Some 100,000 households will see their mortgage repayments rise by £240 a month before the upcoming General Election on July 4, according to new analysis by the Liberal Democrats.

Homeowners have seen mortgage repayments increase substantially over the last two years following consecutive hikes to interest rates from the Bank of England and the market response to former Prime Minister Liz Truss’ mini-Budget in 2022.

Ahead of voters heading to the ballot next month, the Liberal Democrats are slamming the Conservatives’ over their record when it comes to mortgage costs.

House of Commons Library research commissioned by the party found that 3,333 households will be slapped with higher costs between now and the General Election.

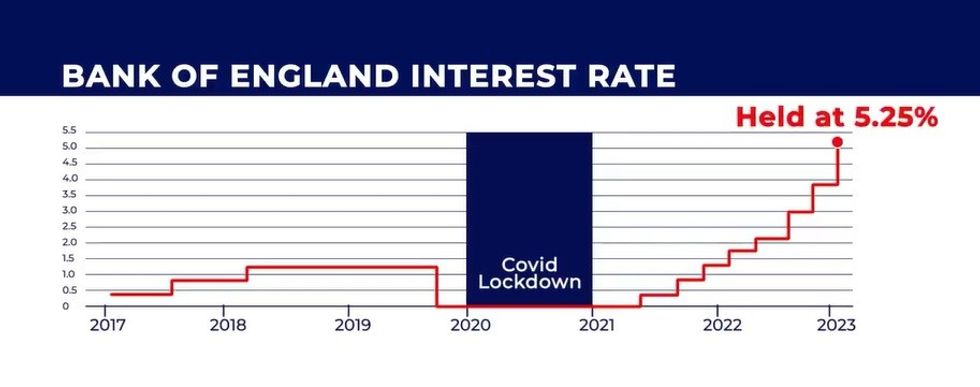

This comes soon after the UK’s central bank maintained the base rate at 5.25 per cent earlier this month, with interest rates having remained at this level since August 2023.

Those mortgage holders impacted by the pending hike to repayments will likely pay an additional £240 a month as a result.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

According to the Lib Dems, Prime Minster Rishi Sunak’s is living in “parallel universe” when it comes to his claim that the economy is improving.

For the 12 month to April 2024, inflation eased to 2.3 per cent which analysts have claimed is partially contributable to the Bank’s decision raise interest rates.

However, one of the consequences of the central bank’s decision is that homeowners have been saddled with soaring costs.

The Liberal Democrats claim mortgage holders coming off fixed rate deals ahead of the General Election will pay an extra £290million in repayments over the year.

As such, the party believes Sunak and the Tories will face a “blue wall reckoning” on polling day with key seats in the Conservative heartlands turning their backs on the Government.

Current data shows various Tory seats falling to the Liberal Democrats, including Taunton Deane, Tewkesbury and Steve Barclay’s seat of North East Cambridgeshire.

Lib Dem Treasury Spokesperson Sarah Olney said: “This Conservative government crashed the economy and now they are condemning hard-working households to a mortgage nightmare.

“Rishi Sunak’s claim that the government’s plan is working shows he is living in a parallel universe, as every day thousands of families are seeing their mortgage go up by eye-watering amounts.

“The Prime Minister is set for a blue wall reckoning in key battleground seats where fed up voters are ready to say enough is enough with this out-of-touch Conservative Government on 4th July.”

These numbers cited by the party have been disputed by the Government’s economic secretary to the Treasury, Bim Afolami.

LATEST DEVELOPMENTS:

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

He said: “This is yet another press release from the Liberal Democrats where they are just sniping from the sidelines and contains absolutely no plan for the country.

““Rishi Sunak and the Conservatives have a clear plan and are taking bold action to strengthen the economy – with mortgages rates coming down, inflation down from 11.1 per cent to 2.3 per cent and £900 back in hard-working people’s pockets, which we were able to do as a result of the economy growing, securing a brighter future for all.

“A vote for the Liberal Democrats is an endorsement of Keir Starmer and Angela Rayner, which would see a tax rise of £2,094 for working families to fund Labour’s £38.5 billion blackhole. Labour’s high tax approach will take us back to square one on the economy which will harm families and punish hard work.”

For today, Moneyfactsconpare reports the average two-year fixed residential mortgage rate today is 5.93 per cent which is up from an average rate of 5.92 per cent on the previous working day.

Furthermore, the average five-year fixed residential mortgage rate today is 5.50 per cent, a slight jump from the average rate of 5.49 per cent from last Friday.