Multiple high street banks have been struck by this morning’s global IT outage, including Lloyds Bank and Santander.

Microsoft has confirmed it was investigating an issue with its services and apps which has impacted businesses across the world.

According to Downdetector, Nationwide and Santander are among the banks and building societies that have been impacted by this error.

The outage appeared to have started impacted online services between 7am and 7:20am, continuing throughout the morning

On its website, the London Stock Exchange confirmed the disruption was due to third party global technical issue.

Taking to social media, bank customers shared their frustration about this morning’s events.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Some services appear to have been affected by the global IT issues

GB NEWS

One Scottish Widows customer, which is part of Lloyds Banking Group, wrote on X: “What is going on with the technical issues with Scottish Widows this week?

“Can’t speak to anyone, connections to portals down, valuations not getting updated and website down…….its a bit of a joke and nothing sent to policy holders to let them know?”

Another Santander customer messaged the bank: “Is there an issue with Mastercard authentication. I’ve tried to pay a bill online and the confirm text doesn’t come through.”

Santander replied: “We’re very sorry about this, Nat. There are IT issues across the wider industry today that are affecting some of our customers. We’re aware of this issue and are currently investigating it.”

Cybersecurity experts have previously warned how bank customers at risk from these outages Andrew Martin, CEO and Founder of SMEB, says: “Payment outages shine a fresh light on the continued importance of cash and why the march to a cashless society is a bad idea.

“We’re seeing a growing number of businesses across the UK label themselves as ‘cashless’ venues and it makes you wonder how they must cope when technical glitches like this happen, and the frustration it must cause their customers.“Fortunately, millions of customers and businesses still recognise the benefits of cash. Unfortunately getting your hands on it is not as easy as it used to be.

“The UK has lost 6000 bank branches since 2015, meaning that access to crucial financial services, such as the ability to withdraw and deposit cash at the end of the day, is no longer possible in many areas.

“Now that the UK has chosen its new government, we need to see them spring into action to solve the UK’s banking deserts. Every day that we wait, local businesses will suffer.”

Yesterday, the Bank of England confirmed it was impacted “global payments issue”.

As such, the central bank made the decision to temporarily halt certain high value and time sensitive payments, including house purchases.

LATEST DEVELOPMENTS:

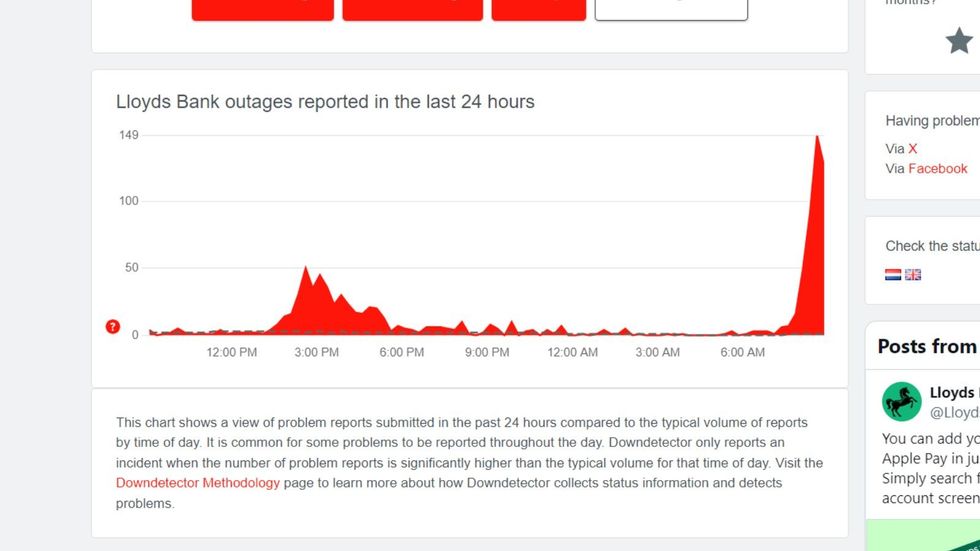

Lloyds experienced a surge in outage reports

DOWNDETECTOR

A Bank of England spokesperson said: “A global payments issue is affecting the Bank’s CHAPS service and delaying some high value and time-sensitive payments, including some house purchases.

“We are mindful of the impact this is likely to have and are working closely with a third party supplier, industry and other authorities to resolve the issue as promptly as possible.

“If you are concerned about a CHAPS payment you plan to make or receive today, please contact your bank, or other payment service provider.

“Retail payment systems are unaffected so people and businesses can continue to use cash points, card payments and bank transfers as normal.”