5 –

Consumer understanding and engagement with promotional offers

Around 76 percent of respondents who received an offer went on to use it. Free bets in particular had the highest conversion rate, with nearly 6 in 10 respondents going on to use these offers having seen it.

Figure 3: Conversion of offer receipt to offer up-take (in the last 4 weeks)

Conversion of offer receipt to offer up-take (in the last 4 weeks)

| 90% | 74% | 72% | 70% | 64% | 62% | 47% | 47% |

| 76% | 58% | 52% | 53% | 27% | 31% | 38% | 29% |

Despite variation in the up-take rates of different types of offer, offers were viewed positively as tools that enhance consumers’ play or betting experience for both practical and emotional reasons.

Practically, consumers genuinely enjoy the act of gambling, and believe that offers enable them to do more of it whilst using less of their own money. Although rare, consumers had experienced what they considered to be significant financial reward from playing offers previously, and this was used to rationalise their continued engagement. Barriers to accessing the financial rewards of a promotional offer such as wagering requirements are accepted as part of the challenge, and consumers feel confident navigating which wagering requirements are acceptable or achievable.

“Yeah, you do find yourself staying up till the middle of the night doing your spins so you can meet the minimum wagering requirement.”

Male (age 36), Problem Gambling Severity Index score (PGSI) Score: 2

Emotionally, offers were viewed as tools that facilitate consumer empowerment. Consumers felt valued by receiving promotional offers, as if their loyalty and continued custom was being rewarded. Consumers rarely consider how operators are benefiting from providing offers, believing they are simply promoting their ‘best deals’ in a way to remain competitive within the market.

“They should leave them [promotional offers] alone! They’re a good thing that increases my enjoyment of gambling!”

Male (age 38), PGSI Score: 1

“If you were shopping for a jacket on Amazon, you wouldn’t just pay the first price you found. You’d shop around other retailers, to try and find the best price, and if one had a 20 percent discount, you’d go for that. Gambling is exactly the same – it’s all about finding the best odds, and promotional offers are the best deals.”

Male (age 66), PGSI Score: 6

How consumers decide which offers to use

The decision of which offers are worth playing was driven mainly through an offer’s perceived risk and potential for winning returns. This is calculated by factors such as staking and wagering requirements, and previous experiences of wins and losses.

This decision-making process can also be explained by System 1 and System 2 thinking, a behavioural science concept that details how human decision-making occurs. System 1 thinking is characterised by fast, intuitive and automatic decision-making, requiring little effort and driven by instinct and experience. System 2 thinking, however, is defined by slower, deliberate and logical decision-making, requiring greater analysis reserved for more complex tasks. This concept is not exclusive to gambling but is highly relevant in understanding how consumers may determine an offer’s appeal and worthiness to engage with.

Free spins, free bets, and bets with boosted odds

Free spins, free bets, and boosted odds were widely considered by consumers to be without risk and reflected a constant feature throughout their gambling journey.

Such offers are advertised most frequently and are judged by consumers to have little additional risk over their regular gambling activity (that is, gambling done without use of a promotional offer).

This perception is based on the understanding that a consumer will not need to stake their own money, or not stake more than they would be prepared to do so without using a promotional offer. There are limited “friction points” within these offers which may stop consumers from analysing the quality of an offer. The straightforward mechanics of free spins and bets in particular, are familiar to all types of gambler, promising instant reward and the potential to prolong their gambling (through the offer’s reward).

“Paddy Power are always pushing their free daily spins to me, so I usually start my day by doing that, because it’s free essentially.”

Male (age 21), PGSI Score: 2

“It’s a nice thing to do, to start your gambling off on a win.”

Male (age 21), PGSI Score: 8

System 1 thinking is highly evident within the mechanics of free spins and bets, whereby offers are taken up by consumers automatically and often used to kick start their gambling routine. Furthermore, free spins and bets incorporate fast gameplay, promising potential of a quickly realised bet outcome with minimal risk associated.

The marketing of free spins and bets tap into System 1 decision-making. The language used in marketing of such offers strongly suggest these offers should be engaged with immediately, by framing offers as ‘daily spins’ or encouraging consumers to ‘try again tomorrow’. Marketing language can also reinforce belief that engagement is genuinely free, despite some offers having wagering requirements. Consumers felt the highly gamified imagery within casino games can lessen the perceived risk of offers if they seem similar to “child-like” games, where the enjoyment of the playing experience is prioritised above the potential to win money. The prospect of prolonging the time they are able to gamble for without staking as much of their own money is a key driver to consumer engagement.

Sign-up offers, cashback rewards and deposit based offers

The requirement to stake one’s own money triggers more considered and selective engagement with certain offers, reflected by a lower conversion rate for sign-up offers, cashback rewards and deposit-based offers (as depicted in Figure 4), indicative of System 2 thinking.

For these offers, consumers are forced to think more deeply about how much money they will need to stake immediately and in the future, to meet wagering requirements to become eligible for offer rewards. Previous experiences of wins and losses can be highly influential in their decision here, and over time engagement with these offers is likely to decrease and become more selective.

Consumers cited cashback rewards as an offer type having the greatest potential for harm, as the perceived ‘safety net’ of receiving cashback on losses encouraged them to make riskier bets that are less likely to win. With experience, cashback rewards tended to be used more selectively as consumers recognised recouped losses were insignificant in comparison to their cumulative losses. However, less experienced consumers appeared more likely to engage with these offers, believing any return on a lost bet to be appealing. They felt by using cashback rewards, they were practicing safer and more responsible betting.

“I’ve stopped using cashback rewards. You just end up making stupid bets you know won’t come in, just because you’ll get some of your money back.”

Male (age 66), PGSI Score: 6

“I think I used them when I started betting and I was bit naive. Done it maybe a few times at the start, but then after that, I realised that I’m just gonna lose even more money. You end up losing more money than you put originally. So it’s just another way of you get into betting even more. I try and refrain from that.”

Male (age 44), PGSI Score: 0

Similarly, deposit-based offers appealed to consumers wanting to stake fixed amounts, to allow better tracking of gambling expenditure. For these individuals, up-take was driven by the prospect of prolonged gambling periods relative to the amount of money staked, appearing to have greater appeal to less-experienced gamblers wanting to ‘learn the ropes’ of gambling. However, wagering requirements are well-known to consumers who exercise increased caution on this factor to determine whether an offer is worth playing.

“I think we’ve all be stung by the wagering requirements once. But you just kind of learn from it and look out for this when you bet on it again.”

Male (age 38), PGSI Score: 1

“Sometimes some of them aren’t worth doing and there’s one here: it’s bet £10 get £20 in free bets. You know in all ways it’s always risky paying out my money.”

Male (age 24), PGSI Score: 1

In contrast, sign-up offers were considered by consumers to be one of the best promotional offers available. Promising significantly improved rewards and lower staking requirements than deposit-based offers, respondents reported having signed-up to multiple gambling sites to take advantage of them. In some cases, consumers had exhausted all possible sign-up offers and had accounts with every gambling operator known to them. In extreme cases, consumers reported using friends’ or relatives’ information to create additional accounts to take advantage of sign-up offers. Consumers are likely to demonstrate a natural decline in their use of sign-up offers, due to there being less of these offers that they are eligible to receive. Whilst there was recognition that the creation of multiple accounts further increases the quantity of other types of offers received, consumers rarely considered this to be a negative consequence.

“Over the years I must have created accounts with every gambling site there is to use their sign-up offers. Sometimes I’ll find a new one, only to find I’ve already created an account!”

Male (age 55), PGSI Score: 1

Engagement with offer Terms and Conditions

The majority of consumers agreed that Terms and Conditions and offer characteristics are clear, with some indications that deposit-based offers and cashback rewards are slightly less clear, with the greatest potential to be misleading.

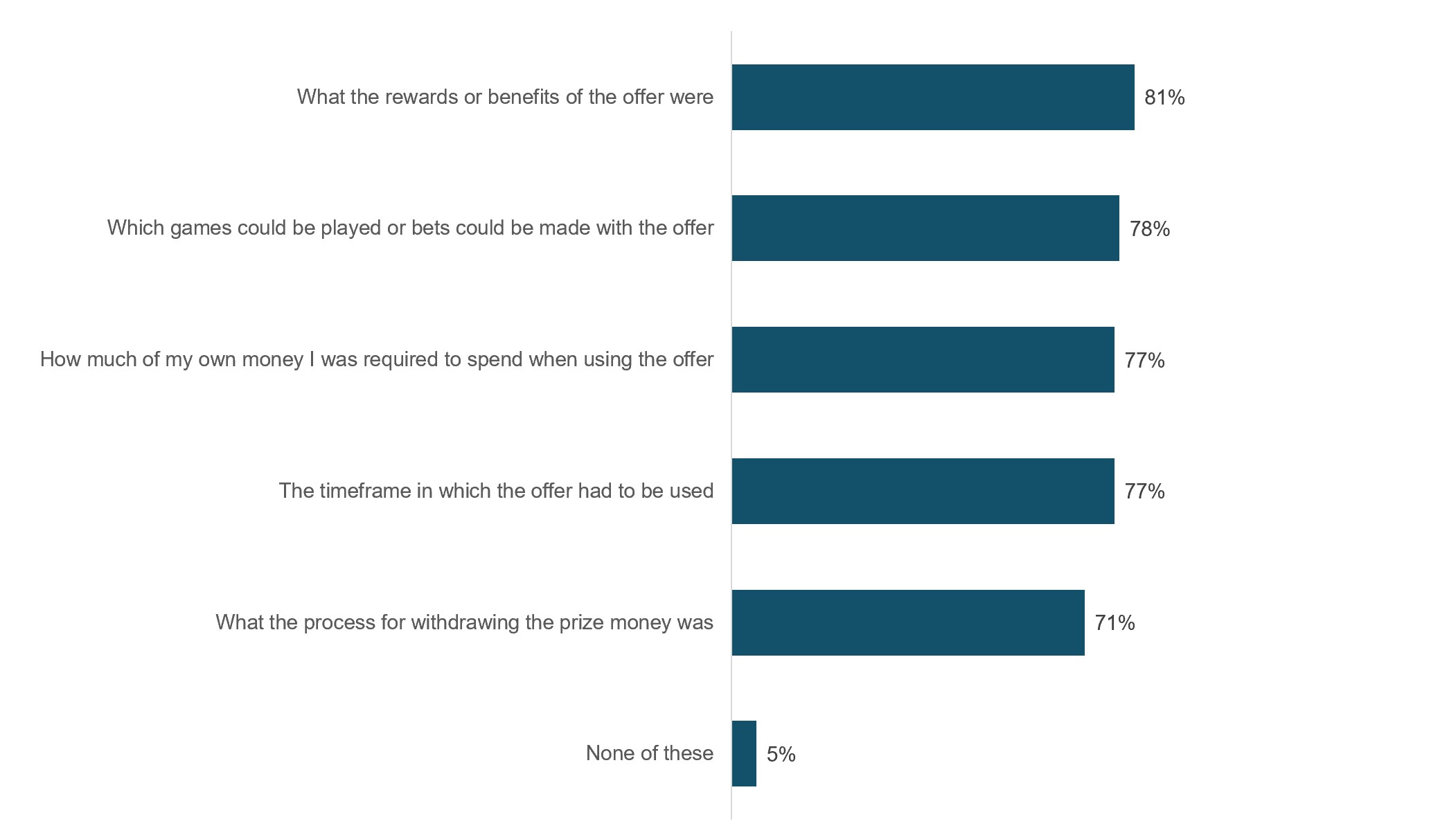

Figure 4: Understanding of the offer most recently taken up

The corresponding chart shows the proportion of consumers agreeing that each statement was clear to them.

Understanding of the offer most recently taken up

| What the rewards or benefits of the offer were | 81% |

| Which games could be played or which bets could be made with the offer | 78% |

| How much of my own money I was required to spend when using the offer | 77% |

| The timeframe in which the offer had to be used | 77% |

| What the process for withdrawing the prize money was | 71% |

| None of these | 5% |

Respondents admitted to rarely reviewing the Terms and Conditions when engaging with promotional offers. They’re confident that their previous experience playing offers and general understanding of gambling is enough to safely navigate them, and they believed that Terms and Conditions tend not to vary considerably between types of offers, or between gambling operators.

“But most of these things on most of these apps, I’m on them every day. So I kind of know what’s what, and I know what’s good and what’s not good.”

Male (age 48), PGSI Score: 1

However, there was a consensus amongst our consumers that the Terms and Conditions are inaccessible and not user-friendly: appearing complex, long-winded and often hidden from users who may want to read them thoroughly. Despite this consensus, any improvements to the accessibility or simplicity of Terms and Conditions seemed unlikely to result in consumers reading them more.

Despite limited concern for reading the Terms and Conditions, within the qualitative stage there were reports of having been ‘stung’ by wagering requirements in the past, with some offers considered to have the potential to mislead. Some wagering requirements appear unachievable and can result in longer gambling sessions, as consumers attempt to meet the terms in one sitting. The details of which games can be played to fulfil wagering requirements, or the time frame in which offers must be completed can also be misunderstood, resulting in some consumers having unexpectedly found themselves ineligible for rewards.

Although negative experiences with wagering requirements are common, consumers appeared to take accountability for not reading the Terms and Conditions properly themselves, rather than placing fault with the gambling company. Consumers will typically form their own standards for what are acceptable wagering terms, however standards varied considerably amongst our consumers.

“Yeah, you may get caught out once, but you don’t make that mistake again!”

Male (age 66), PGSI Score: 6

There were also instances of individuals feeling misled after trying to take advantage of a sign-up offer, only to find out they already had an account with a partnered or parent gambling site and were therefore ineligible for the advertised offer. Whilst frustrating, this did not impact their perceptions of sign-up offers and consumers assumed responsibility for not properly reviewing the Terms and Conditions of the offer.

Last updated: 24 November 2023