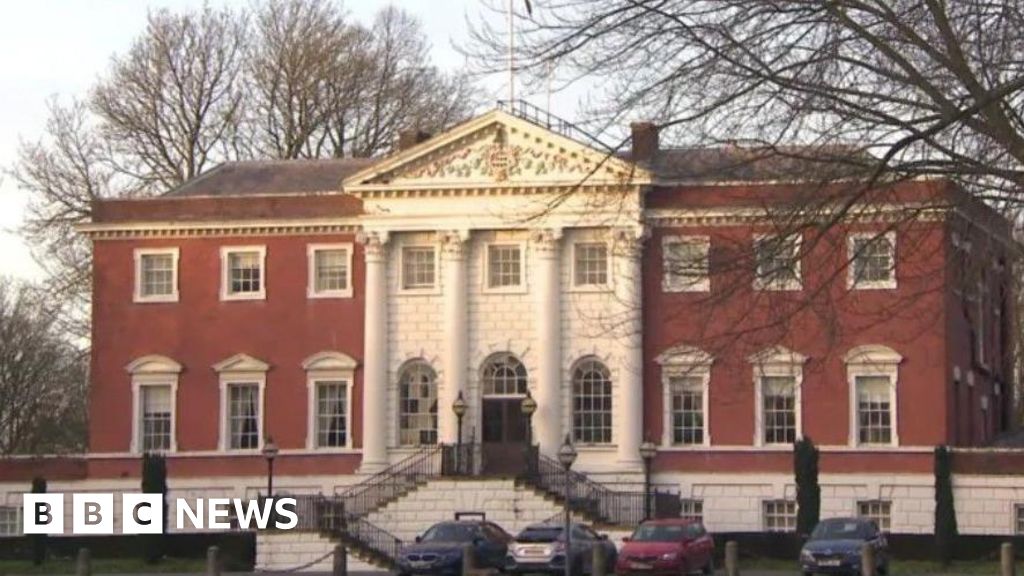

A respected international credit ratings agency has pulled its rating of a heavily indebted Cheshire council.

Warrington Borough Council told bondholders on Monday that the global agency Moody’s had withdrawn its rating because of “the inability of the council’s to procure that its statements of accounts are audited by external auditors”.

The Labour-led council has debts amounting to £1.85 billion, and has come under scrutiny for a number of its investments.

In a statement the council said it had been “impacted by the national issue of delays in signing off council accounts”.

Last month, the Financial Times reported the local authority had refused to hand over key information to its external auditor, Grant Thornton, restricting the auditor’s ability to review the council’s books.

In May, the government ordered an inspection to ascertain whether the authority was complying with its legal requirements, amid concerns about “very large” debts.

Auditors only recently finished reviewing Warrington’s accounts for the financial year ending March 2019, meaning the council is years behind the legal requirement in terms of financial reporting.

The council said it has been unable to complete more recent audits “due to challenges which apply across the local government sector as a whole in securing auditors of sufficient capacity and capability”.

On Monday, following Moody’s withdrawal, the authority said it was seeking to secure an alternative rating from another EU-recognised ratings agency.

It added in a statement: “Warrington is one of only a small number of councils with a credit rating. Like other councils across the country, we have been impacted by the national issue of delays in the signing off of council accounts.

“Moody’s have been clear that the limited prospects towards a timely resolution of the audit backlog across the entire local authority sector means that, in our case, they have insufficient information to maintain the ratings. They have therefore made the decision to withdraw our credit rating.”

Warrington Council has been criticised for its £1.8 billion shortfall, which is mostly blamed on its “uniquely complex” investment programme.

The Labour administration had previously come under pressure from opposition councillors over those investments, which include the ownership of supermarkets in Greater Manchester and solar farms in York, Hull and Cirencester – as well as part-ownership of the now-collapsed energy firm Together Energy.

It has also reportedly provided loans to e-commerce entrepreneur Matthew Moulding to fund a property deal for his THG business.

BBC research earlier this year also found the authority had one of the highest levels of average debt per resident.