- BTC saw a surge in long liquidations in the past 24 hours.

- This comes as the market awaits the release of the CPI report and the outcome of the Federal Reserve meeting.

Bitcoin’s [BTC] price corrected to near $66,000 during the intraday trading session on 11th June, ahead of 12th June’s U.S. inflation report and FOMC meeting.

The coin has, however, rebounded slightly since then to exchange hands at $67,243 as of this writing, according to CoinMarketCap’s data.

As reported by CNBC, economists expect the May Consumer Price Index (CPI) to show a modest increase of 0.1% from April. However, this would still translate to a 3.4% annual increase in prices.

The Federal Reserve is expected to do nothing regarding interest rates.

However, its officials will take other actions, such as releasing quarterly updates to their Summary of Economic Projections, which could be influenced by the CPI report.

Long traders bear the brunt

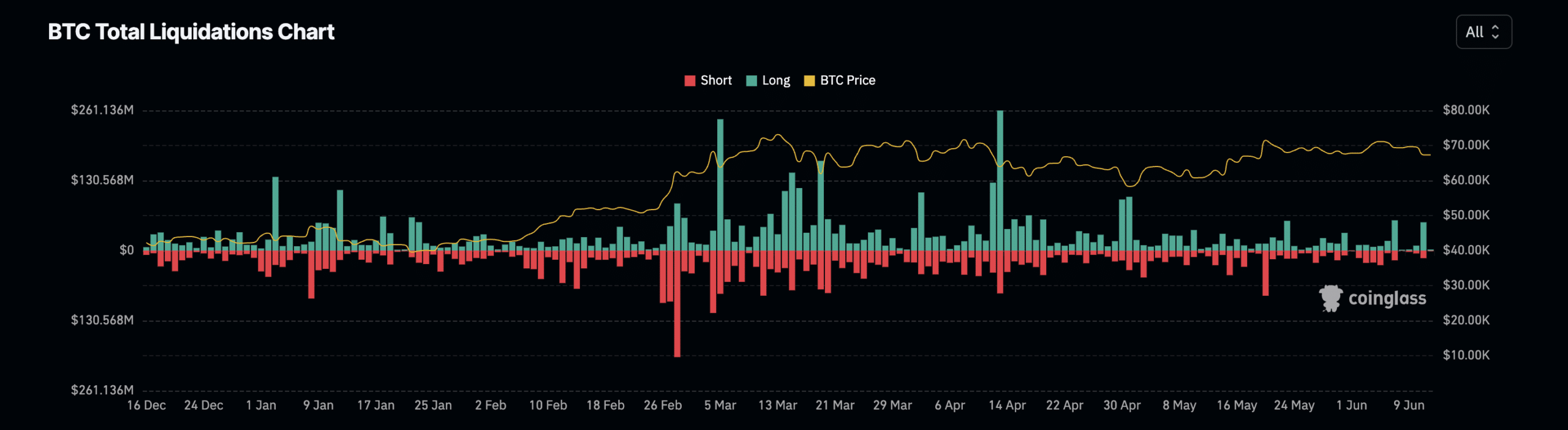

BTC’s price slump on 11th June led to a surge in long liquidations in its futures market. According to Coinglass, liquidations on that day totaled $67 million, with 77% of them being long liquidations.

Liquidations happen in an asset’s derivatives market when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations occur when the value of an asset suddenly drops, forcing traders who have open positions in favor of a price rally to exit their positions.

AMBCrypto found that on the day in question, BTC’s long liquidations totaled $52 million, while short liquidations totaled $14 million.

Bitcoin to surge?

Although many long traders have been plunged into losses in the past 24 hours, market observers noted that the coin’s historical performance hints at a possible recovery in no time.

In a post on X, pseudonymous crypto analyst Gumshoe noted that four FOMC meetings have been held so far this year, and each one followed the same pattern.

BTC’s price declined 10% in the 48 hours before these meetings and fully recovered on the day of the meetings. According to Gumshoe, “The market always prices in overly bearish statements, then reverses.”

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Another crypto analyst, Jelle, shared the same sentiments. The analyst opined the Federal Reserve meetings “have been good for the market recently.”

According to Jelle, the past four FOMC events have coincided with local bottoms and resulted in over 20% rallies for the leading crypto asset.