The latest fund flow data from Calastone shows outflows from every category of equity fund last month.

A record amount of money was pulled out of equity funds in October as UK investors were spooked by the capital gains tax (CGT) hike in the Labour government’s first Budget, data from Calastone reveals.

The global funds network’s latest Fund Flow Index shows investors withdrew a net £2.71bn from funds in October, with every category of equity fund posting outflows during the month.

Calastone noted that October’s outflows followed a weak September, which itself had seen the first net redemptions since October 2023. Sell orders surged 36% month-on-month but then dropped 40% overnight as the CGT hikes took effect on 30 October, the day of the Budget.

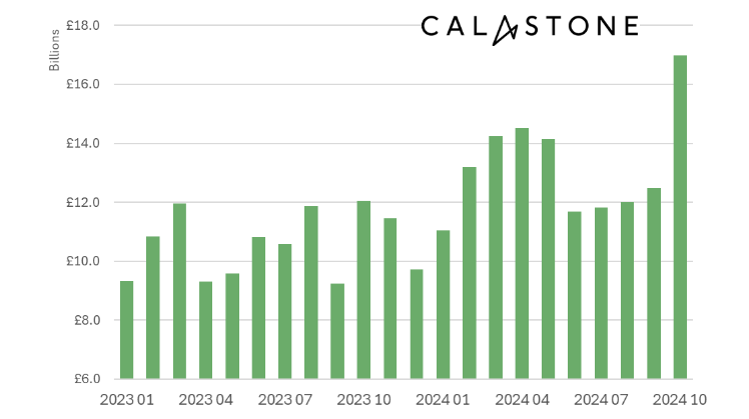

Net flows – equity funds

Source: Calastone Fund Flow Index – Oct 2024

Buying activity also rose sharply in October, which suggests the reinvestment of some of the proceeds of fund sales after the capital gain had been booked.

Edward Glyn, head of global markets at Calastone, said: “Fears of a capital gains tax grab in last week’s Budget spurred investors to book their profits and crystallize a lower tax bill well before the chancellor rose to her feet in the Commons. Unease in September meant the early birds took fright first, but by October investors were flocking for the exits.”

In the Budget, chancellor Rachel Reeves increased the higher rate of CGT from 20% to 24%, while the lower rate for basic-rate taxpayers was lifted from 10% to 18%. She emphasised that the UK still has the lowest CGT rates among European G7 nations, even after these increases.

The hike is intended to help address the government’s fiscal challenges but has been viewed as a blow for investors. The chancellor’s increase has not aligned CGT with income tax rates, which had been a widely discussed possibility before the Budget announcement.

Sell order value – equity funds

Source: Calastone Fund Flow Index – Oct 2024

Glyn added that there were “no major catalysts” in global markets that could have sparked such flight from funds. While indices drifted lower in the second half of October on the back of rising bond yields, “there were no alarming moves”.

“Instead, sharply higher selling by investors based here in the UK suggests the net outflow (the difference between the buying and selling) was driven by a motivation to book profits after strong market rises this year,” he explained.

“Moreover, October’s robust buying activity indicates that investors were also happy enough to reinvest much of the proceeds of their sales back into funds. The startling change in behaviour between 29 October and Budget day is a clear indication that tax was the main motivation for all this activity.”

The Calastone Fund Flow Index shows that UK assets were hardest hit by October’s outflows. Some £988m – more than a third of the total – was pulled out funds focused on UK equities. This was their fourth worst month on record.

Another quarter (£733m) came from equity income funds, which are skewed towards the UK stock market. It was the third worst month for income funds.

What’s more, October was the first month in more than two years when UK investors withdrew cash from global equity funds and the first month in more than a year for money to come out of US equity funds.

“With US markets and global markets having risen strongly over the last year, this is a further indication that booking gains for tax purposes was a key motivation,” Calastone added.

However, fixed income funds had their best month since June 2023 even though bond yields have surged in recent weeks. This follows investor caution of the depth of interest rate cuts now expected from the Federal Reserve and concerns around higher government borrowing in the UK.

Higher bond yields mean lower bond prices, but also creates an opportunity for newly invested capital to lock into these yields.

There were few days of outflows from fixed income funds in mid-October when bond yields rose fastest but investors added £631m over the whole month, the best result for bonds funds since June 2023.

Money market funds, the classic safe-haven asset class, also saw higher inflows, rising to £402m in October.

Glyn finished: “The suggestion that interest rates may stay higher for longer in the wake of the Budget made interest-earning assets like bonds and cash funds more attractive to investors.”