Peloton Interactive, Inc. PTON has entered into a partnership with the YMCA of Metropolitan Chicago (“Y”) to offer a first-of-its-kind debut program to the Chicagoland market.

The latest partnership will offer top-tier fitness options to the members of the YMCA, both on-site and on the go. The offline facilities include the availability of Peloton Bike+ and Row equipment at Community Hubs of Y. Online access through Peloton App One will be automatically given to the members without additional cost after enrolling for membership at $12.99 monthly.

Members aged 18 or older will have access to the applications from where they can avail services, which include a variety of workouts, activity tracking outside of Peloton workouts, programs and challenges, and more.

The company is optimistic about its partnership with Y as this strategic move will offer the chance to cater to the health and well-being of the community in the market.

Price Performance

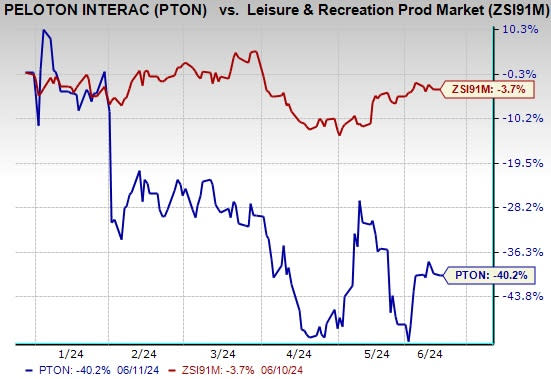

Shares of this Zacks Rank #3 (Hold) company have plunged 40.2% in the year-to-date period compared with the Leisure and Recreation Products industry’s 3.7% decline. Shares have underperformed its industry most likely due to soft contributions from the company’s Connected Fitness Products segment on the back of fewer Bike, Accessories and Row deliveries driven by less demand. Also, demand patterns in North America are on the softer side, thereby hurting prospects. Increases in sales and marketing expenses due to the rise in spending on advertising and marketing programs are headwinds.

Image Source: Zacks Investment Research

Going forward, this exercise equipment and media company aims to undertake strategic initiatives including investments in its global member support team, improvements in systems and tools, and onboarding new onshore outsourcing partners. These initiatives are likely to drive its growth in the upcoming period.

Let’s take a look at the estimate revision trend to get a clear picture of what analysts are thinking about the company. In the past 60 days, the Zacks Consensus Estimate for 2024 loss has narrowed to 18 cents per share from a loss of 23 cents. The estimated figure indicates 73.5% growth from the year-ago period’s reported levels.

Key Picks

Here are better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has gained 46.2% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share (EPS) indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has risen 52% in the past year.

The consensus estimate for NFLX’s 2024 sales and EPS implies a rise of 14.8% and 52.2%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has surged 66.1% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS implies growth of 16.8% and 63.8%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Peloton Interactive, Inc. (PTON) : Free Stock Analysis Report