- BlackRock’s IBIT flipped GBTC as the top spot BTC ETF

- IBIT could eye Gold ETF as the next target.

BlackRock’s Bitcoin [BTC] ETF, iShares Bitcoin Trust (IBIT), has flipped Grayscale’s GBTC as the world’s largest BTC ETF, with $20 billion in assets.

As of 29th May, IBIT held 288.67K BTC, which translates to about $19.5 billion based on the current market value of $67.7K per BTC.

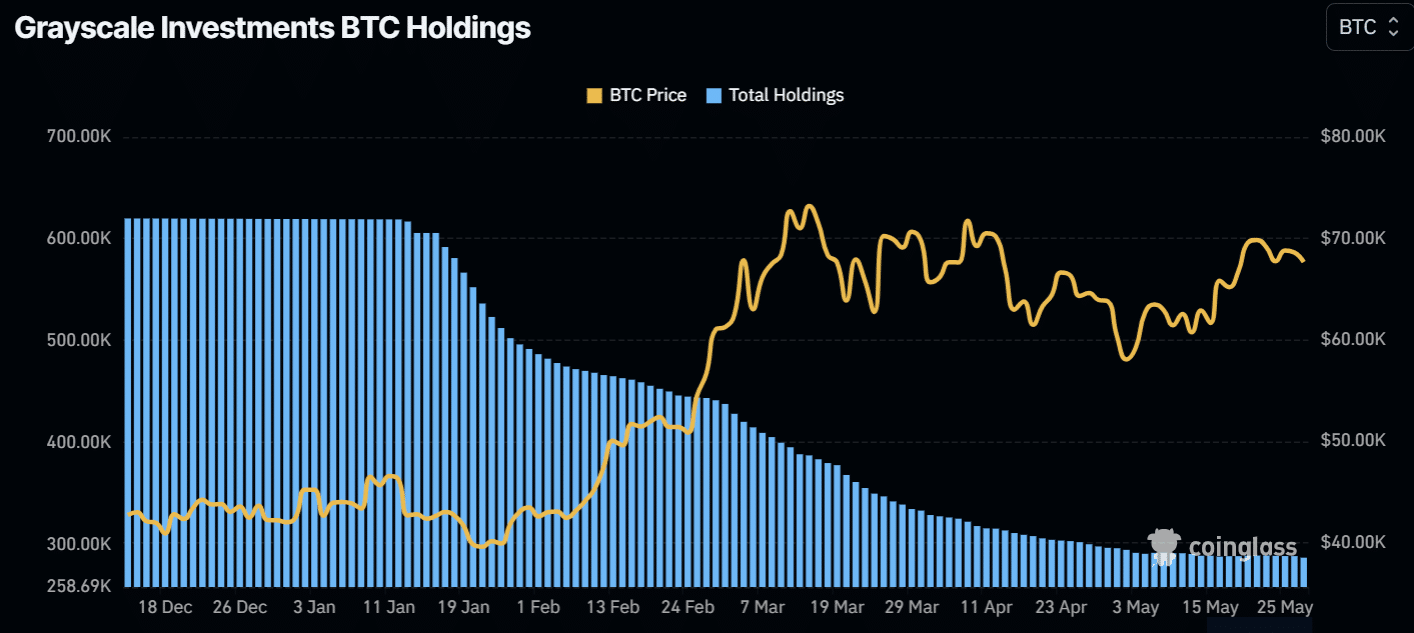

On the other hand, Grayscale’s BTC holding as of 29th May stood at 287.44K, per the firm’s website.

According to one of the market watchers, the flipping happened after GBTC recorded extra outflows on 28th May worth $105.2 million against IBIT’s inflow of $102.5 million.

BlackRock Bitcoin ETF tops after GBTC’s massive outflows

Since the GBTC conversion in January, Grayscale has lost over 300K BTC due to heavy outflows as the firm maintained higher fees compared to new entrants.

“Grayscale held 620,000 BTC at the time of the conversion (1/10/2024), which was more than 3% of circulating supply, but refused to lower the fee (1.5% vs 0.2% for peers), even after investors pulled 330,000+ BTC. So much for the “differentiated” strategy.”

According to Farside Investors data, GBTC’s record cumulative negative flows hit $17.7 billion on 29th May. On the other hand, the BlackRock Bitcoin ETF has seen remarkable net positive flows over the same period, worth $16.5 billion.

Apparently, IBIT’s nearly $20 billion in assets was a remarkable record in traditional ETF, too, per Bloomberg ETF analyst Eric Balchunas. Balchunas noted that,

“More context on just how absurd $IBIT is: there’s only been one ETF in history to reach $20b in assets in under 1000 days. $JEPI, which did it in 985 days. $IBIT is a hair away at 137 days”

According to Nate Geracci of ETF Store, the next target for IBIT could be the iShares Gold ETF, which has over $29 billion in assets.

“Would be something if IBIT caught it (iShares Gold ETF) before year-end.”

In the meantime, the overall spot BTC ETFs recorded positive flows last week, which could boost BTC price action.

However, the King coin was battling short-term sell pressure near $67K at the time of writing. The long-term projection still painted a bullish scenario, given that the current rally might be only half-way before the market tops out.