- Bitcoin was trading at around $96,000 at press time.

- Indicators are making a strong case for it rising to $100K.

Bitcoin’s [BTC] recent price movement has sparked widespread interest as the cryptocurrency consolidates within a tight range below the $100,000 mark.

Analysts suggest this period of range-bound trading is a necessary pause following a significant rally, allowing the market to stabilize before the next breakout.

Consolidation or preparation?

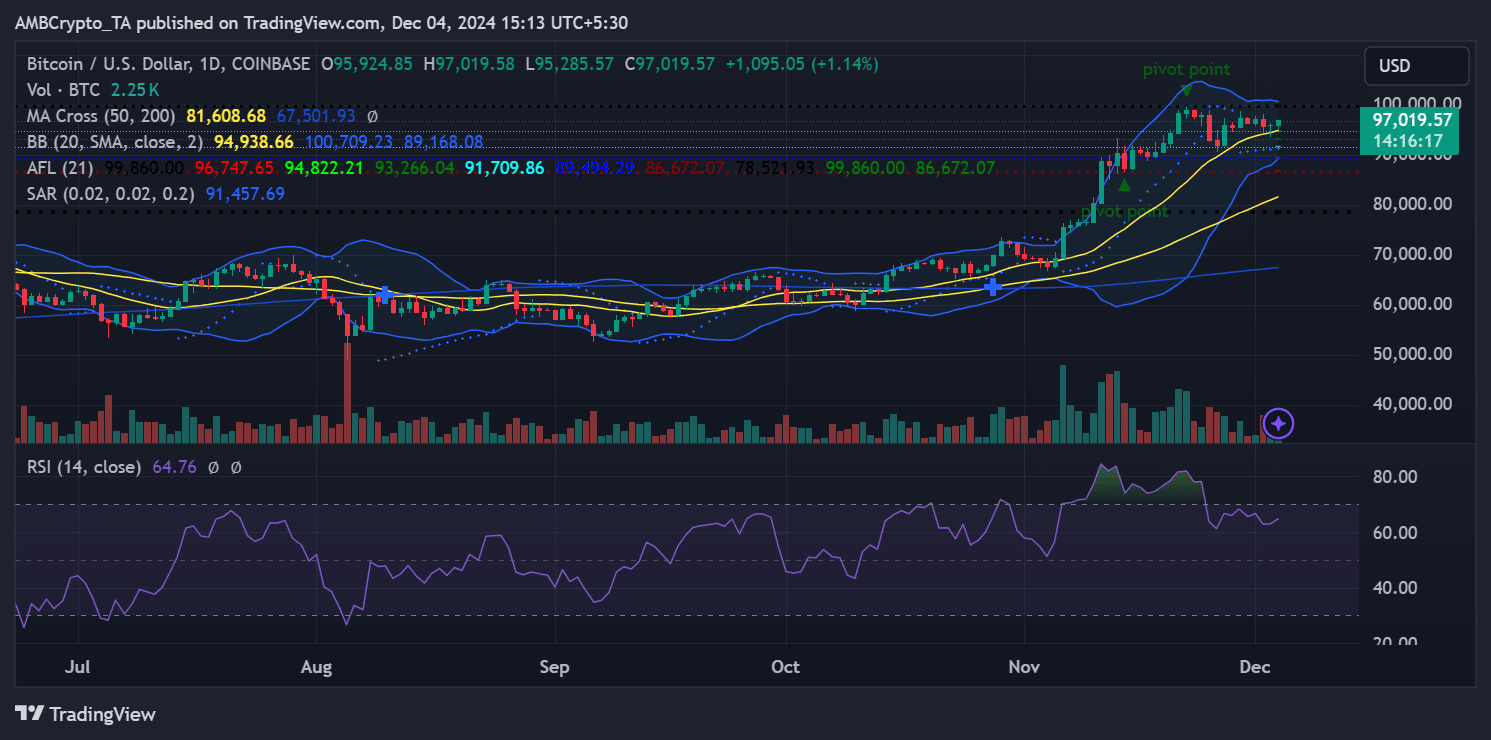

Bitcoin’s price action on the daily chart revealed a consolidation phase between $95,000 and $98,000, with reduced volatility signaling indecision in the market.

Technical indicators, however, reflected an overall bullish structure.

The moving averages remained firmly in a golden cross pattern, with the 50-day moving average holding above the 200-day moving average, underscoring the ongoing bullish momentum.

The Bollinger Bands have tightened, which typically precedes a sharp directional move.

Meanwhile, the Relative Strength Index (RSI) sat at 64.76, edging close to overbought territory but still allowing room for additional upside.

The Parabolic SAR dots, positioned below the candles, further reinforce the upward momentum.

MVRV ratio and exchange reserves

On-chain data provided additional context to Bitcoin’s consolidation. The MVRV ratio, which measures market valuation against the realized price, was near 2.7 at press time.

While not at extreme highs, this level suggests Bitcoin is approaching overvaluation, a potential warning for short-term investors. Historically, a ratio above three has often preceded periods of profit-taking and price corrections.

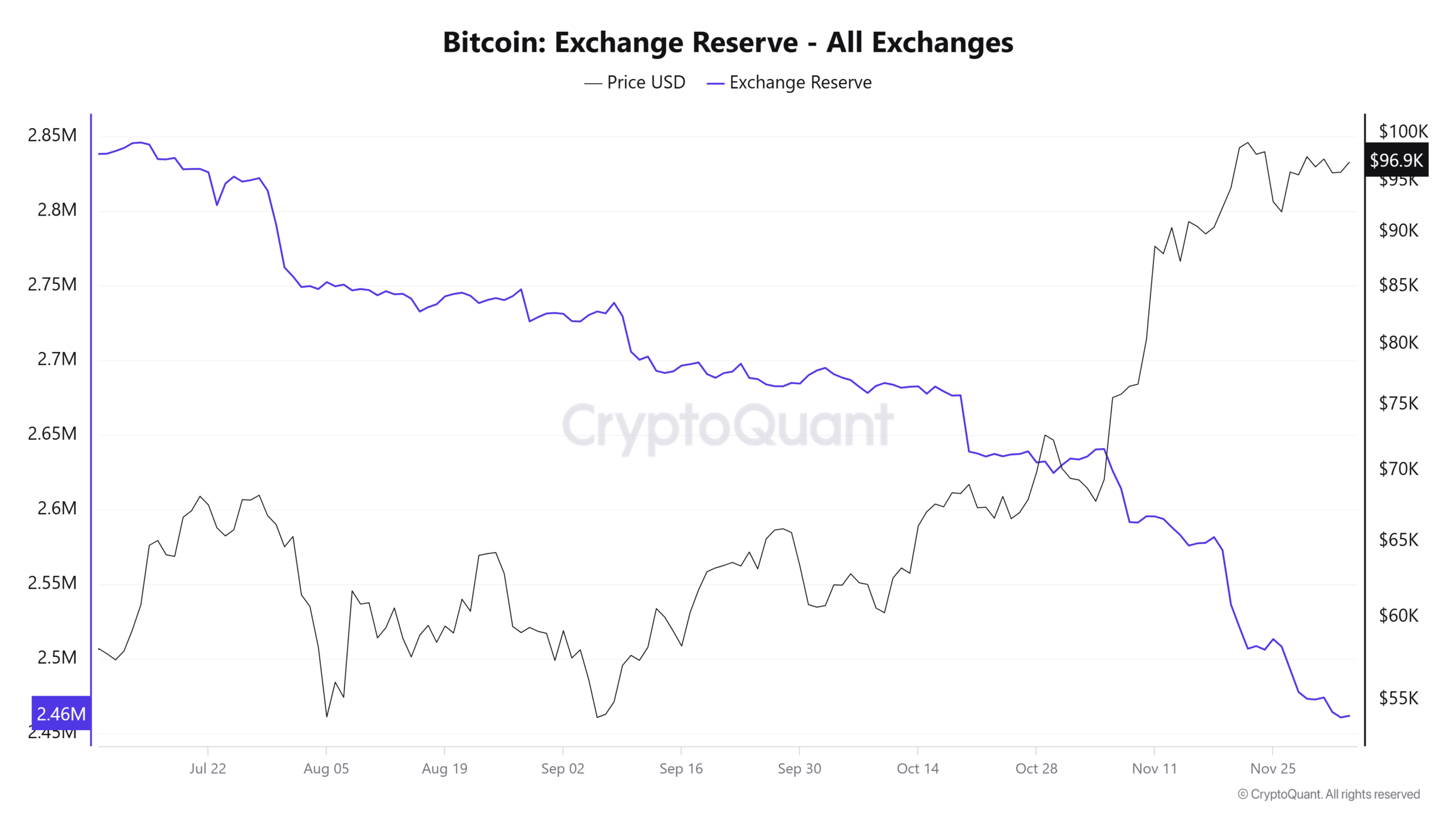

Exchange reserves, according to data from CryptoQuant, continue to decline, a bullish indicator reflecting reduced selling pressure from holders.

The trend suggests investors are opting to keep their Bitcoin off exchanges, signaling confidence in the asset’s long-term potential.

Market sentiment: Derivatives and accumulation

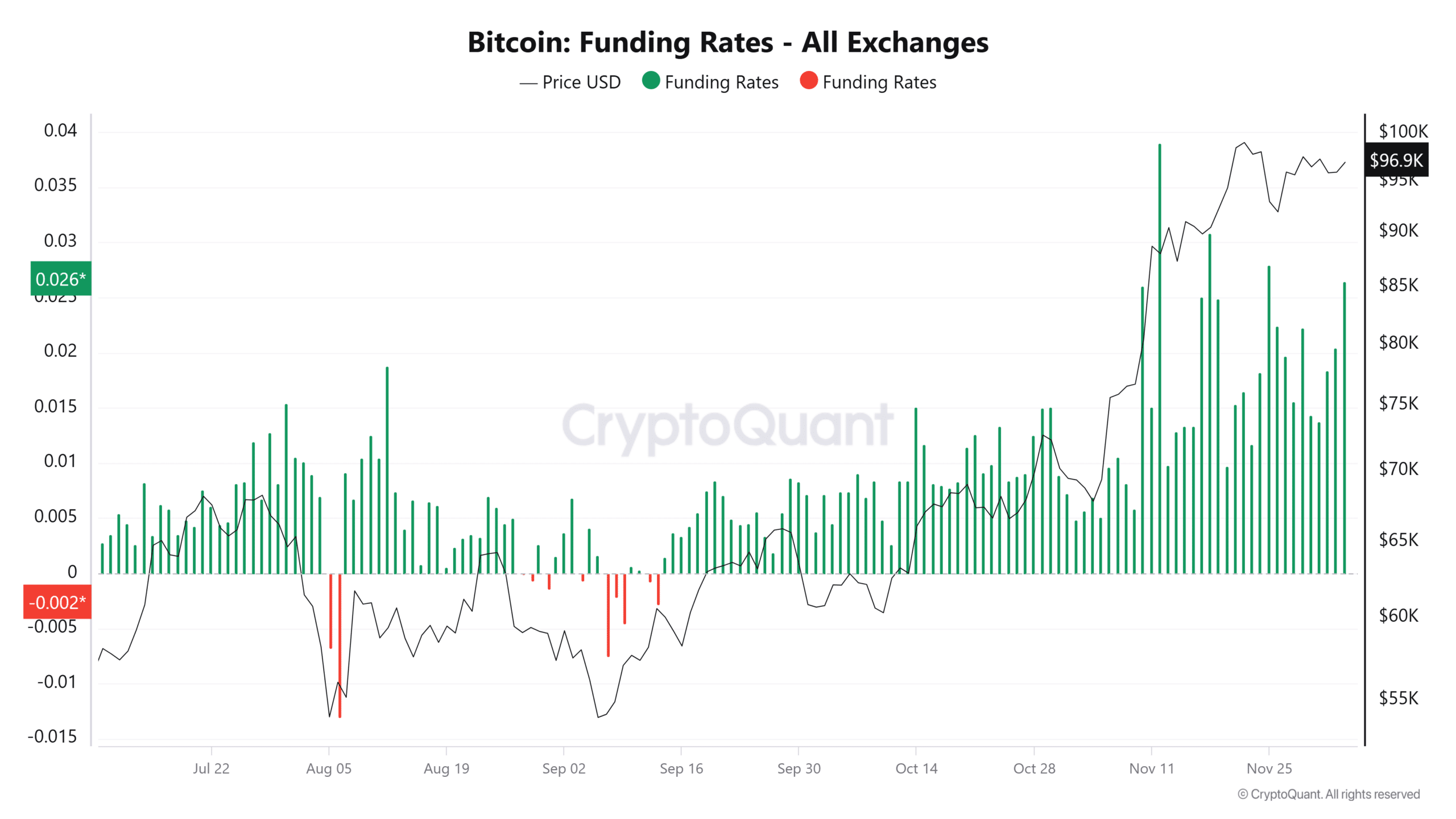

Bitcoin Funding Rates across major exchanges have turned positive, reflecting bullish sentiment in the derivatives market.

Traders appeared willing to pay a premium for long positions, signaling confidence in further price gains. This optimism is further supported by on-chain data showing a continued accumulation by whale addresses.

Large-scale investors have increased their holdings, reinforcing the narrative of long-term confidence in Bitcoin’s upward trajectory.

Retail activity, in contrast, has declined, indicating that larger investors drive the current rally. This divergence often adds stability to price action, as whale accumulation typically supports higher price levels.

Outlook: Bitcoin to $100K

Bitcoin’s consolidation is a healthy phase in its market cycle, creating a foundation for a potential breakout toward $100,000.

A move beyond $98,000, backed by increased trading volume, could confirm the resumption of the uptrend.

However, investors should remain cautious of any sudden spikes in exchange reserves or an overextension in the MVRV ratio, which could signal a reversal or correction.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Despite these risks, the broader market structure remains favorable.

As Bitcoin digests recent gains, it appears well-positioned for further upward movement, with strong technical and on-chain indicators supporting the case for a breakout.