- TapSwap had a weak bearish outlook at press time despite the weekend volatility.

- The volume indicator showed some hope, but bulls will need to flip this level to support.

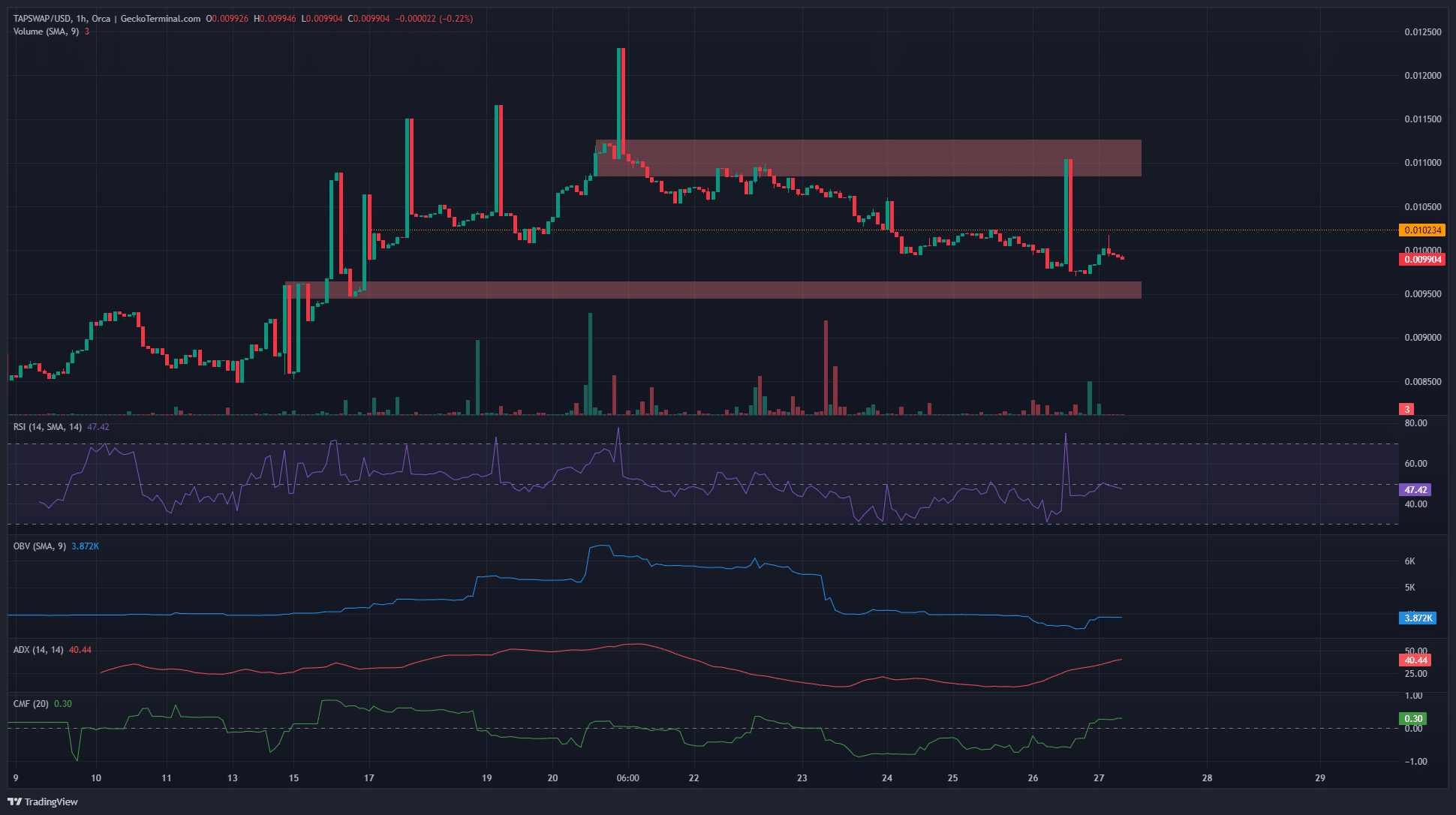

TapSwap [TAPSWAP] saw a lot of volatility on the 26th of May, Sunday. It rose from $0.0098 to $0.011, a 12.4% move upward within an hour, before falling to $0.00974 a couple of hours later.

This volatility is common among small-cap coins without much trading volume behind them. What is the short-term TapSwap price prediction based on technical analysis?

The past week’s trend was concerning

The price action on the 1-hour chart showed a strongly bearish bias over the past week. The price has set a series of lower highs after the $0.011 region was flipped to resistance on the 22nd of May.

The RSI was also consistently below the neutral 50 level to highlight bearish momentum in the past few days.

At press time, TAPSWAP was retreating toward the $0.0095 support zone highlighted by the red box. The OBV has slid lower over the past four days, showing increased selling pressure.

However, the CMF contradicted this finding and threw a wrench in the TapSwap price prediction.

The CMF reading of +0.3 signaled significant capital inflows into the market and meant buyers were in control. The dissonance among the volume indicators was a concern for traders.

The ADX showed a strong trend in progress with its reading of 40.

Is your portfolio green? Check the TapSwap Profit Calculator

With Bitcoin [BTC] achieving a breakout past the local resistance at $67k last week, the sentiment across the market could see a TAPSWAP recovery in the coming days.

In conclusion, the TapSwap price prediction is that a bounce from the $0.0095 support is likely based on the price action.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.