- Avalanche witnessed a significant surge in development activity over the last few days.

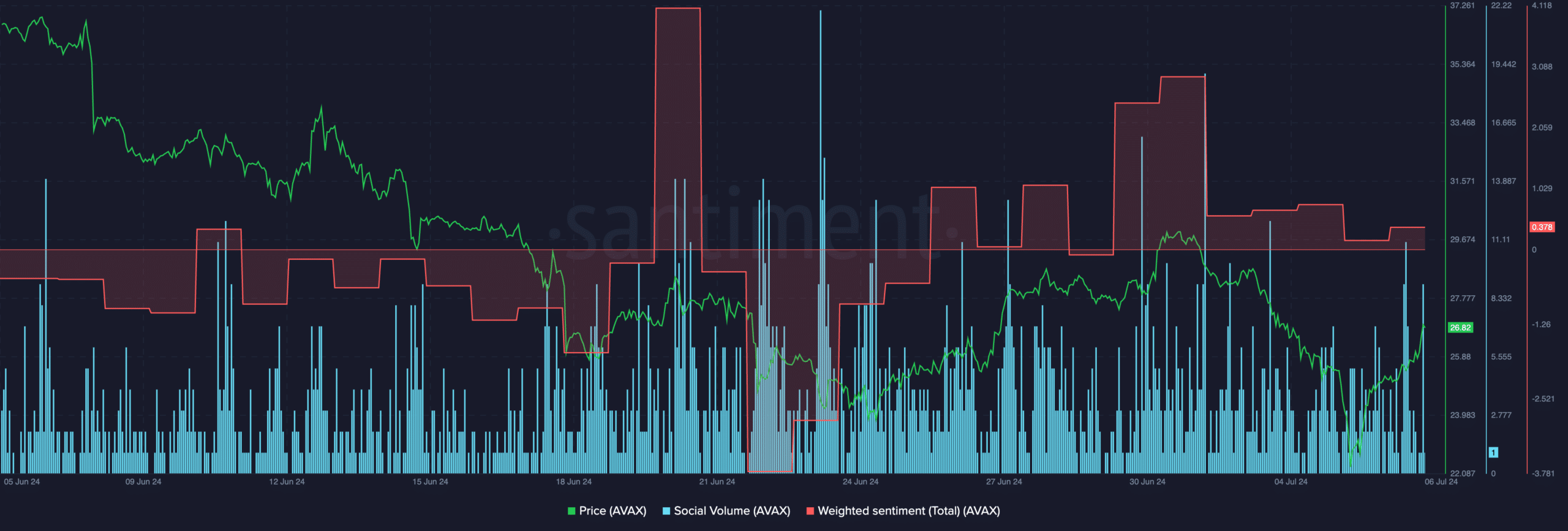

- Social volume and sentiment around the AVAX token remained high.

Avalanche [AVAX] was one of the few layer 1 networks that hasn’t been able to go toe to toe with popular competitors such as Solana [SOL] and Binance [BNB] for quite some time.

Development activity on the network grew

Avalanche’s ecosystem development activity boomed in the past year. Data on relative commit counts, indexed from a year ago, revealed that the Avalanche ecosystem was the most active among Layer 1 blockchains.

This signified a substantial amount of code being written and pushed to repositories, suggesting a period of innovation and project growth within the Avalanche ecosystem.

Despite the rise in development, the Avalanche network witnessed a decline in activity recently.

Both the number of daily active addresses and the number of transactions on the network fell over the past week. This suggests that fewer people are using the Avalanche network, and there is less overall activity on the blockchain.

Compounding these issues, the total value locked (TVL) and trading volumes on Avalanche’s decentralized exchanges (DEXes) have also dipped.

This indicates a potential decrease in the amount of crypto assets locked into Avalanche’s DeFi protocols and a slowdown in trading activity,

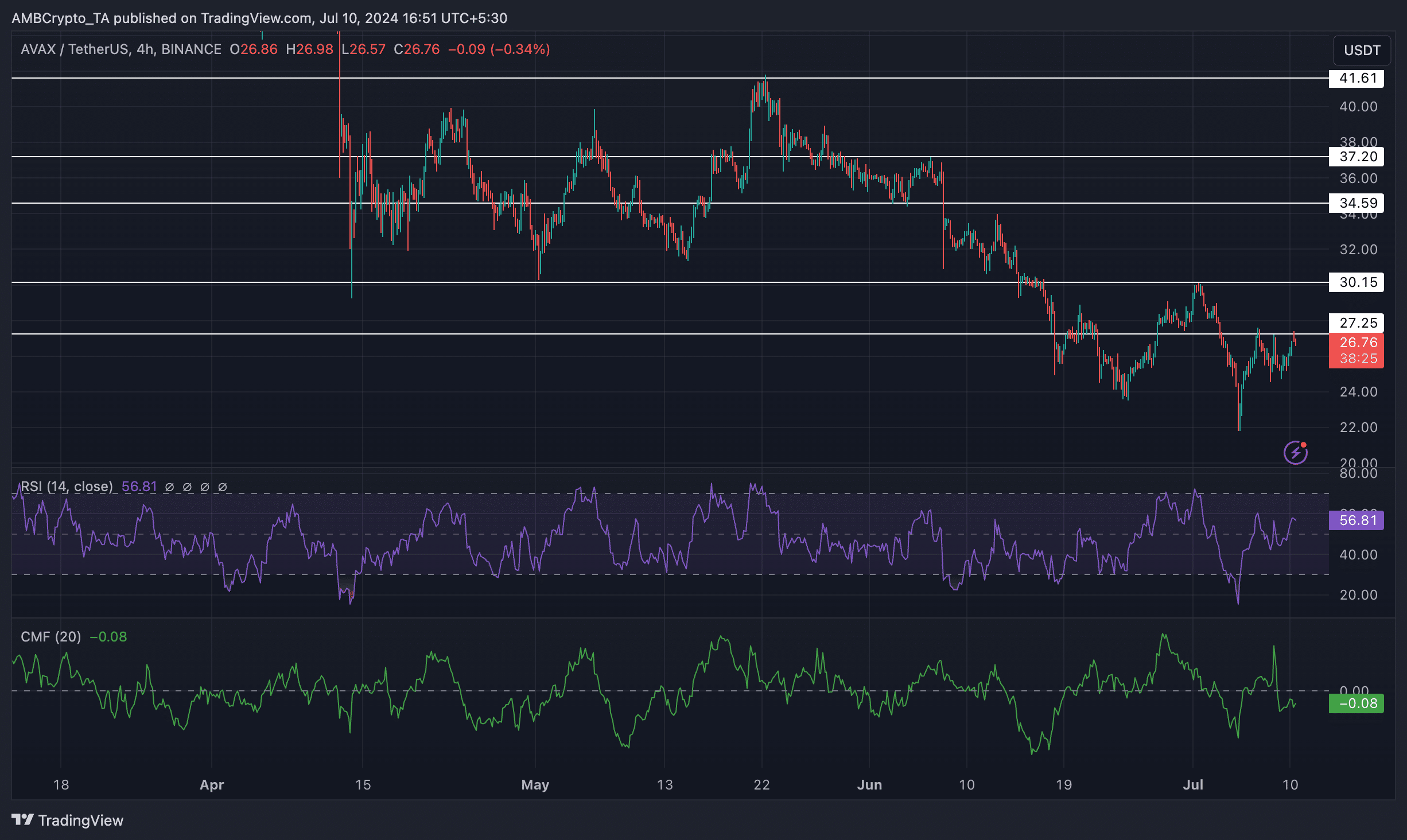

At press time, AVAX was trading at $26.84 and its price had grown by 5.01% in the last 24 hours. Despite the spike in price, the overall trend for AVAX was negative.

Since the 24th of May, the price of AVAX declined significantly showcasing lower lows and lower highs, indicative of a bearish trend.

If AVAX manages to retest the 27.25 level it may be able to push to the $30.15 level where it could start its journey to the top.

The RSI (Relative Strength Index) for AVAX was 58.81 which indicated that the bullish momentum around AVAX had grown significantly.

Moreover, the CMF(Chaikin Money Flow) for AVAX also decreased which suggested that the money flowing into AVAX fell.

Looking at social data

Coming to the social front, it was seen that in the last few days, the social volume around AVAX surged, which suggested that the popularity around the AVAX token had surged.

Realistic or not, here’s AVAX market cap in BTC’s terms

Moreover, the weighted sentiment around the token had also increased which implied that the number of positive comments around the AVAX token had surged.