- Bernstein analysts have revised the 2025 BTC target from $150K to $200K

- However, short-term rally could be derailed by slow network growth, per Fidelity executive.

Bitcoin [BTC] has struggled to clear the record high of $73.7K hit in mid-March, about three months ago. However, Jurrien Timmer, director of global macro at asset manager Fidelity, has pointed fingers at its recent ‘slow’ network.

Penning his analysis on X (formerly Twitter), Timmer noted,

‘The growth of Bitcoin’s network has slowed in recent months, while its price has continued to gain. In my view, this divergence between price and adoption could explain why Bitcoin has slowed down a bit along its path to potential new all-time highs.’

Bitcoin network activity declined after March

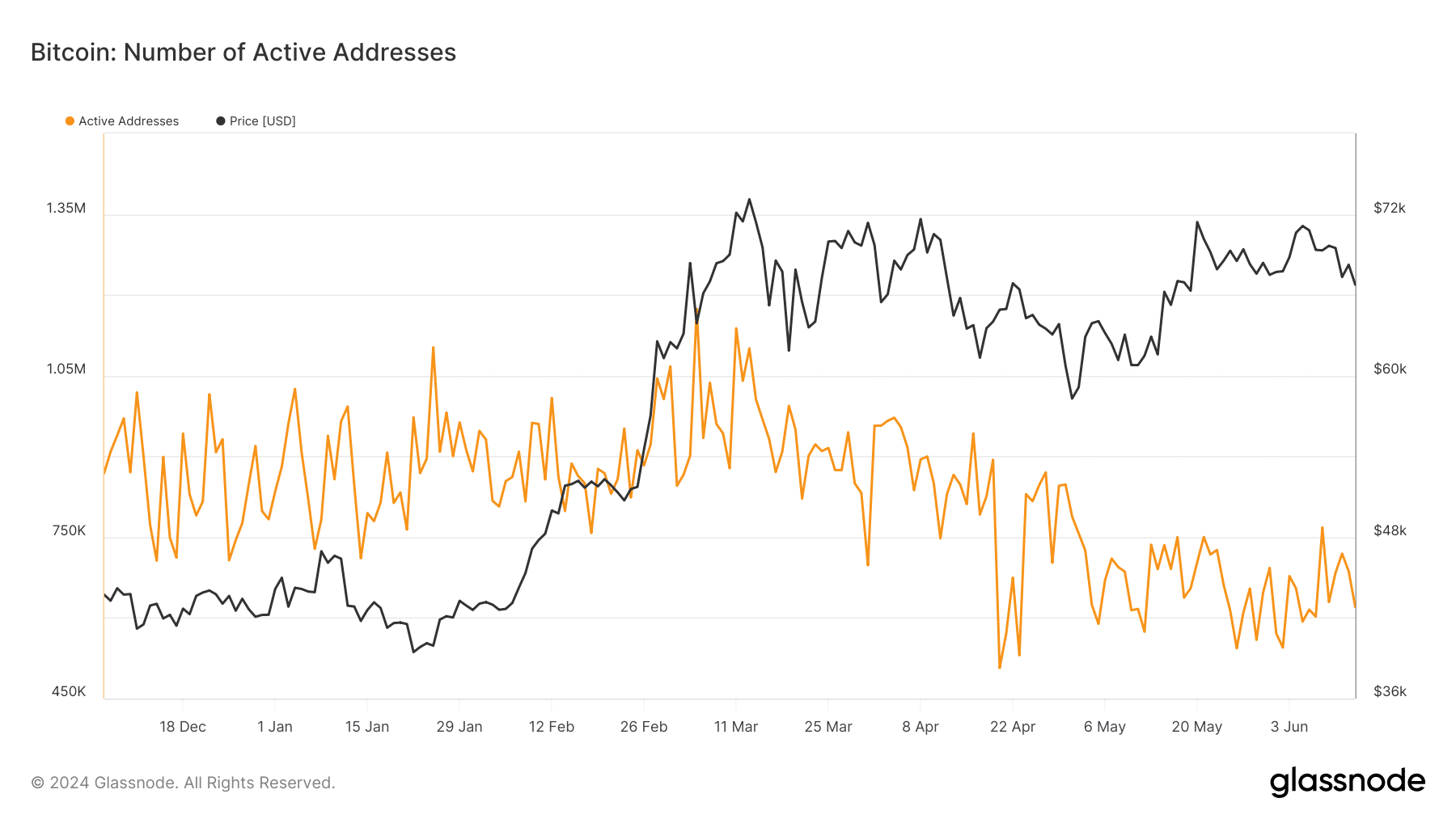

AMBCrypto’s analysis of the active addresses of the Bitcoin network supported Timmer’s assertion.

After peaking at 1.1 million active addresses in early March, just days before hitting the ATH, the metric has dropped to 620K as of press time. This showed network activity declined considerably in Q2.

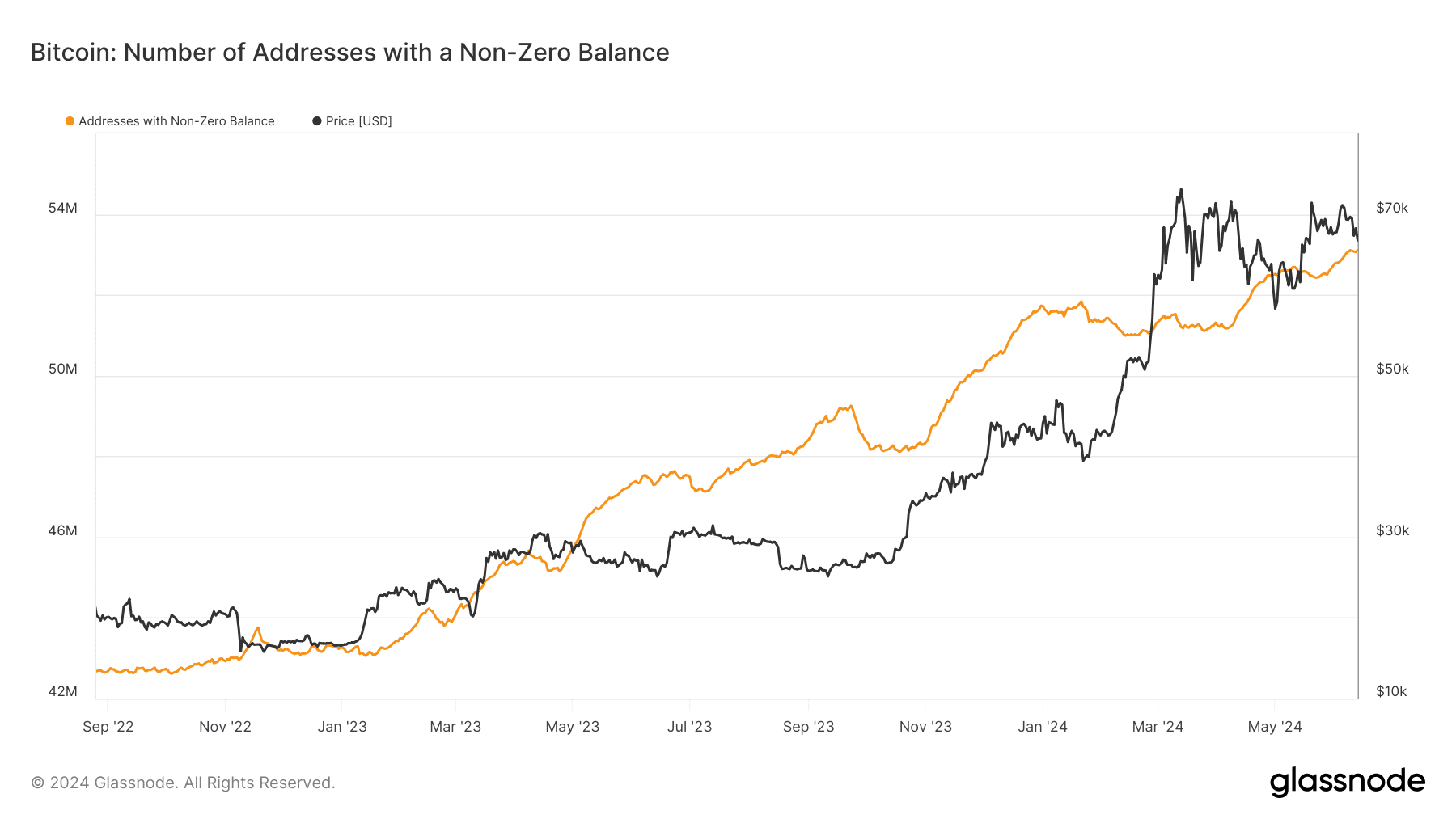

The executive cited the non-zero BTC addresses to further support his thesis on the importance of network growth to BTC price.

He added that the number of non-zero BTC addresses surged when network growth surged and bottomed when its activity declined.

Interestingly, non-zero BTC balance addresses crossed the 50 million mark in Q4 2023, amidst heightened US spot BTC ETF speculations.

The metric jumped from 51 million in January 2024 to 53 million in mid-year, an addition of about 2 million addresses in the past five months.

Despite the surge in non-zero BTC addresses, Timmer stated that the overall drop in network activity was dragging the BTC potential rally. He added,

“For the new highs to continue, the network may have to accelerate again. Could this be driven by the next chapter in the fiscal dominance thesis’

Bernstein: BTC to hit $200K by 2025

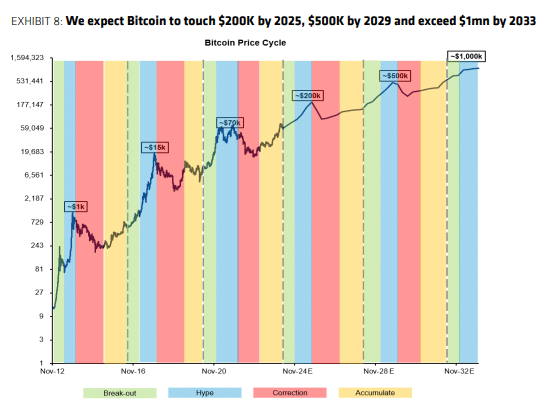

In the meantime, analysts at brokerage and research firm Bernstein have revised their price target for BTC from $150K to $200K by the end of 2025.

In a recent note to clients, the analysts cited ETF demand and BTC supply shock as crucial drivers to their projection.

The analysts estimated that the ETF’s AUM (asset under management) will rise from the current $60 billion to $190 billion by 2025.

As such, they projected BTC could rally 2.8X from the current level to $200K by next year.

‘For the 2024-27 cycle, we expect bitcoin to rally to 1.5 times Bitcoin’s marginal cost of production, implying a cycle high of $200,000 (2.8x appreciation from today’s BTC price) by mid 2025’