Experts are reminding bank customers to grab the best savings deals available as multiple accounts are offering accounts with interest rates north of six per cent.

Savers have benefited in recent years from the Bank of England’s decision to raise the base rate which high street banks and building societies have passed onto customers.

Rachel Springall, finance expert at Moneyfactscompare, reminded Britons why they need to ensure they take advantage of the best savings accounts of this week.

She explained: “Savers who have a simple easy access account may want to check to see if they are getting a decent return on their pot, as rates have improved due to provider competition.

“The average easy access rate rose to 3.12 per cent, the first rise since March 2024.

“The average rate is above three per cent but the best deals pay much more, so it is clear there are many easy access accounts out there paying a poor return.”

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Here is a breakdown of the best savings accounts of the week, according to Moneyfactscompare:

Best regular savings accounts

- The Co-operative Bank – seven per cent interest rate

- Nationwide Building Society – 6.50 per cent interest rate

- NatWest – 6.17 per cent interest rate

- Royal Bank of Scotland – 6.17 per cent interest rate

- Principality Building Society – six per cent interest rate

- West Brom Building Society – six per cent interest rate

- TSB – six per cent interest rate

- Saffron Building Society – 5.75 per cent interest rate

- Principality Building Society – 5.50 per cent interest rate

- Halifax – 5.50 per cent interest rate.

Best fixed-rate savings accounts

- Vanquis Bank – 5.21 per cent interest rate

- Al Rayan Bank – 5.20 per cent interest rate

- National Bank of Egypt (UK) Limited – 5.18 per cent interest rate

- Hodge Bank – 5.16 per cent interest rate

- SmartSave – 5.16 per cent interest rate

- Atom Bank – 5.15 per cent interest rate

- MBNA – 5.15 per cent interest rate

- Union Bank of India (UK) Ltd – 5.15 per cent interest rate

- FCMB Bank (UK) – 5.15 per cent interest rate

- Mizrahi Tefahot Bank Ltd – 5.15 per cent interest rate.

Best cash ISAs

- Virgin Money – 5.05 per cent interest rate

- Shawbrook Bank – 4.89 per cent interest rate

- Castle Trust Bank – 4.87 per cent interest rate

- United Trust Bank – 4.85 per cent interest rate

- OakNorth Bank – 4.84 per cent interest rate

- Paragon Bank – 4.83 per cent interest rate

- Cynergy Bank – 4.83 per cent interest rate

- Secure Trust Bank – 4.82 per cent interest rate

- Punjab National Bank (International) Limited – 4.80 per cent interest rate

- UBL UK – 4.77 per cent interest rate.

LATEST DEVELOPMENTS:

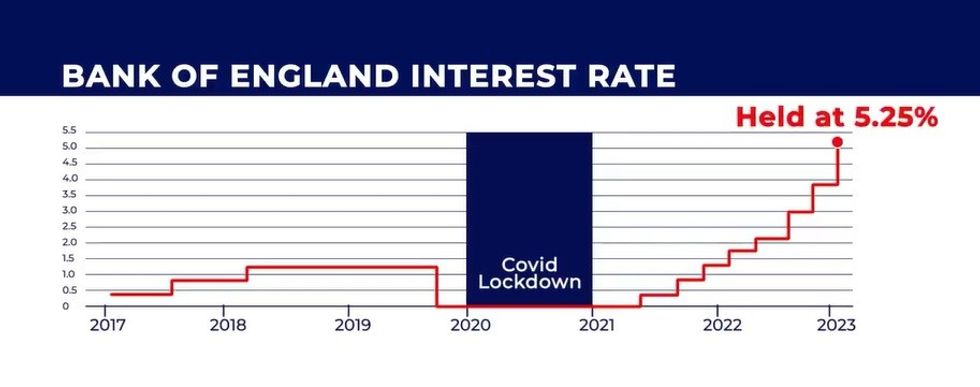

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

Best easy access savings accounts

Here is a full list of the best easy access savings products without a bonus attached:

- cahoot – 5.20 per cent interest rate

- Ulster Bank – 5.20 per cent interest rate

- Oxbury Bank – 5.02 per cent interest rate

- Monument Bank – 5.01 per cent interest rate

- Oxbury Bank – 4.94 per cent interest rate

- Wealthify – 4.91 per cent interest rate

- Paragon Bank – 4.91 per cent interest rate

- Secure Trust Bank – 4.90 per cent interest rate

- Aldermore – 4.90 per cent interest rate

- Close Brothers Savings – 4.90 per cent interest rate.

Here is a full list of the best easy access savings products with a bonus attached:

- Chase – 5.10 per cent interest rate

- Cynergy Bank – 4.91 per cent interest rate

- Principality Building Society – 4.75 per cent interest rate

- Tesco Bank – 4.66 per cent interest rate

- Post Office Money – 4.60 per cent interest rate

- Principality Building Society – 4.60 per cent interest rate

- Marcus by Goldman Sachs – 4.55 per cent interest rate

- SAGA – 4.55 per cent interest rate

- Post Office Money – 4.10 per cent interest rate

- Sainsbury’s Bank – four per cent interest rate.