National Savings and Investment (NS&I) has announced the September 2024 Premium Bonds winners with two lucky savers scooping the £1million jackpot prizes.

A winner from West Sussex claimed the first top prize with Bond number 388VE682612, purchased in April 2020 with an overall holding of £18,101.

The second millionaire hails from Manchesteron, with winning Bond number 569RS008033.

This fortunate individual bought their winning Bond in only February 2024 with a bond value of £10,000 and overall holding of £21,700.

All Premium Bonds holders are being encouraged by NS&I to check their winnings from the September draw, as several other significant prizes have also been awarded.

Several savers with relatively small Bond holdings also struck lucky in the September draw.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

A Birmingham resident won £100,000 despite having only £525 in Bonds. Similarly, a Surrey saver with just £700 in Bonds also bagged a £100,000 prize. One particularly remarkable win came from South Scotland, where a long-time investor claimed £100,000 on a Bond purchased nearly five decades ago in January 1976.

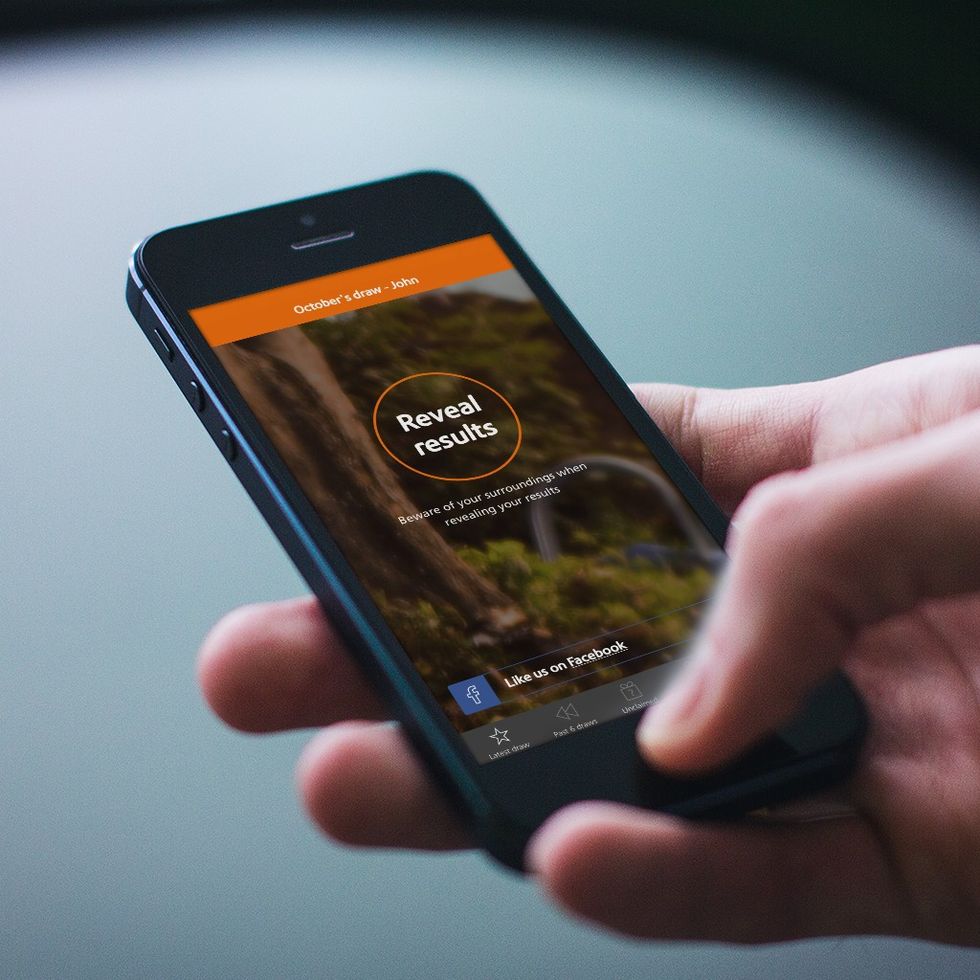

NS&I’s prize checker tool, available on their website and app, allows Bond holders to check for any unclaimed prizes. With multiple prizes possible from a single draw, savers are encouraged to verify their accounts for potential winnings from September or earlier months.

Andrew Westhead, NS&I Retail Director, said: “Congratulations to this month’s millionaires from West Sussex and Manchester. What a fantastic way to wrap up the summer.

“I’d also like to extend special congratulations to the high value prize winner who bagged a £100,000 win with a modest investment of £525.”

Premium Bonds are a unique savings product offered by NS&I. Unlike traditional savings accounts, they don’t earn interest. Instead, bondholders are entered into a monthly prize draw.

Prizes range from £25 to £1 million, with all winnings free from UK Income Tax and Capital Gains Tax. Each £1 Bond has an equal chance of winning, with current odds at 21,000 to 1. The current prize fund rate stands at 4.4 percent.

Savers can invest between £25 and £50,000 in Premium Bonds. Many opt to automatically reinvest winnings to increase their chances in future draws.

However, there’s no guarantee of winning. Some savers may go months or even years without a return on their investment.

Bonds can be cashed in at any time, providing flexibility for savers.

Ed Monk, associate director of Fidelity International, explained NS&I’s approach to setting the prize fund rate.

LATST DEVELOPMENTS:

NS&I updates the Premium Bonds prize checker app each month NS&I;

NS&I updates the Premium Bonds prize checker app each month NS&I;He said: “NS&I sets the prize fund rate to balance various competing objectives.

“It has a remit to provide a competitive rate for savers, but also to achieve value for money for taxpayers – NS&I is government backed and the money it holds provides a source of financing for the Treasury.”

Monk added: “Meanwhile, it is required not to distort the commercial savings market by providing rates other providers cannot compete with.”

He noted that the prize fund rate is carefully considered in relation to other savings options: “You can see how the prize fund rate has compared to savings rates in the chart below. The blue line shows the typical rate achieved by cash ISA investors, based on figures collected by the Bank of England and weighted by volume.”