- Driven by anticipation for a major event, interest in SEI surged and the price increased.

- Traders who expected a price decrease encountered liquidations valued at $476,500.

Sei [SEI] crypto, the token of the layer-1 project that leverages modular blockchain, surged by 10% in the last 24 hours. At press time, SEI changed hands at $0.33, making it one of the top gainers in the market.

However, there were reasons the token got close to the peak. Specifically, the Modular Summit which is an event involving projects building modular blockchain projects is billed to be held between the 11th and 13th of July.

More positions is not more profits

As a result, interest in cryptos linked to the sector surged. AMBCrypto found proof of this after examining SEI’s Open Interest (OI). Open Interest refers to the sum of all open contracts in the market.

When it increases, it means that traders are adding liquidity while increasing net positions. However, a decrease implies an increase in closed positions. According to Coinglass, the total OI in SEI crypto was an increase to $59.44 million.

This meant that trader increased their exposure to the token while trying to profit from the price movement.

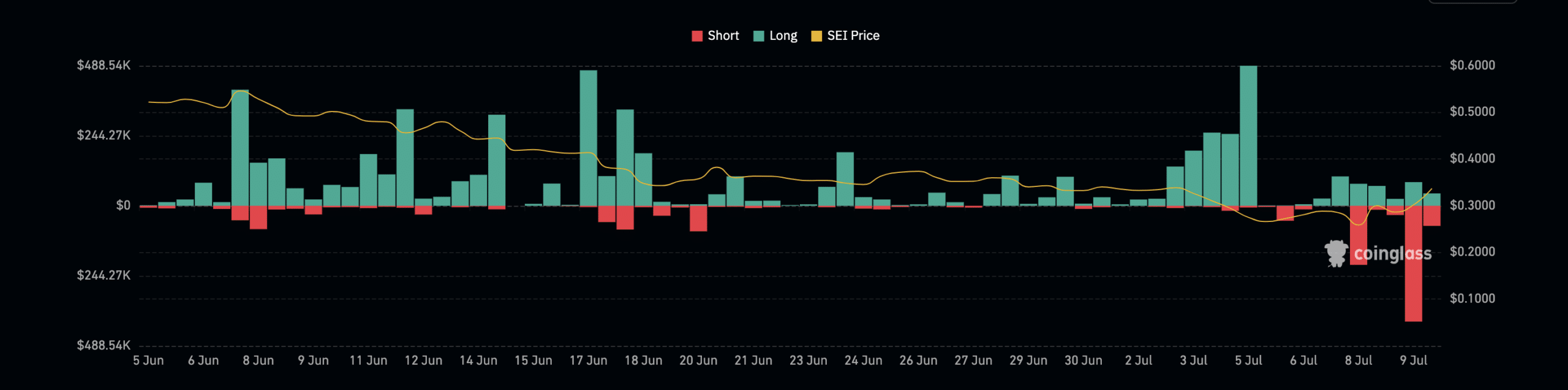

Despite the rising interest, a lot of traders were caught off guard by the cryptocurrency’s performance. According to Coinglass, a total of $612, 400 SEI positions was liquidated from the market in the last 24 hours.

Out of this, shorts accounted for $476,500. Longs, on the other hand, only took $135,900 of the hit. Liquidations occur when an exchange closes a trader’s position to avoid further losses.

This could be due to an insufficient margin balance, or high volatility in the market. For context, shorts are traders betting on the price to decrease while longs are those anticipating a rise.

Therefore, the liquidation data shows that most of those affected were traders anticipating a fall in SEI crypto price.

SEI’s price prediction points to another hike

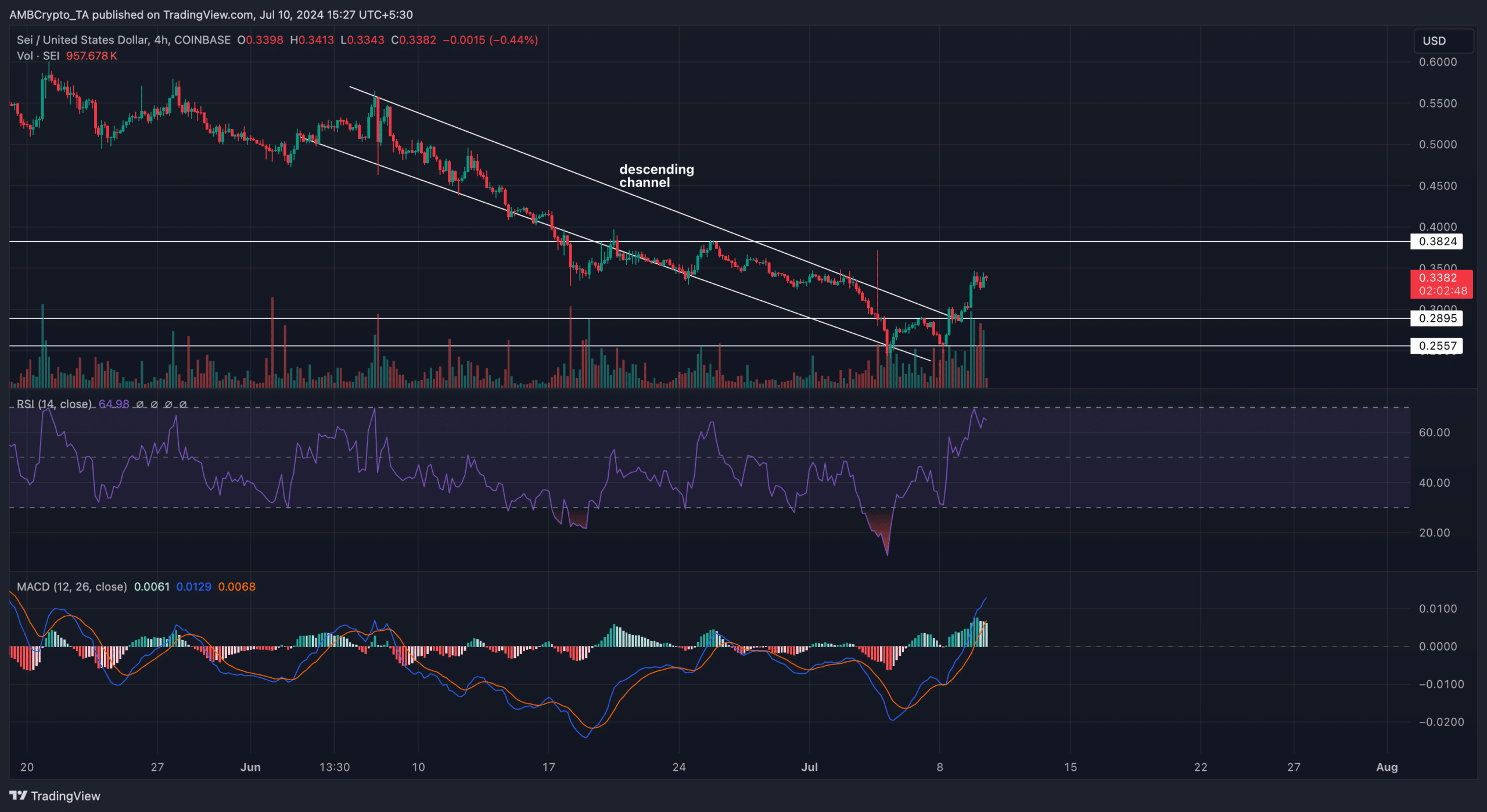

But will SEI’s price continue to increase? Let’s look at it from a technical perspective. According to the 4-hour chart, SEI had formed a descending channel since reaching $0.55 on July 7.

A descending channel pattern appears when the price of a token hit lower highs and lower low. Usually, this is bearish pattern that leads to lower prices.

At press time, AMBCrypto observed that bulls spotted seller exhaustion around $0.25. With increasing demand, the price was able scale through the $0.28 resistance.

Trading at $0.33, the Moving Average Convergence Divergence (MACD) was positive. This indicates that momentum around the token was bullish. The Relative Strength Index (RSI) also aligned with the same position.

Realistic or not, here’s SEI’s market cap in TIA terms

If sustained, the price of SEI might jump at $0.35. In a highly bullish situation, the value could hit $0.38 before the week runs out.

However, if holders of the token decide to sell, the prediction will be invalidated. Should this be the case, SEI’s price could drop to $0.28.