- BTC ETFs attracted inflows from Gold ETFs, per a VanEck executive.

- BTC could be closer to a parabolic run following a key update on the US money supply.

Market watchers have long speculated that US spot Bitcoin [BTC] ETFs could draw flows from Gold ETFs. According to VanEck’s CEO, Jan Van Eck, this has become a reality.

On the sidelines of Paris Blockchain Week 2024, the VanEck executive underscored that Gold ETFs have seen outflows despite hitting record highs and rallying 14% in 2024.

“There are outflows out of Gold bullion ETFs in the US this year even as it (gold) hits all-time highs and is up 14% this year.”

Van Eck added that, based on a Google search analysis, investors’ interest in ‘Bitcoin dominated gold.’

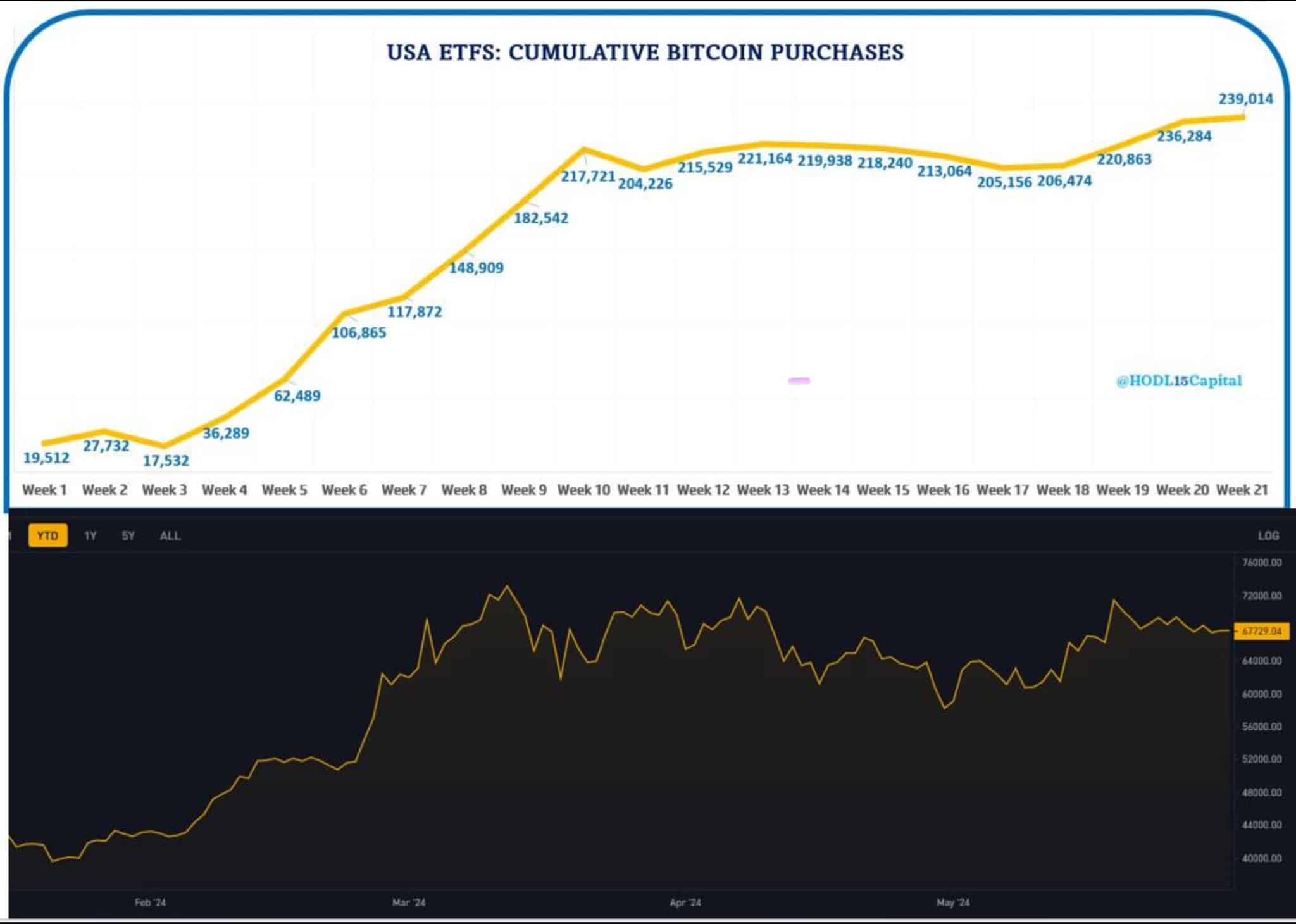

Despite the above interesting developments, US Bitcoin ETFs added about 30K BTC in May, but demand stagnated.

Bitcoin ETF demand stagnates, but …

In May, the US spot BTC ETFs recorded net positive flows and added 29.5K BTC, factoring GBTC selling.

On 31st May, the ETFs logged a net positive inflow of $48.7 million per Soso Value data. BlackRock’s IBIT led the inflows with $169 million, followed by Fidelity’s FBTC’s $5.9 million.

However, Grayscale’s GBTC dented the above inflows after recording $124.3 million in outflows last Friday, per Farside Investors data.

When the cumulative spot BTC ETF demand was plotted against the BTC price, the chart showed that the demand stagnated along with the price.

However, BTC could soon hit a parabolic run. The king coin has hit a crucial and similar milestone last seen before the 2017 parabolic run – breaking above the US money supply. According to crypto analyst TechDev,

‘In 2021 $BTC was carried to new USD highs by increased money supply. In 2024 it’s gotten there on its own demand (and thus broke out against M1). Add the anticipated M1 growth this time and we likely see $BTC outpace expectations based in part on 2021.”

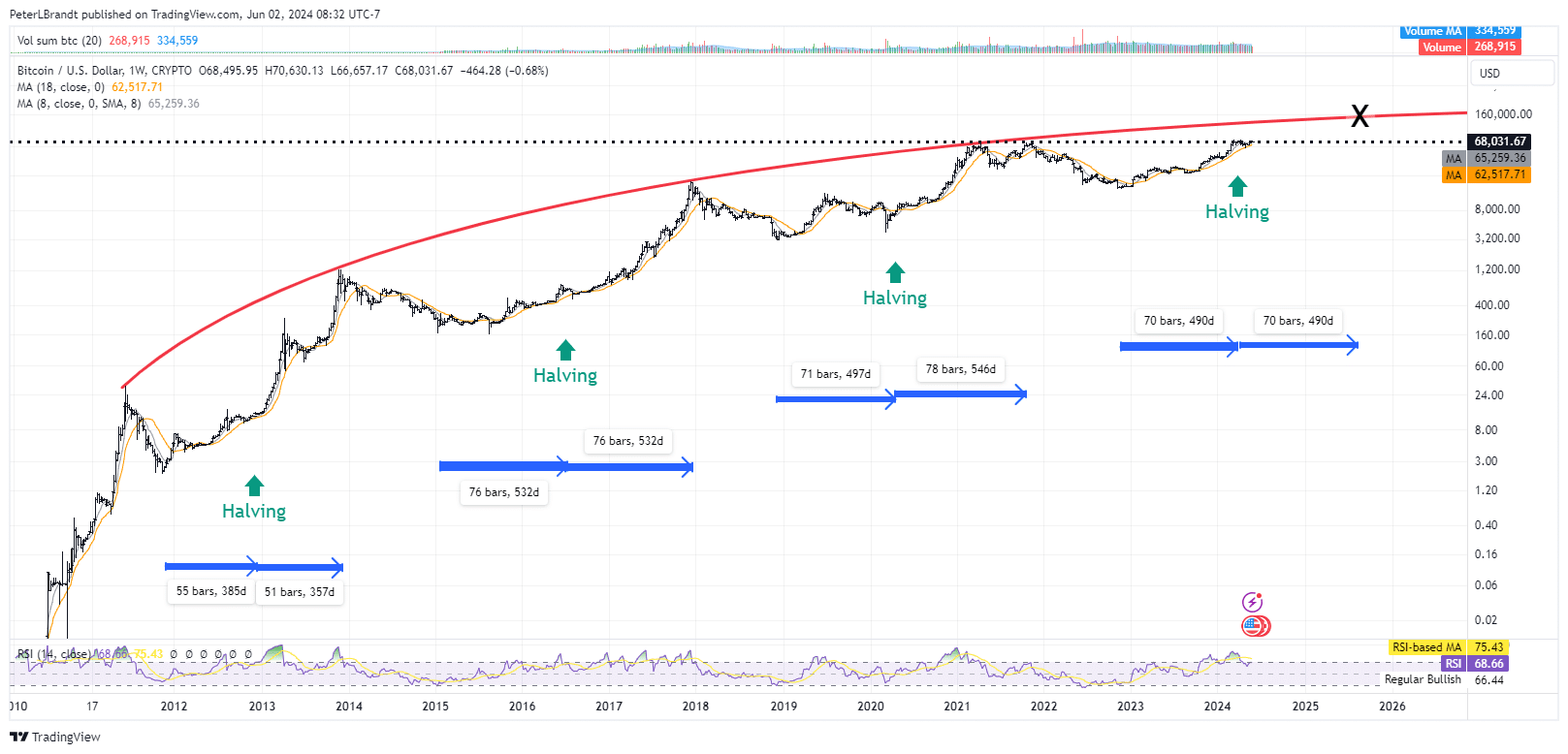

Another analyst, Peter Brandt, based on standard historical data, capped the upside of this market cycle at $130K-$150K per BTC by August 2025.

However, BTC entered a third month of price consolidation and must break above the range to confirm the uptrend momentum.