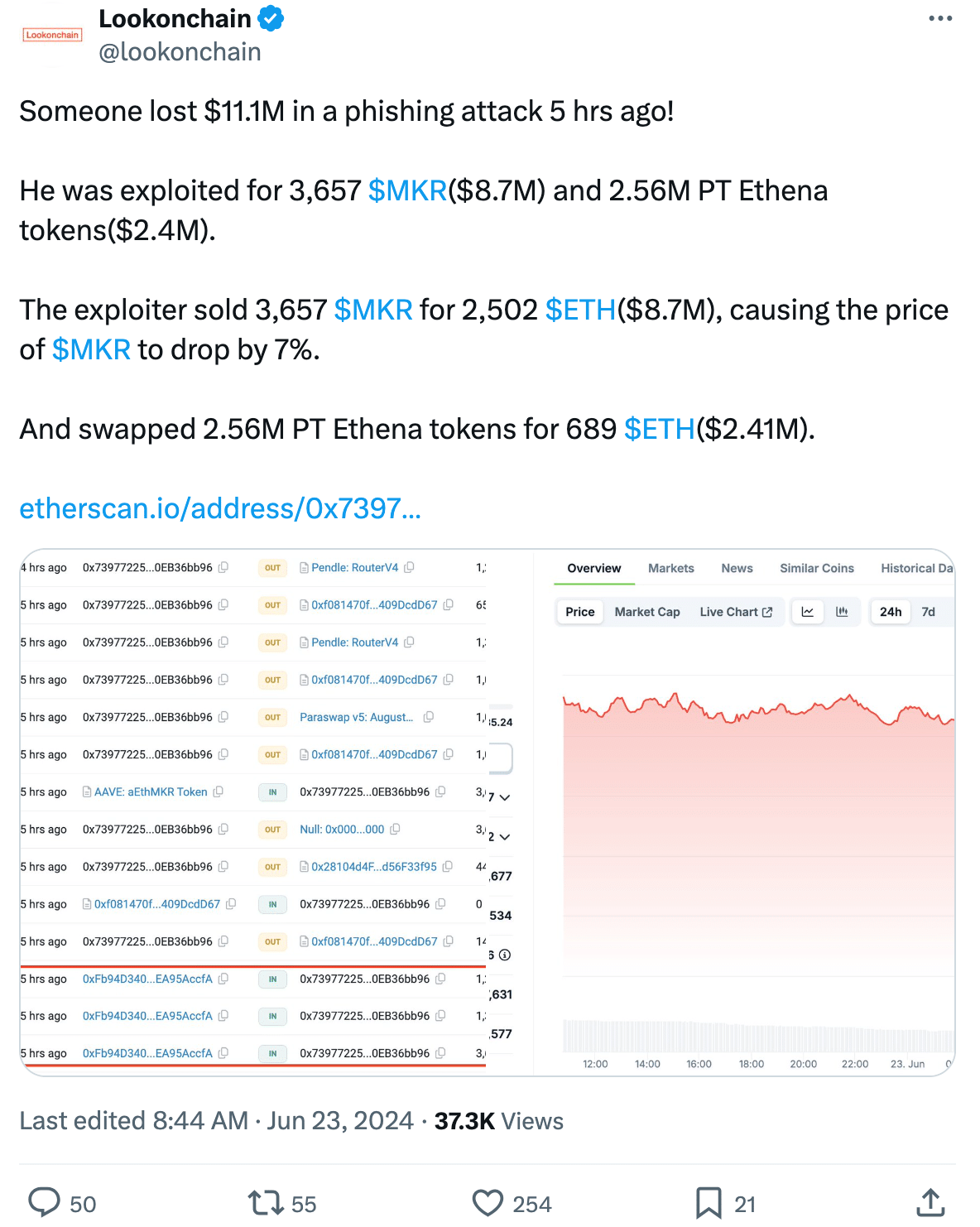

Gone phishing

Lookonchain, an onchain analytics account, reported a major phishing attack that occurred just 5 hours ago. In this incident, a victim suffered a staggering loss of $11.1 million.

The attacker exploited the victim’s digital wallet, making away with a significant amount of cryptocurrency holdings.

This included 3,657 MKR tokens, valued at approximately $8.7 million, and 2.56 million PT Ethena tokens, worth around $2.4 million.

In a move to quickly turn the stolen assets into usable currency, the attacker dumped a large quantity of MKR tokens onto the market.

This sudden sell-off of 3,657 MKR tokens resulted in a significant price drop of 7% for the cryptocurrency. The attacker also swapped 2.56 million PT Ethena tokens for 689 ETH, which translates to roughly $2.41 million.

This price drop can have a significant negative impact on sentiment surrounding MKR. Investors may become wary of holding a token susceptible to such sudden and substantial losses.

News of the exploit can spread fear and uncertainty, leading investors to sell their MKR holdings to avoid further losses.

The incident is likely to contribute to a rise in overall short interest for MKR. With the price of MKR already declining, short sellers may see this as an opportune moment to enter the market, betting that the price will continue to fall.

Short positions against MKR have already grown to 50.83% at the time of writing.

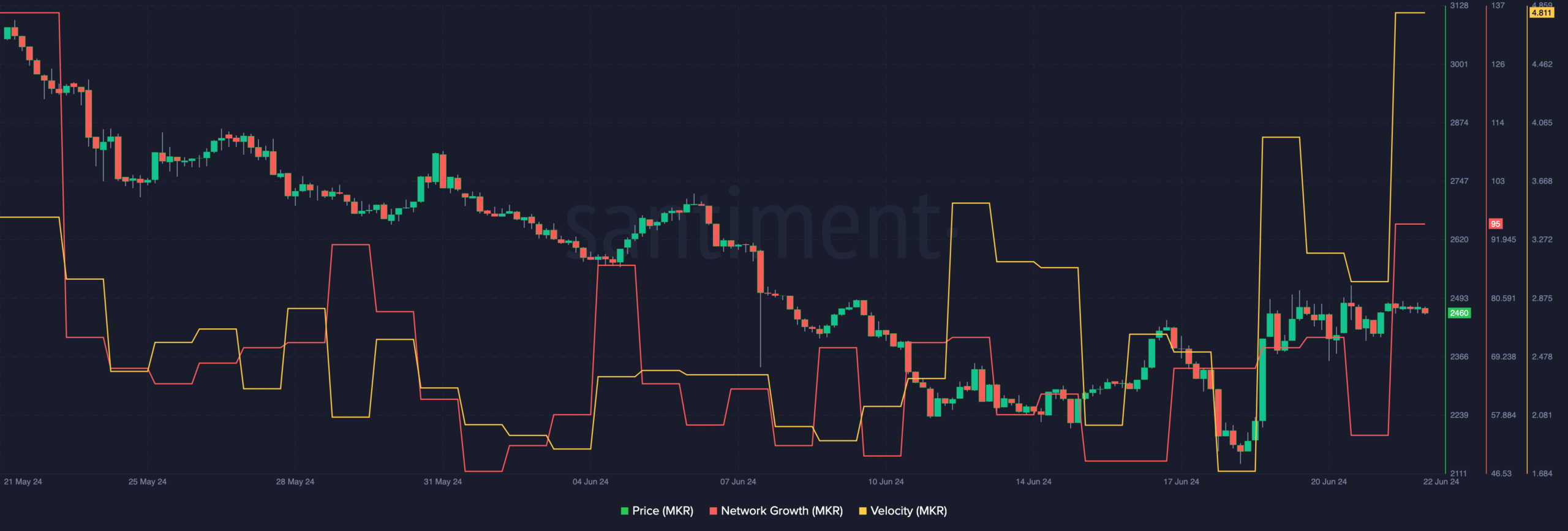

On-chain data shows signs of hope

However, despite all of these factors, Network Growth had grown materially in the last few days, implying that new users were showing interest in the MKR token.

The Velocity also surged, indicating the heightened frequency of trading.

Is your portfolio green? Check out the MKR Profit Calculator.

The rising interest from new addresses also suggests that many investors see the recent correction as an opportunity to buy more MKR at a discounted rate.

If this trend continues, MKR could recover and see green going forward. At press time, MKR was trading at $2,420.47.